Global Market's Trio Of Value Stock Picks For Estimated Growth

Reviewed by Simply Wall St

As global markets experience fluctuations driven by inflation data and interest rate speculation, investors are closely watching economic indicators that influence stock performance. With U.S. equities reaching new highs amid hopes for a Federal Reserve rate cut, the focus shifts to identifying undervalued stocks that could offer potential growth opportunities in this evolving landscape. In such an environment, a good stock is often characterized by strong fundamentals and resilience to economic shifts, making it well-positioned for long-term value appreciation.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.71 | CN¥311.10 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥113.18 | CN¥223.99 | 49.5% |

| Matsuya R&DLtd (TSE:7317) | ¥714.00 | ¥1425.34 | 49.9% |

| Lotes (TWSE:3533) | NT$1340.00 | NT$2677.45 | 50% |

| King Yuan Electronics (TWSE:2449) | NT$140.50 | NT$279.59 | 49.7% |

| InPost (ENXTAM:INPST) | €13.36 | €26.57 | 49.7% |

| IDI (ENXTPA:IDIP) | €79.40 | €157.98 | 49.7% |

| Echo Investment (WSE:ECH) | PLN5.38 | PLN10.71 | 49.7% |

| Atea (OB:ATEA) | NOK142.40 | NOK283.91 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.58 | 49.9% |

Here's a peek at a few of the choices from the screener.

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining and various chemical products with a market cap of CN¥113.89 billion.

Operations: The company generates revenue from its operations in coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products.

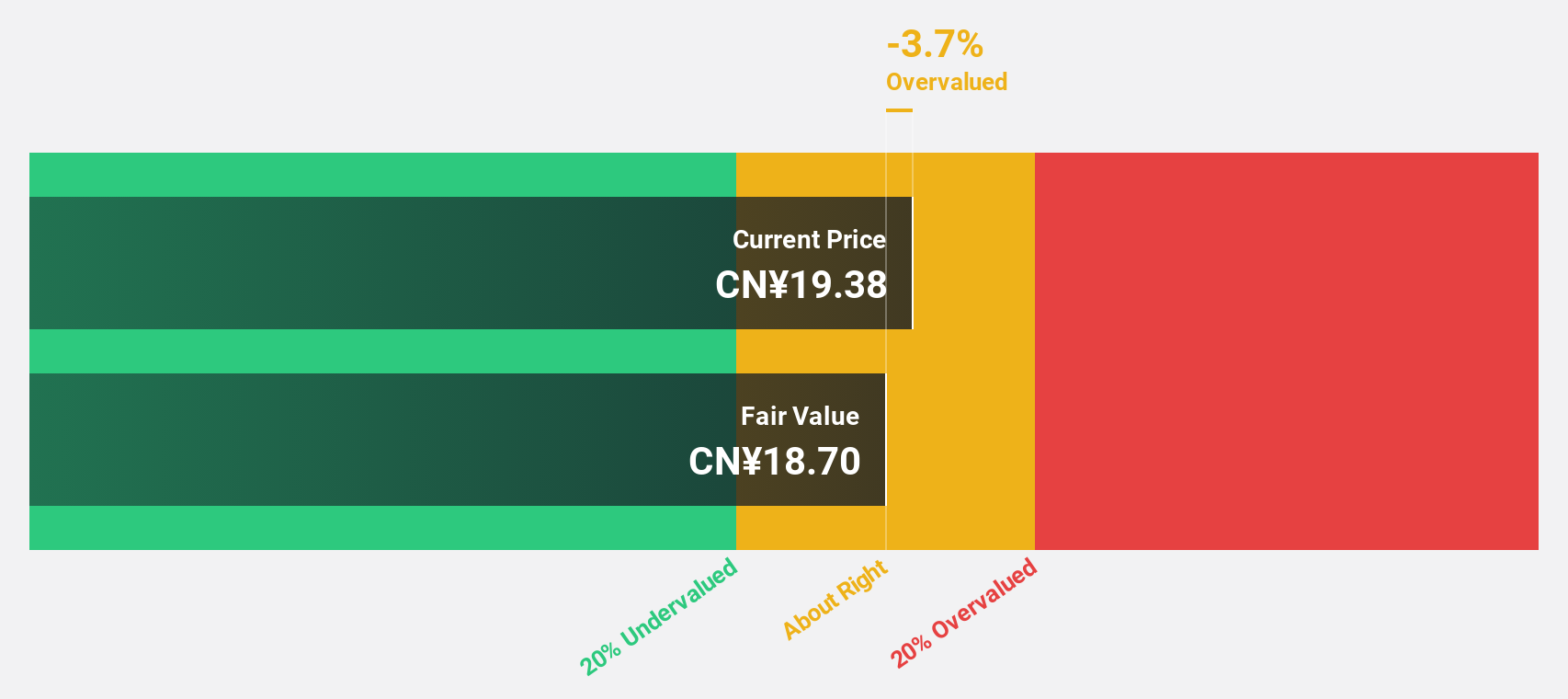

Estimated Discount To Fair Value: 11.6%

Ningxia Baofeng Energy Group is trading at CN¥15.53, below its estimated fair value of CN¥17.58, indicating it is undervalued based on cash flows. Despite a high level of debt and slower earnings growth forecasts compared to the market, the stock's revenue growth outpaces the Chinese market average. Recent removal from the Shanghai Stock Exchange 180 Value Index may impact perception but analysts agree on a potential price rise by 45.8%.

- The analysis detailed in our Ningxia Baofeng Energy Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Ningxia Baofeng Energy Group with our comprehensive financial health report here.

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. specializes in providing wind energy, construction, and safety protection equipment both in China and internationally, with a market cap of CN¥8.66 billion.

Operations: The company's revenue from construction machinery and equipment is CN¥1.37 billion.

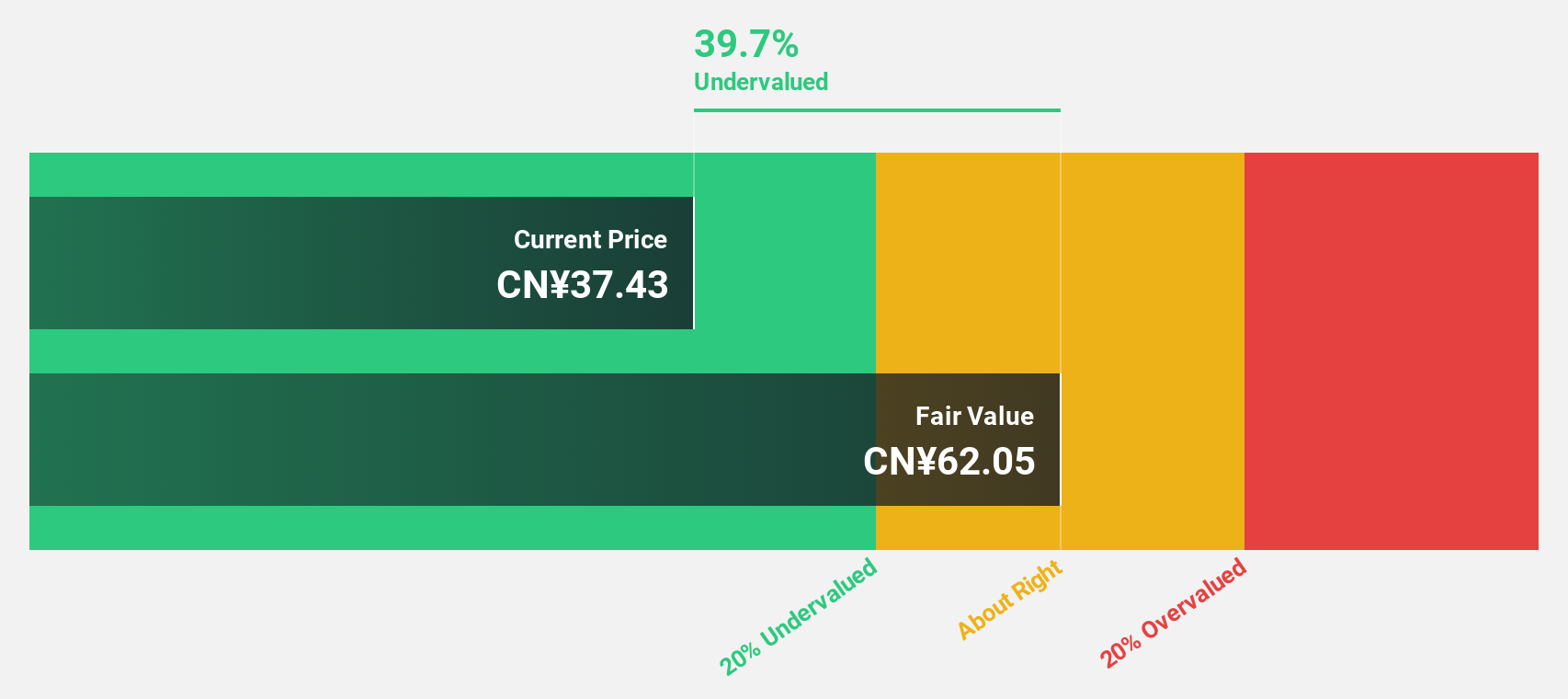

Estimated Discount To Fair Value: 34.8%

Ficont Industry (Beijing) is currently trading at CN¥40.75, significantly below its estimated fair value of CN¥62.53, highlighting its undervaluation based on cash flows. The company's earnings grew by 41.9% last year and are forecast to increase by 25.55% annually, outpacing the Chinese market's growth expectations. While it offers good relative value compared to peers, its dividend track record remains unstable and future Return on Equity is expected to be modest at 18.5%.

- Insights from our recent growth report point to a promising forecast for Ficont Industry (Beijing)'s business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Ficont Industry (Beijing).

H.U. Group Holdings (TSE:4544)

Overview: H.U. Group Holdings, Inc., along with its subsidiaries, operates in the healthcare sector across Japan, the United States, Europe, and other international markets with a market capitalization of ¥192.78 billion.

Operations: H.U. Group Holdings, Inc. and its subsidiaries generate revenue through their operations in the healthcare industry across various regions, including Japan, the United States, Europe, and other international markets.

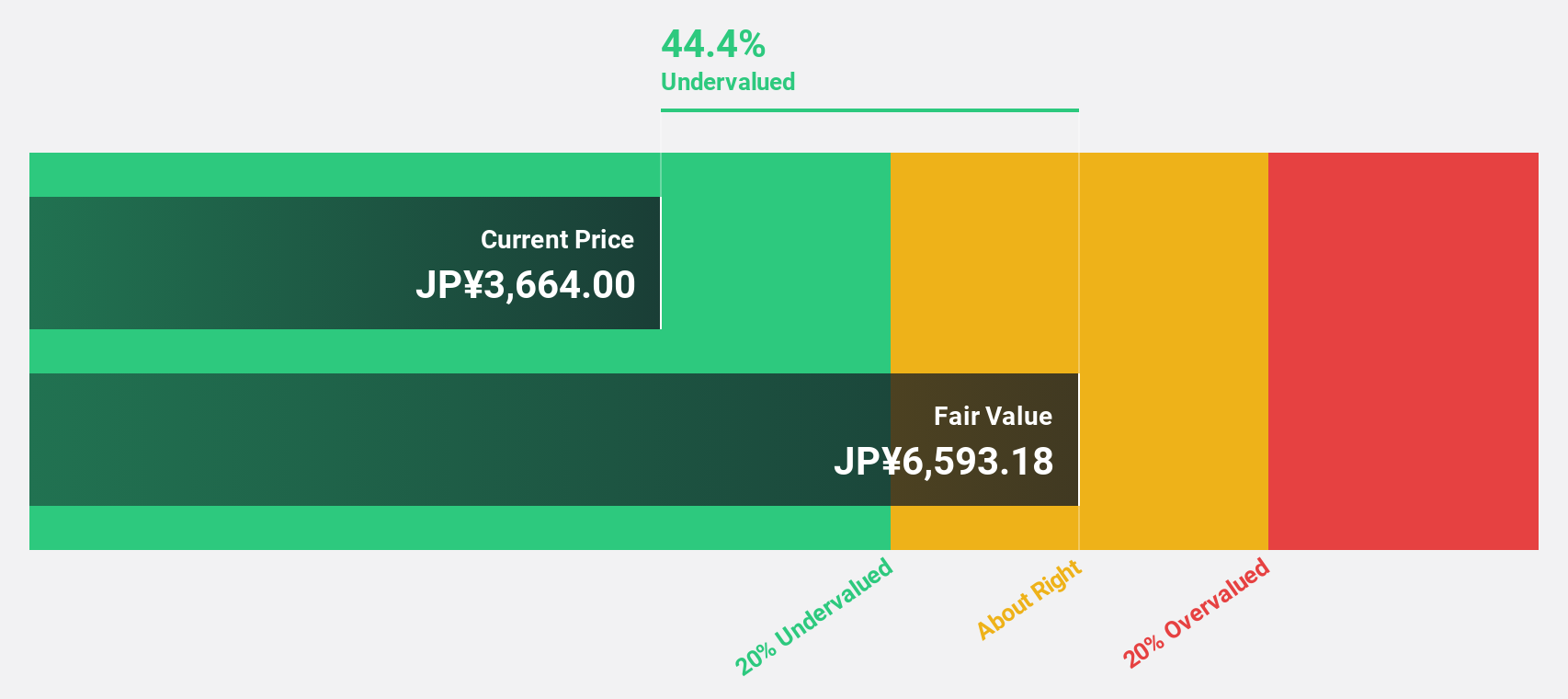

Estimated Discount To Fair Value: 47.1%

H.U. Group Holdings is trading at ¥3415, significantly below its estimated fair value of ¥6455.03, indicating it is undervalued based on cash flows. Earnings are expected to grow 48.8% annually, outpacing the Japanese market's growth rate of 8%. However, the dividend yield of 3.66% isn't well covered by earnings and Return on Equity is forecasted to be low in three years at 6.1%. Recent product advancements include the Lumipulse G sTREM2 assay for neuroinflammation research.

- Our comprehensive growth report raises the possibility that H.U. Group Holdings is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of H.U. Group Holdings.

Make It Happen

- Dive into all 510 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Baofeng Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600989

Ningxia Baofeng Energy Group

Produces and sells methanol and olefin products in China.

Outstanding track record average dividend payer.

Market Insights

Community Narratives