Market Cool On Ningbo Shanshan Co.,Ltd.'s (SHSE:600884) Revenues

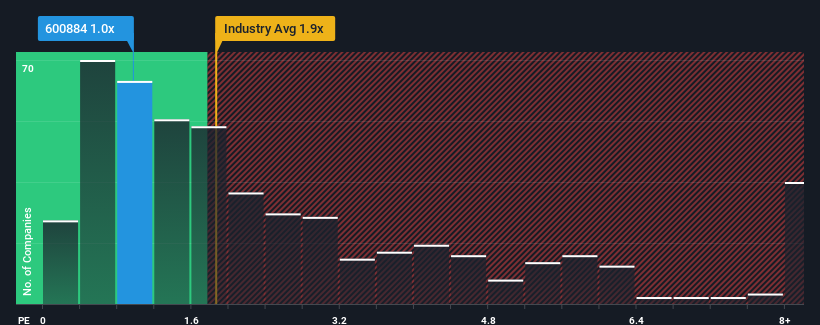

With a price-to-sales (or "P/S") ratio of 1x Ningbo Shanshan Co.,Ltd. (SHSE:600884) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ningbo ShanshanLtd

What Does Ningbo ShanshanLtd's Recent Performance Look Like?

Ningbo ShanshanLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Ningbo ShanshanLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ningbo ShanshanLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Ningbo ShanshanLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 67% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 28% over the next year. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Ningbo ShanshanLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Ningbo ShanshanLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Ningbo ShanshanLtd is showing 4 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo ShanshanLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600884

Ningbo ShanshanLtd

Provides lithium battery materials in China, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026