Anhui Wanwei Updated High-Tech Material Industry Co.,Ltd (SHSE:600063) Doing What It Can To Lift Shares

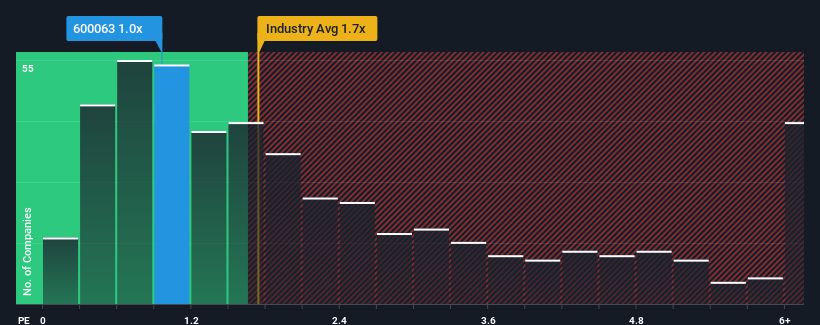

You may think that with a price-to-sales (or "P/S") ratio of 1x Anhui Wanwei Updated High-Tech Material Industry Co.,Ltd (SHSE:600063) is a stock worth checking out, seeing as almost half of all the Chemicals companies in China have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Anhui Wanwei Updated High-Tech Material IndustryLtd

What Does Anhui Wanwei Updated High-Tech Material IndustryLtd's Recent Performance Look Like?

Anhui Wanwei Updated High-Tech Material IndustryLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Anhui Wanwei Updated High-Tech Material IndustryLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.7% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 28% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Anhui Wanwei Updated High-Tech Material IndustryLtd's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Anhui Wanwei Updated High-Tech Material IndustryLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Anhui Wanwei Updated High-Tech Material IndustryLtd that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600063

Anhui Wanwei Updated High-Tech Material IndustryLtd

Provides chemicals, chemical fibers, new materials, and building materials.

Proven track record and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion