- China

- /

- Paper and Forestry Products

- /

- SHSE:600462

Hubei Geoway Investment Co.,Ltd.'s (SHSE:600462) 32% Jump Shows Its Popularity With Investors

Despite an already strong run, Hubei Geoway Investment Co.,Ltd. (SHSE:600462) shares have been powering on, with a gain of 32% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

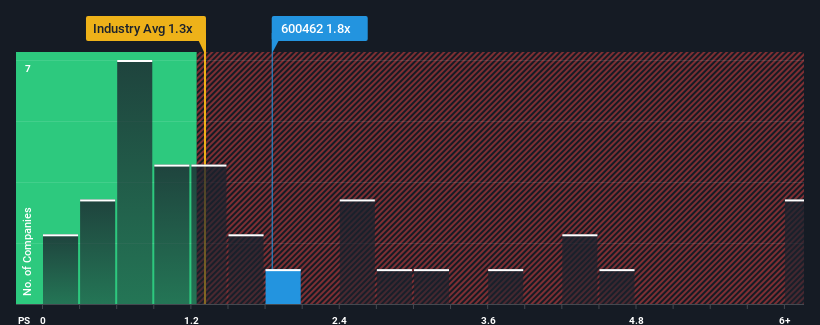

After such a large jump in price, you could be forgiven for thinking Hubei Geoway InvestmentLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.8x, considering almost half the companies in China's Forestry industry have P/S ratios below 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Hubei Geoway InvestmentLtd

What Does Hubei Geoway InvestmentLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Hubei Geoway InvestmentLtd has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hubei Geoway InvestmentLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hubei Geoway InvestmentLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 71%. The strong recent performance means it was also able to grow revenue by 98% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Hubei Geoway InvestmentLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Hubei Geoway InvestmentLtd's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hubei Geoway InvestmentLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Hubei Geoway InvestmentLtd (including 1 which is significant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hubei Geoway InvestmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600462

Hubei Geoway InvestmentLtd

Researches, develops, designs, manufactures, and sells Internet of Things equipment, electronic products, image vision technology products, sensors, and related software and hardware in China.

Slight and slightly overvalued.

Market Insights

Community Narratives