As the global markets close out a holiday-shortened week, major U.S. stock indexes have shown moderate gains, with technology stocks leading the charge despite a dip in consumer confidence and manufacturing figures. In this context of fluctuating market dynamics, penny stocks remain an intriguing investment area for those interested in smaller or newer companies. Despite their vintage name, penny stocks can offer surprising value when backed by strong financials and growth potential, making them worth watching for investors seeking opportunities beyond larger firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market cap of CN¥5.45 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.45B

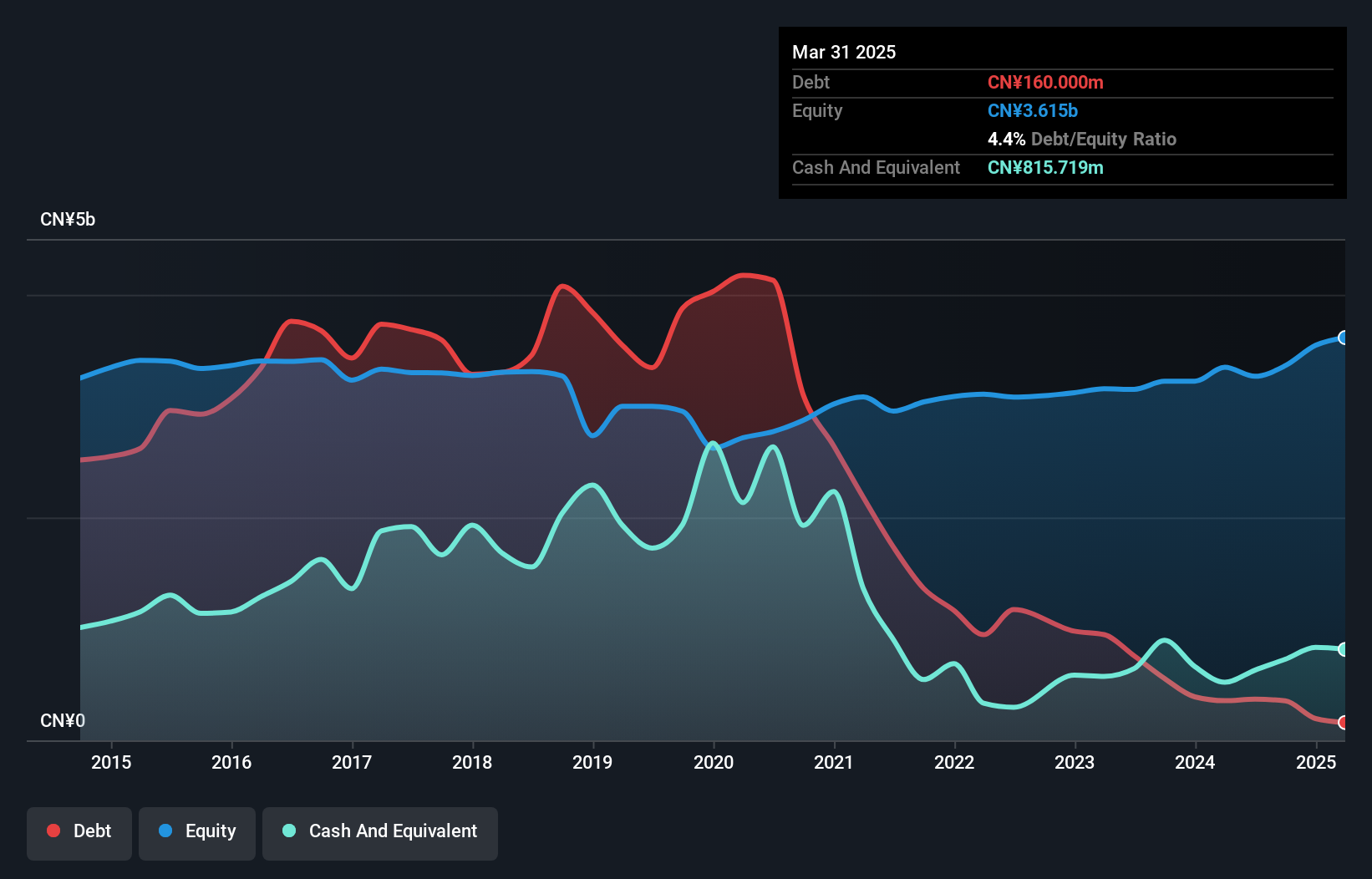

V V Food & Beverage Co., Ltd, with a market cap of CN¥5.45 billion, has demonstrated significant financial progress despite some challenges. The company's earnings grew by 146% over the past year, surpassing industry averages and reflecting strong profit growth acceleration. Its debt-to-equity ratio has notably improved from 131.4% to 10.5% over five years, indicating effective debt management. However, operating cash flow covers only 7.5% of its debt, suggesting potential liquidity concerns. Recent earnings reports show increased net income despite a decline in sales compared to the previous year, highlighting resilience amid fluctuating revenue streams.

- Unlock comprehensive insights into our analysis of V V Food & BeverageLtd stock in this financial health report.

- Evaluate V V Food & BeverageLtd's historical performance by accessing our past performance report.

Beihai Gofar Chuanshan Biological (SHSE:600538)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beihai Gofar Chuanshan Biological Co., Ltd. operates in the biological and pharmaceutical industry, with a market capitalization of approximately CN¥2.62 billion.

Operations: The company's revenue segment is primarily derived from China, amounting to CN¥349.37 million.

Market Cap: CN¥2.62B

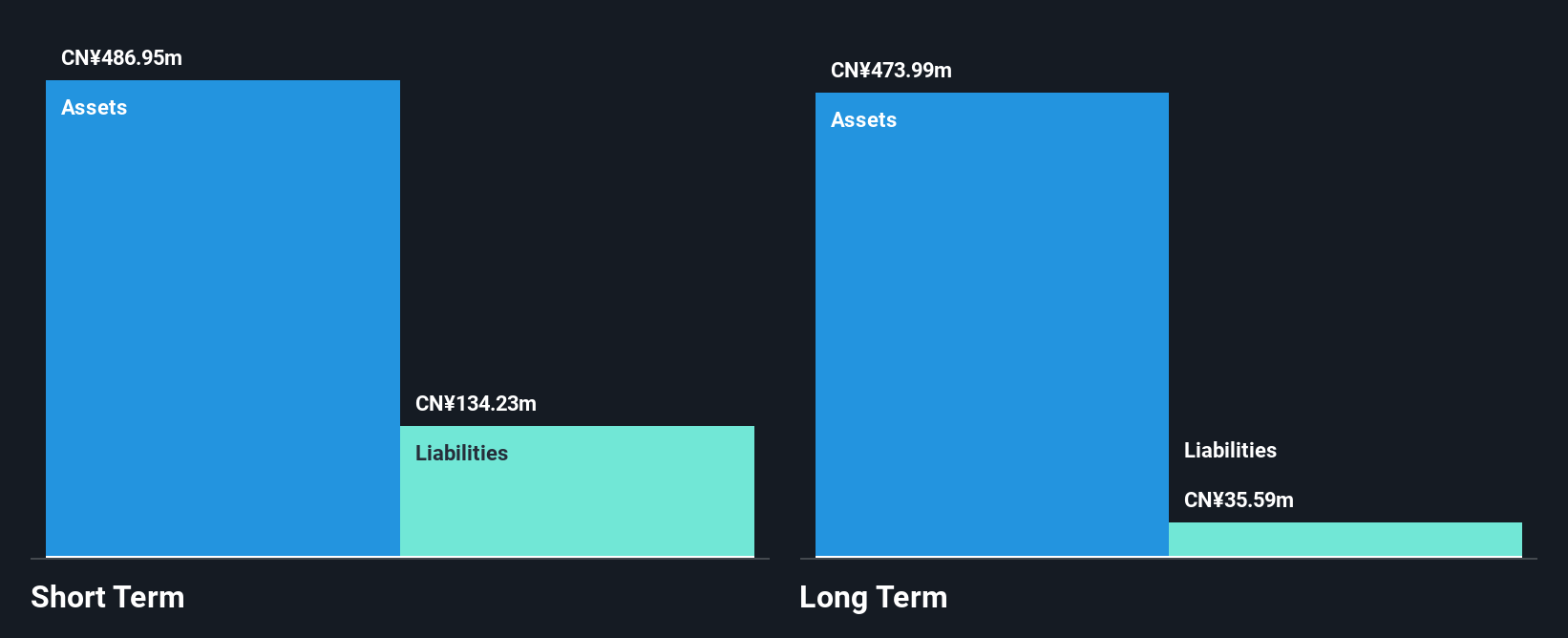

Beihai Gofar Chuanshan Biological Co., Ltd. presents a mixed financial picture with a market capitalization of CN¥2.62 billion and revenue of CN¥263.48 million for the first nine months of 2024, down from the previous year. The company remains unprofitable, with losses increasing at an annual rate of 50.7% over five years and a net loss widening to CN¥20.88 million this period compared to last year’s CN¥15.73 million loss. Despite these challenges, it maintains more cash than total debt and has sufficient short-term assets to cover both short- and long-term liabilities, providing some financial stability amidst ongoing volatility.

- Click to explore a detailed breakdown of our findings in Beihai Gofar Chuanshan Biological's financial health report.

- Gain insights into Beihai Gofar Chuanshan Biological's past trends and performance with our report on the company's historical track record.

Jinyuan EP (SZSE:000546)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jinyuan EP Co., Ltd. operates in the cement, concrete, and environmental sectors with a market capitalization of CN¥3.75 billion.

Operations: The company generated CN¥5.79 billion in revenue from its operations in China.

Market Cap: CN¥3.75B

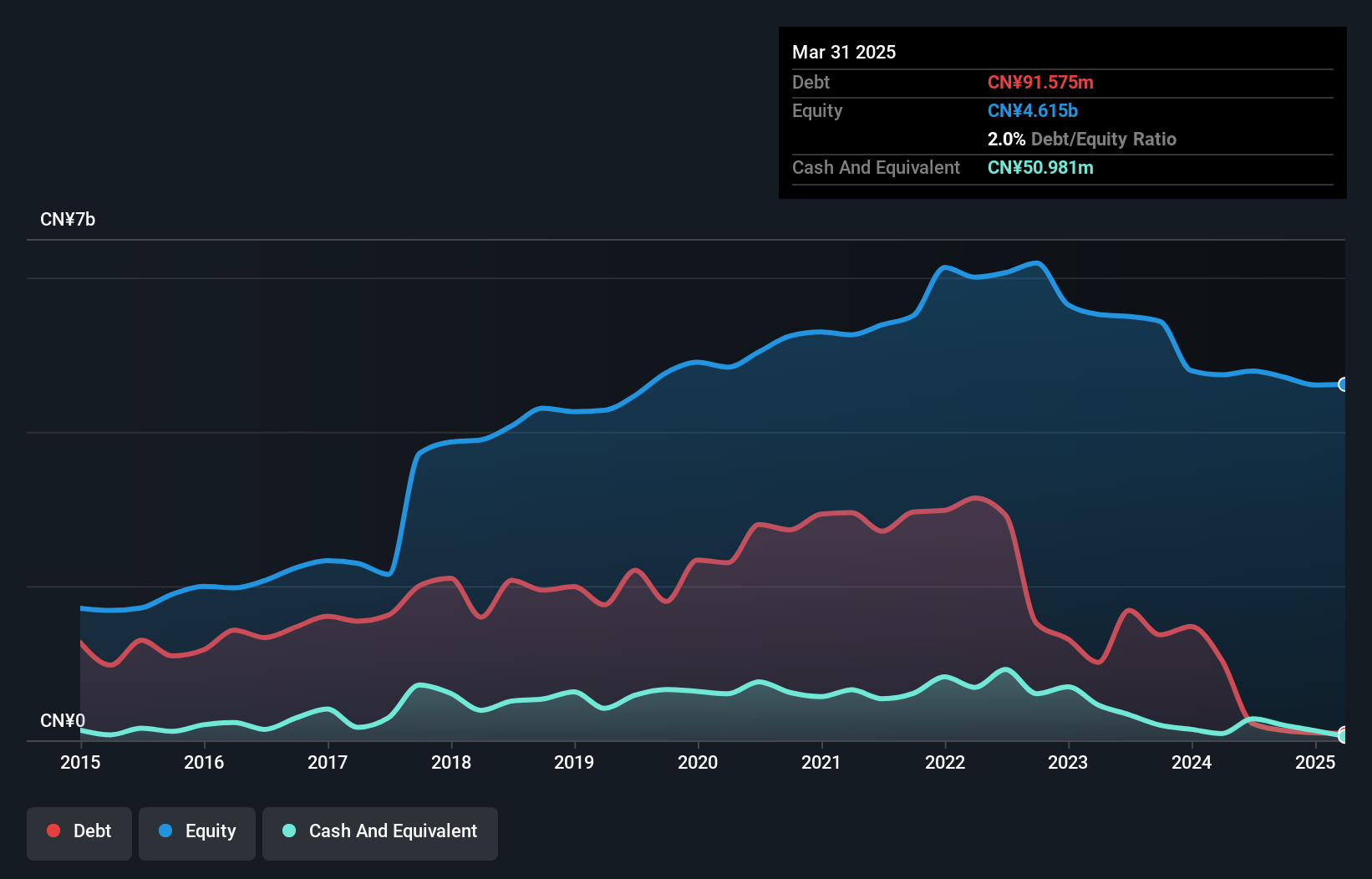

Jinyuan EP Co., Ltd. exhibits a complex financial profile, with a market capitalization of CN¥3.75 billion and generating CN¥5.79 billion in revenue from its operations in China. Despite reporting sales of CN¥4.49 billion for the first nine months of 2024, the company remains unprofitable with negative return on equity and increasing losses over five years at a rate of 68.8% annually. However, Jinyuan EP has more cash than total debt and sufficient short-term assets to cover liabilities, providing some financial resilience despite being dropped from the S&P Global BMI Index recently due to performance issues.

- Jump into the full analysis health report here for a deeper understanding of Jinyuan EP.

- Explore historical data to track Jinyuan EP's performance over time in our past results report.

Seize The Opportunity

- Embark on your investment journey to our 5,823 Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beihai Gofar Chuanshan Biological might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600538

Beihai Gofar Chuanshan Biological

Beihai Gofar Chuanshan Biological Co., Ltd.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives