- China

- /

- Household Products

- /

- SZSE:301009

Hangzhou Coco Healthcare Products Co.,Ltd. (SZSE:301009) Doing What It Can To Lift Shares

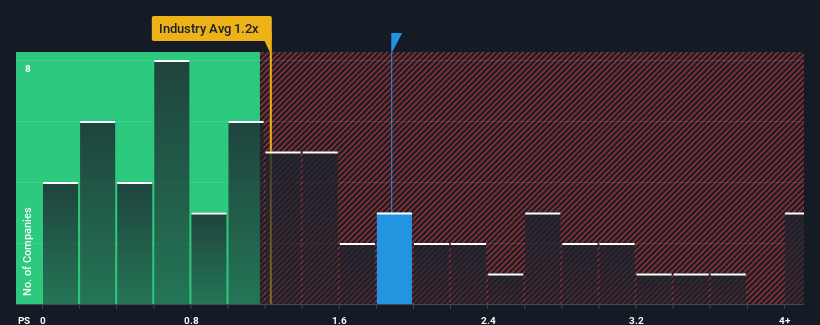

It's not a stretch to say that Hangzhou Coco Healthcare Products Co.,Ltd.'s (SZSE:301009) price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" for companies in the Household Products industry in China, where the median P/S ratio is around 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hangzhou Coco Healthcare ProductsLtd

What Does Hangzhou Coco Healthcare ProductsLtd's Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, Hangzhou Coco Healthcare ProductsLtd has been doing relatively well. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Hangzhou Coco Healthcare ProductsLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hangzhou Coco Healthcare ProductsLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.1%. The last three years don't look nice either as the company has shrunk revenue by 30% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 34% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 16% growth forecast for the broader industry.

With this information, we find it interesting that Hangzhou Coco Healthcare ProductsLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Hangzhou Coco Healthcare ProductsLtd's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Hangzhou Coco Healthcare ProductsLtd with six simple checks.

If these risks are making you reconsider your opinion on Hangzhou Coco Healthcare ProductsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Coco Healthcare ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301009

Hangzhou Coco Healthcare ProductsLtd

Hangzhou Coco Healthcare Products Co.,Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives