Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Chengtun Mining Group Co., Ltd. (SHSE:600711) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Chengtun Mining Group

How Much Debt Does Chengtun Mining Group Carry?

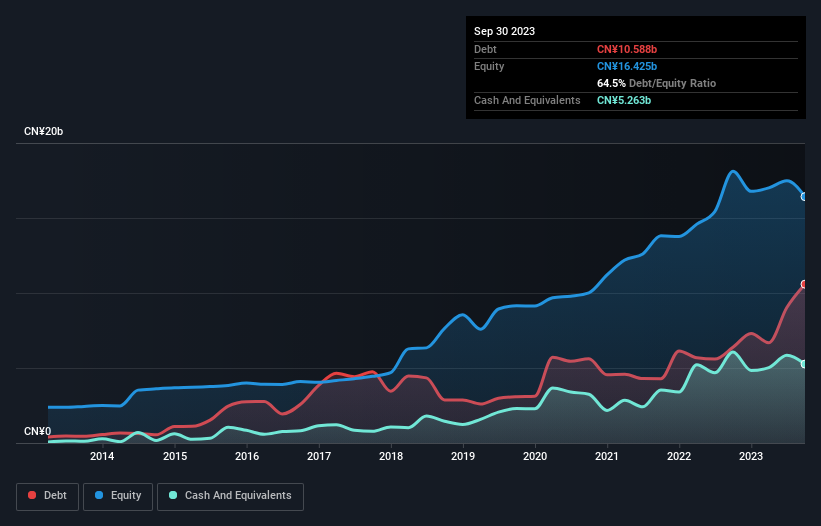

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Chengtun Mining Group had CN¥10.6b of debt, an increase on CN¥6.38b, over one year. However, it does have CN¥5.26b in cash offsetting this, leading to net debt of about CN¥5.33b.

A Look At Chengtun Mining Group's Liabilities

According to the last reported balance sheet, Chengtun Mining Group had liabilities of CN¥14.7b due within 12 months, and liabilities of CN¥5.46b due beyond 12 months. On the other hand, it had cash of CN¥5.26b and CN¥1.85b worth of receivables due within a year. So it has liabilities totalling CN¥13.1b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of CN¥12.2b, we think shareholders really should watch Chengtun Mining Group's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Chengtun Mining Group's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 2.1, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, Chengtun Mining Group saw its EBIT tank 74% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Chengtun Mining Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Chengtun Mining Group saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Chengtun Mining Group's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its net debt to EBITDA also fails to instill confidence. Taking into account all the aforementioned factors, it looks like Chengtun Mining Group has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Chengtun Mining Group is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600711

Chengtun Mining Group

Engages in the non-ferrous metals mining business in China and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives