- China

- /

- Metals and Mining

- /

- SHSE:600725

Optimistic Investors Push Yunnan Yunwei Company Limited (SHSE:600725) Shares Up 32% But Growth Is Lacking

Yunnan Yunwei Company Limited (SHSE:600725) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

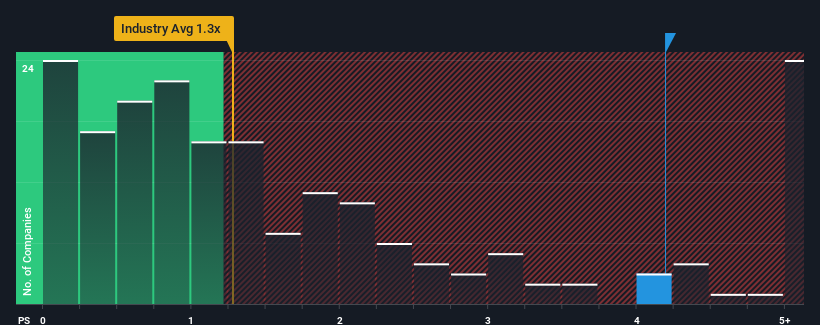

After such a large jump in price, you could be forgiven for thinking Yunnan Yunwei is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Yunnan Yunwei

How Has Yunnan Yunwei Performed Recently?

As an illustration, revenue has deteriorated at Yunnan Yunwei over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Yunnan Yunwei's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Yunnan Yunwei would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, revenue from three years ago have also fallen 48% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this information, we find it concerning that Yunnan Yunwei is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Yunnan Yunwei's P/S

The strong share price surge has lead to Yunnan Yunwei's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Yunnan Yunwei revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Yunnan Yunwei that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600725

Yunnan Yunwei

Engages in the production and operation of coal coke and chemical products in China.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives