- China

- /

- Metals and Mining

- /

- SHSE:600547

Here's Why We Think Shandong Gold Mining (SHSE:600547) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Shandong Gold Mining (SHSE:600547). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shandong Gold Mining with the means to add long-term value to shareholders.

Check out our latest analysis for Shandong Gold Mining

Shandong Gold Mining's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Shandong Gold Mining's EPS has grown 23% each year, compound, over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Shandong Gold Mining shareholders is that EBIT margins have grown from 7.3% to 9.7% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

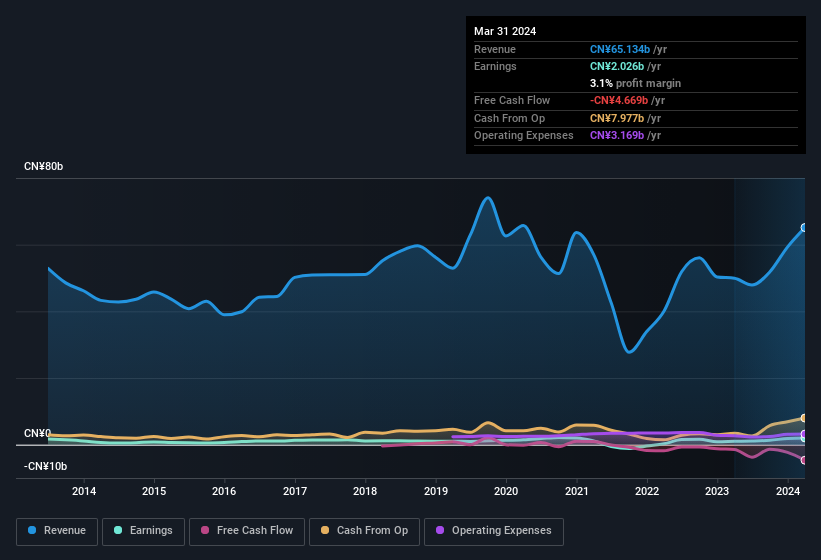

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Shandong Gold Mining's forecast profits?

Are Shandong Gold Mining Insiders Aligned With All Shareholders?

Since Shandong Gold Mining has a market capitalisation of CN¥123b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth CN¥2.4b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Shandong Gold Mining, with market caps over CN¥58b, is about CN¥2.4m.

The Shandong Gold Mining CEO received total compensation of just CN¥898k in the year to December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Shandong Gold Mining Worth Keeping An Eye On?

For growth investors, Shandong Gold Mining's raw rate of earnings growth is a beacon in the night. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Shandong Gold Mining has underlying strengths that make it worth a look at. It is worth noting though that we have found 1 warning sign for Shandong Gold Mining that you need to take into consideration.

Although Shandong Gold Mining certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Shandong Gold Mining, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600547

Shandong Gold Mining

Engages in the exploration, mining, processing, smelting, and selling of gold and silver ores in the People’s Republic of China.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives