Guangdong Rongtai Industry Co.,Ltd's (SHSE:600589) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Guangdong Rongtai Industry Co.,Ltd (SHSE:600589) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 4.4% in the last year.

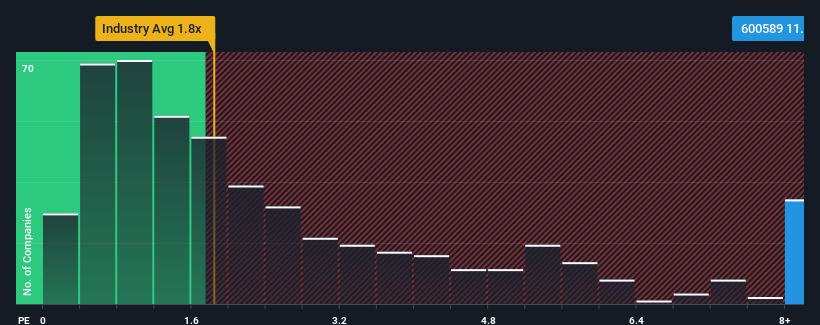

Even after such a large drop in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.8x, you may still consider Guangdong Rongtai IndustryLtd as a stock not worth researching with its 11.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guangdong Rongtai IndustryLtd

How Has Guangdong Rongtai IndustryLtd Performed Recently?

Revenue has risen firmly for Guangdong Rongtai IndustryLtd recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Rongtai IndustryLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Guangdong Rongtai IndustryLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 67% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Guangdong Rongtai IndustryLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Guangdong Rongtai IndustryLtd's P/S Mean For Investors?

Even after such a strong price drop, Guangdong Rongtai IndustryLtd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Guangdong Rongtai IndustryLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Guangdong Rongtai IndustryLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600589

Dawei Technology (Guangdong) Group

Through its subsidiary, engages in the internet data center business in China.

Proven track record and slightly overvalued.

Market Insights

Community Narratives