- China

- /

- Paper and Forestry Products

- /

- SHSE:600308

Optimism around Shandong Huatai Paper Industry ShareholdingLtd (SHSE:600308) delivering new earnings growth may be shrinking as stock declines 6.8% this past week

One of the frustrations of investing is when a stock goes down. But when the market is down, you're bound to have some losers. While the Shandong Huatai Paper Industry Shareholding Co.,Ltd (SHSE:600308) share price is down 16% in the last three years, the total return to shareholders (which includes dividends) was -9.6%. That's better than the market which declined 21% over the last three years. The last week also saw the share price slip down another 6.8%. However, this move may have been influenced by the broader market, which fell 4.9% in that time.

Since Shandong Huatai Paper Industry ShareholdingLtd has shed CN¥379m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Shandong Huatai Paper Industry ShareholdingLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

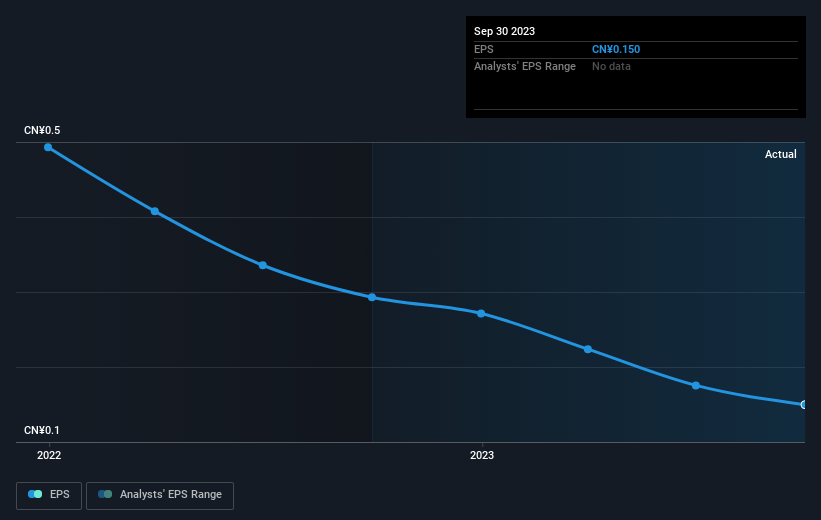

Shandong Huatai Paper Industry ShareholdingLtd saw its EPS decline at a compound rate of 30% per year, over the last three years. In comparison the 5% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Shandong Huatai Paper Industry ShareholdingLtd's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Shandong Huatai Paper Industry ShareholdingLtd's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Shandong Huatai Paper Industry ShareholdingLtd's TSR, which was a 9.6% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Although it hurts that Shandong Huatai Paper Industry ShareholdingLtd returned a loss of 6.8% in the last twelve months, the broader market was actually worse, returning a loss of 20%. Longer term investors wouldn't be so upset, since they would have made 0.8%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Shandong Huatai Paper Industry ShareholdingLtd better, we need to consider many other factors. Take risks, for example - Shandong Huatai Paper Industry ShareholdingLtd has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

We will like Shandong Huatai Paper Industry ShareholdingLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600308

Shandong Huatai Paper Industry ShareholdingLtd

Engages in the manufacture and sale of paper products in China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives