A Piece Of The Puzzle Missing From Weifang Yaxing Chemical Co., Ltd.'s (SHSE:600319) 26% Share Price Climb

Weifang Yaxing Chemical Co., Ltd. (SHSE:600319) shareholders have had their patience rewarded with a 26% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

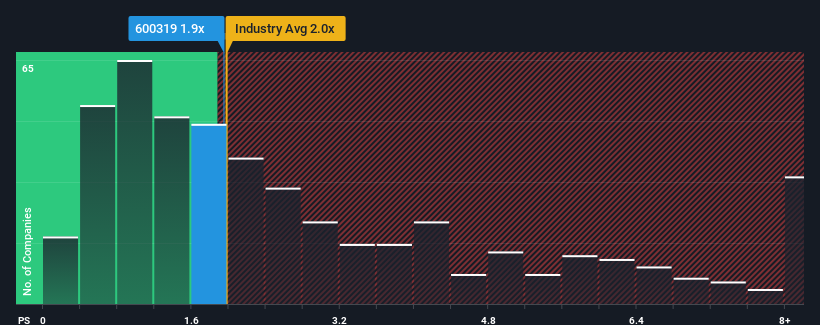

Even after such a large jump in price, there still wouldn't be many who think Weifang Yaxing Chemical's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in China's Chemicals industry is similar at about 2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Weifang Yaxing Chemical

How Weifang Yaxing Chemical Has Been Performing

For instance, Weifang Yaxing Chemical's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Weifang Yaxing Chemical's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Weifang Yaxing Chemical's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Weifang Yaxing Chemical is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Weifang Yaxing Chemical's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision Weifang Yaxing Chemical's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Weifang Yaxing Chemical with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Weifang Yaxing Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600319

Weifang Yaxing Chemical

Engages in the research, production, operation, import, and sale of chemical materials in China and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives