- China

- /

- Communications

- /

- SZSE:300620

3 Asian Growth Companies With Up To 32 Percent Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through a period of mixed economic signals, with inflationary pressures and trade dynamics shaping investor sentiment, the Asian market continues to present unique opportunities for growth. In this environment, companies with high insider ownership can offer an attractive proposition due to their potential alignment of interests between management and shareholders, making them noteworthy considerations for investors seeking growth in Asia.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 26.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We'll examine a selection from our screener results.

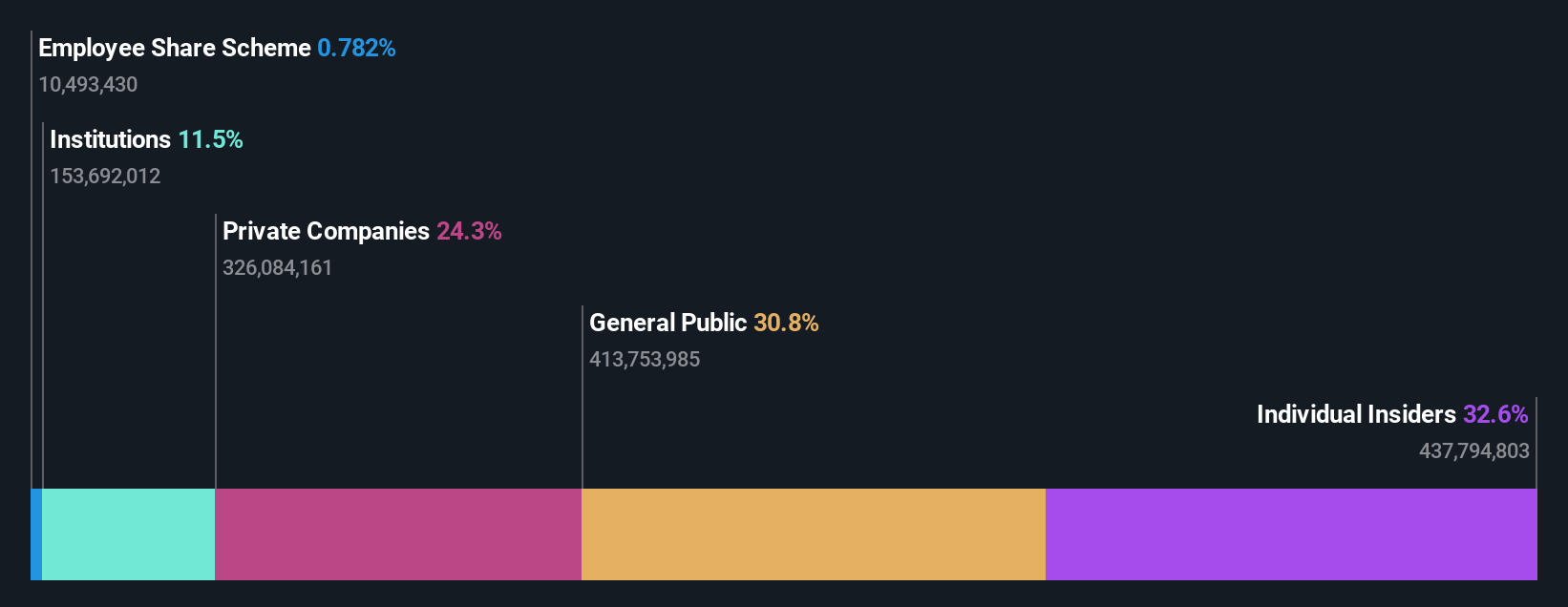

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★★

Overview: Newborn Town Inc. is an investment holding company involved in the global social networking business, with a market capitalization of HK$15.73 billion.

Operations: The company generates revenue from its Social Networking Business, which accounts for CN¥4.63 billion, and its Innovative Business, contributing CN¥459.64 million.

Insider Ownership: 32.6%

Newborn Town is experiencing significant growth, with earnings projected to increase by 31.96% annually, outpacing the Hong Kong market's average. The company's revenue is also expected to grow at 20.5% per year. Despite recent shareholder dilution and lower profit margins compared to last year, Newborn Town remains undervalued by 62.9% against its fair value estimate. Establishing its global headquarters in Hong Kong marks a strategic move for further expansion in a supportive business environment.

- Click here to discover the nuances of Newborn Town with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Newborn Town is priced higher than what may be justified by its financials.

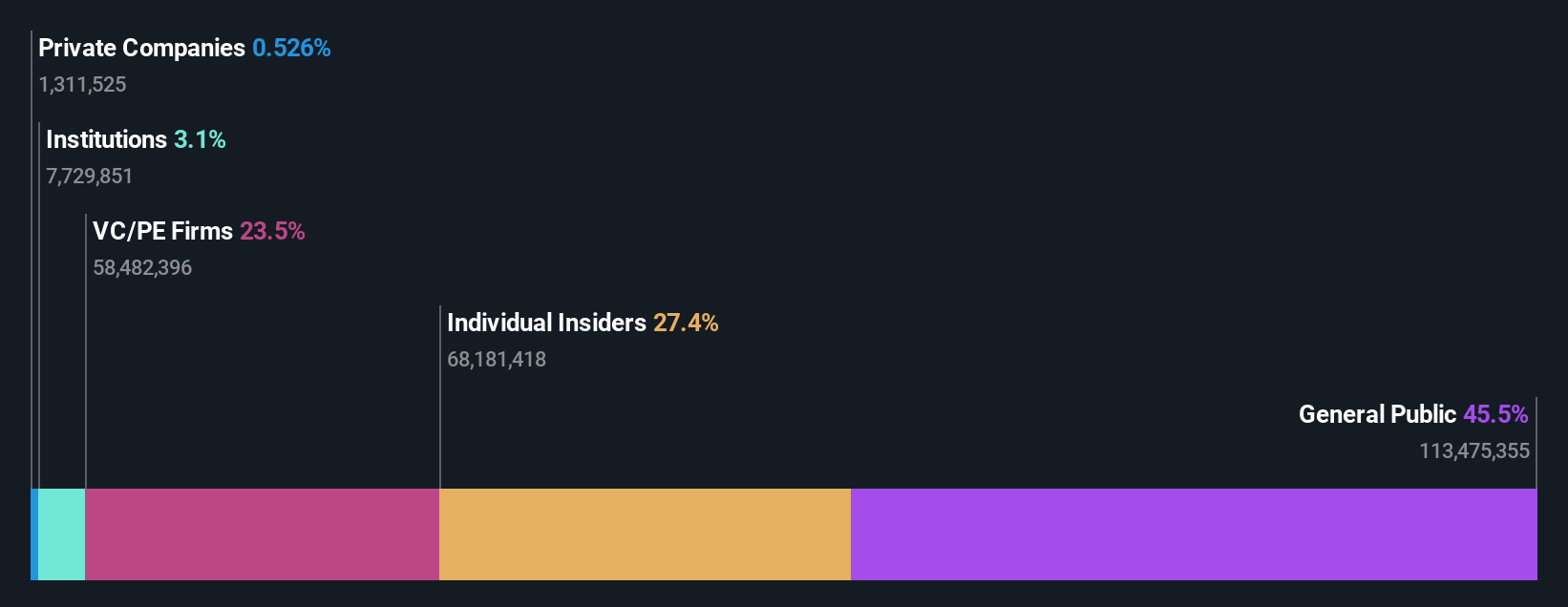

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Fiber Resources (Zhuhai) Ltd. designs and manufactures passive optical components for both domestic and international markets, with a market cap of CN¥12.62 billion.

Operations: The company generates revenue of CN¥1.10 billion from its Optoelectronic Devices and Other Electronic Devices segment.

Insider Ownership: 27.4%

Advanced Fiber Resources (Zhuhai) shows promising growth potential, with earnings expected to rise by 36.6% annually, surpassing the Chinese market's average. Recent financial results highlight a substantial increase in revenue and net income for Q1 2025, indicating robust operational performance. Despite slower projected revenue growth at 19.4% per year compared to earnings, it still exceeds the market rate. The company approved a dividend plan and amended its articles of association at its latest AGM, reflecting sound governance practices.

- Dive into the specifics of Advanced Fiber Resources (Zhuhai) here with our thorough growth forecast report.

- Our valuation report here indicates Advanced Fiber Resources (Zhuhai) may be overvalued.

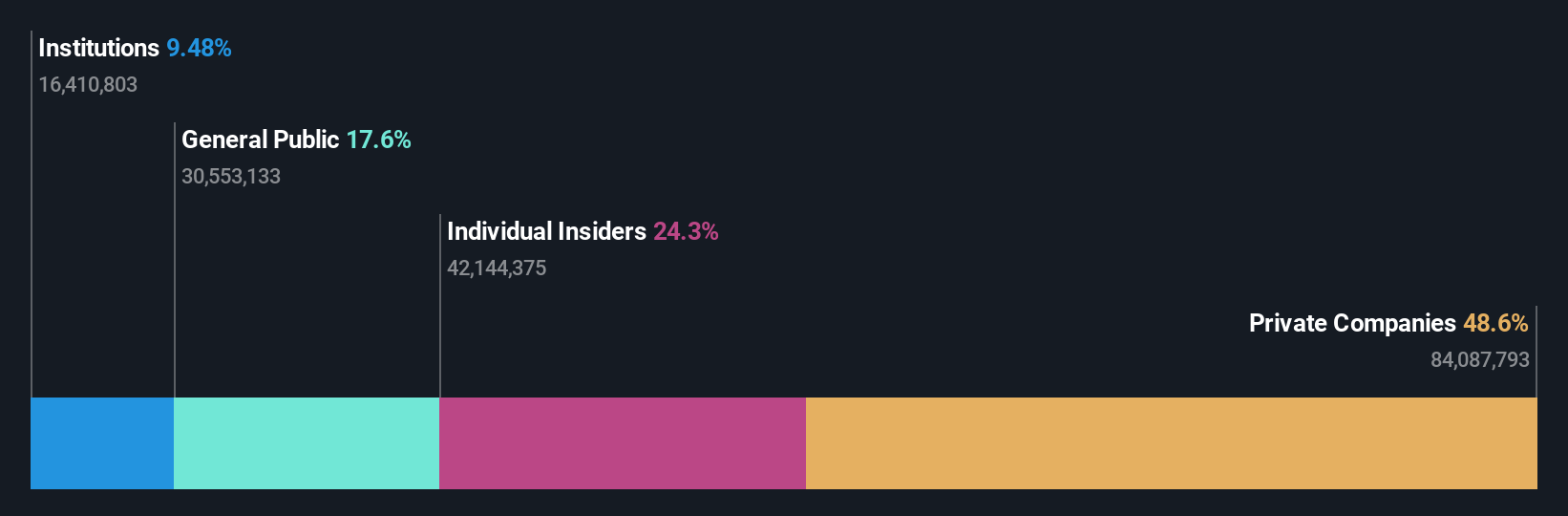

Shenzhen Hello Tech Energy (SZSE:301327)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Hello Tech Energy Co., Ltd. focuses on the research, development, manufacture, and sale of portable power products in China with a market cap of CN¥10.29 billion.

Operations: The company generates revenue through its research, development, manufacturing, and sales activities in the portable power product sector within China.

Insider Ownership: 24.3%

Shenzhen Hello Tech Energy is poised for significant growth, with earnings projected to grow 28.3% annually, outpacing the Chinese market average. The company recently became profitable and expects revenue to increase by 25.4% per year, well above the market rate. Despite a low forecasted return on equity of 7.1%, it trades at a substantial discount to its estimated fair value. Recent shareholder meetings focused on governance amendments and dividend affirmations underscore proactive management strategies.

- Unlock comprehensive insights into our analysis of Shenzhen Hello Tech Energy stock in this growth report.

- Our valuation report here indicates Shenzhen Hello Tech Energy may be undervalued.

Key Takeaways

- Click through to start exploring the rest of the 586 Fast Growing Asian Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300620

Advanced Fiber Resources (Zhuhai)

Designs and manufactures passive optical components in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives