Optimistic Investors Push Guangdong Rongtai Industry Co.,Ltd (SHSE:600589) Shares Up 40% But Growth Is Lacking

Guangdong Rongtai Industry Co.,Ltd (SHSE:600589) shares have continued their recent momentum with a 40% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

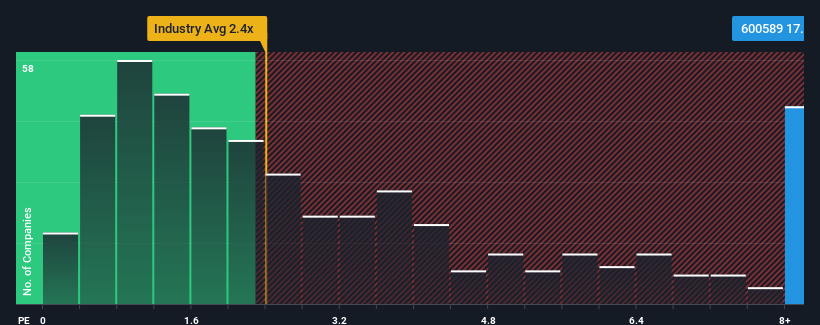

Following the firm bounce in price, you could be forgiven for thinking Guangdong Rongtai IndustryLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 17x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Guangdong Rongtai IndustryLtd

How Has Guangdong Rongtai IndustryLtd Performed Recently?

For example, consider that Guangdong Rongtai IndustryLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Rongtai IndustryLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Guangdong Rongtai IndustryLtd?

In order to justify its P/S ratio, Guangdong Rongtai IndustryLtd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 65% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Guangdong Rongtai IndustryLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

The strong share price surge has lead to Guangdong Rongtai IndustryLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Guangdong Rongtai IndustryLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 2 warning signs we've spotted with Guangdong Rongtai IndustryLtd (including 1 which can't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600589

Dawei Technology (Guangdong) Group

Through its subsidiaries, engages in the internet data center business in China.

Low risk with poor track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.