- China

- /

- Metals and Mining

- /

- SHSE:600259

Rising Nonferrous Metals Share Co.,Ltd. (SHSE:600259) Doing What It Can To Lift Shares

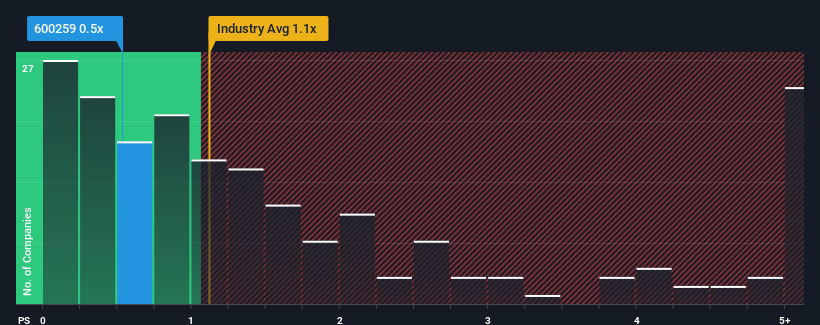

Rising Nonferrous Metals Share Co.,Ltd.'s (SHSE:600259) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Metals and Mining industry in China have P/S ratios greater than 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Rising Nonferrous Metals ShareLtd

What Does Rising Nonferrous Metals ShareLtd's P/S Mean For Shareholders?

Rising Nonferrous Metals ShareLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Rising Nonferrous Metals ShareLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Rising Nonferrous Metals ShareLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 38% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Rising Nonferrous Metals ShareLtd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Rising Nonferrous Metals ShareLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Rising Nonferrous Metals ShareLtd you should know about.

If you're unsure about the strength of Rising Nonferrous Metals ShareLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600259

Rising Nonferrous Metals ShareLtd

Engages in the mining, smelting separation, deep processing, and trading of rare earth and non-ferrous metals in China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives