- China

- /

- Paper and Forestry Products

- /

- SHSE:600462

Hubei Geoway Investment Co.,Ltd.'s (SHSE:600462) P/S Still Appears To Be Reasonable

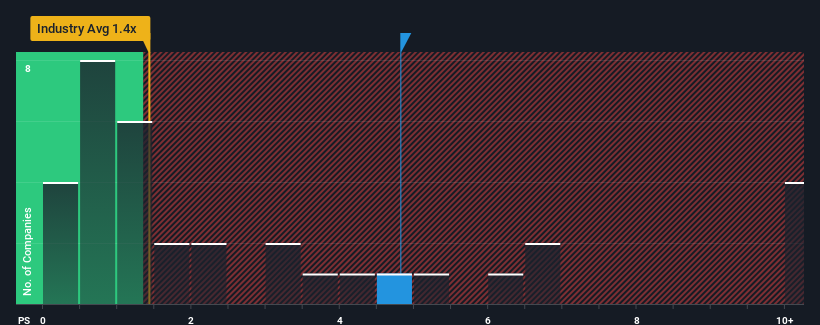

When you see that almost half of the companies in the Forestry industry in China have price-to-sales ratios (or "P/S") below 1.4x, Hubei Geoway Investment Co.,Ltd. (SHSE:600462) looks to be giving off strong sell signals with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hubei Geoway InvestmentLtd

How Has Hubei Geoway InvestmentLtd Performed Recently?

The revenue growth achieved at Hubei Geoway InvestmentLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hubei Geoway InvestmentLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Hubei Geoway InvestmentLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. This was backed up an excellent period prior to see revenue up by 64% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we can see why Hubei Geoway InvestmentLtd is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Hubei Geoway InvestmentLtd's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Hubei Geoway InvestmentLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 1 warning sign for Hubei Geoway InvestmentLtd that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hubei Geoway InvestmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600462

Hubei Geoway InvestmentLtd

Researches, develops, designs, manufactures, and sells Internet of Things equipment, electronic products, image vision technology products, sensors, and related software and hardware in China.

Slight and slightly overvalued.

Market Insights

Community Narratives