- China

- /

- Metals and Mining

- /

- SHSE:600392

Even With A 37% Surge, Cautious Investors Are Not Rewarding Shenghe Resources Holding Co., Ltd's (SHSE:600392) Performance Completely

Shenghe Resources Holding Co., Ltd (SHSE:600392) shareholders have had their patience rewarded with a 37% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

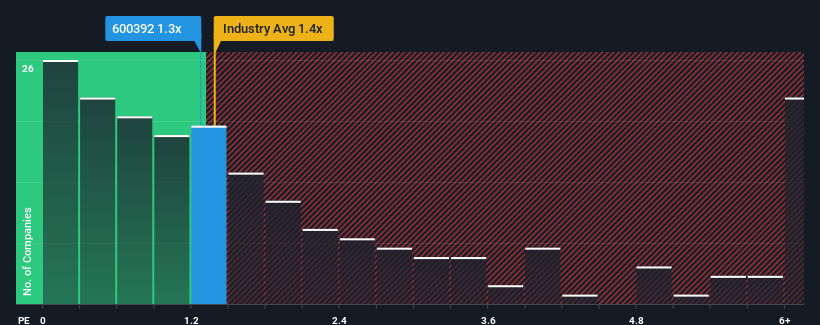

In spite of the firm bounce in price, it's still not a stretch to say that Shenghe Resources Holding's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in China, where the median P/S ratio is around 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Shenghe Resources Holding

How Shenghe Resources Holding Has Been Performing

Shenghe Resources Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenghe Resources Holding.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Shenghe Resources Holding's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. Still, the latest three year period has seen an excellent 56% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 24% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Shenghe Resources Holding's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Shenghe Resources Holding's P/S?

Shenghe Resources Holding appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Shenghe Resources Holding currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shenghe Resources Holding you should know about.

If these risks are making you reconsider your opinion on Shenghe Resources Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600392

Shenghe Resources Holding

Engages in the research and development, production, and supply of rare earth and related products in China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives