- China

- /

- Personal Products

- /

- SZSE:300957

The Market Lifts Yunnan Botanee Bio-Technology Group Co.LTD (SZSE:300957) Shares 26% But It Can Do More

Yunnan Botanee Bio-Technology Group Co.LTD (SZSE:300957) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

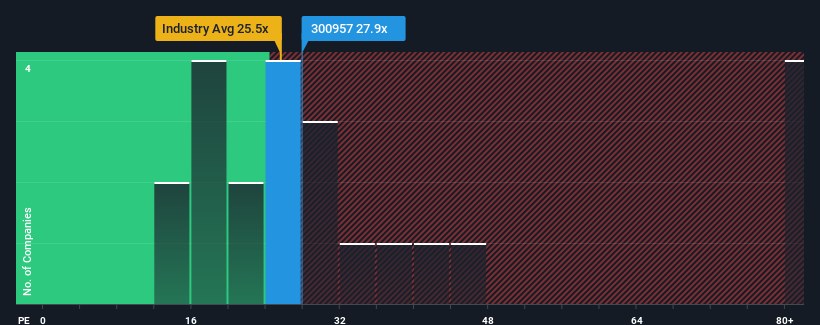

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Yunnan Botanee Bio-Technology GroupLTD's P/E ratio of 27.9x, since the median price-to-earnings (or "P/E") ratio in China is also close to 29x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Yunnan Botanee Bio-Technology GroupLTD has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Yunnan Botanee Bio-Technology GroupLTD

What Are Growth Metrics Telling Us About The P/E?

Yunnan Botanee Bio-Technology GroupLTD's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 28%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 9.4% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 21% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 19% per year growth forecast for the broader market.

In light of this, it's curious that Yunnan Botanee Bio-Technology GroupLTD's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Yunnan Botanee Bio-Technology GroupLTD's P/E?

Yunnan Botanee Bio-Technology GroupLTD appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Yunnan Botanee Bio-Technology GroupLTD currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Yunnan Botanee Bio-Technology GroupLTD (of which 1 is a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Yunnan Botanee Bio-Technology GroupLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300957

Yunnan Botanee Bio-Technology GroupLTD

Engages in the research and development, production, and sales of cosmetics in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives