- China

- /

- Basic Materials

- /

- SHSE:600724

Ningbo Fuda Company Limited's (SHSE:600724) Shares Climb 43% But Its Business Is Yet to Catch Up

Ningbo Fuda Company Limited (SHSE:600724) shareholders have had their patience rewarded with a 43% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 37%.

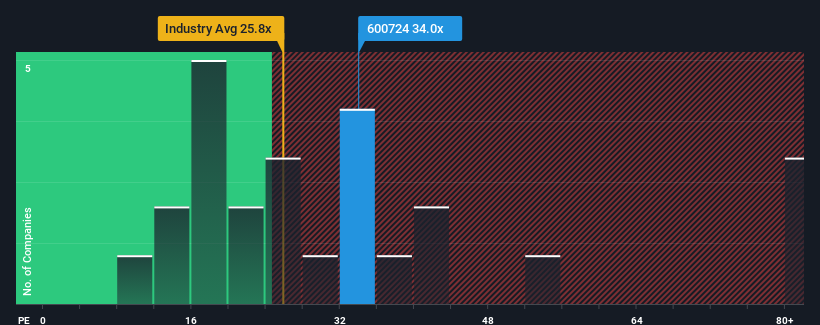

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ningbo Fuda's P/E ratio of 34x, since the median price-to-earnings (or "P/E") ratio in China is also close to 36x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We'd have to say that with no tangible growth over the last year, Ningbo Fuda's earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

View our latest analysis for Ningbo Fuda

What Are Growth Metrics Telling Us About The P/E?

Ningbo Fuda's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. This isn't what shareholders were looking for as it means they've been left with a 42% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Ningbo Fuda is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Ningbo Fuda's P/E?

Ningbo Fuda appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ningbo Fuda revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Ningbo Fuda you should be aware of, and 1 of them doesn't sit too well with us.

If these risks are making you reconsider your opinion on Ningbo Fuda, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Fuda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600724

Ningbo Fuda

Engages in the urban commercial real estate operation and management in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives