- China

- /

- Electrical

- /

- SZSE:300014

Exploring Three Chinese Exchange Stocks Estimated To Be Undervalued By Up To 26.1%

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, Chinese stocks have shown resilience with notable gains following strong export data. This environment may present opportunities for investors to consider undervalued stocks within the region, which could potentially align well with current economic dynamics and market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥169.20 | CN¥321.74 | 47.4% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.50 | CN¥33.40 | 44.6% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥23.35 | CN¥45.90 | 49.1% |

| ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.28 | CN¥22.22 | 49.2% |

| China Film (SHSE:600977) | CN¥10.43 | CN¥20.25 | 48.5% |

| INKON Life Technology (SZSE:300143) | CN¥7.71 | CN¥14.64 | 47.4% |

| Seres GroupLtd (SHSE:601127) | CN¥82.02 | CN¥149.96 | 45.3% |

| Levima Advanced Materials (SZSE:003022) | CN¥13.88 | CN¥27.70 | 49.9% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥51.12 | CN¥96.66 | 47.1% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥10.31 | CN¥18.84 | 45.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

EVE Energy (SZSE:300014)

Overview: EVE Energy Co., Ltd. specializes in the production of lithium batteries, serving both domestic and international markets, with a market capitalization of approximately CN¥77.49 billion.

Operations: The company generates CN¥46.92 billion from its electronic component manufacturing segment.

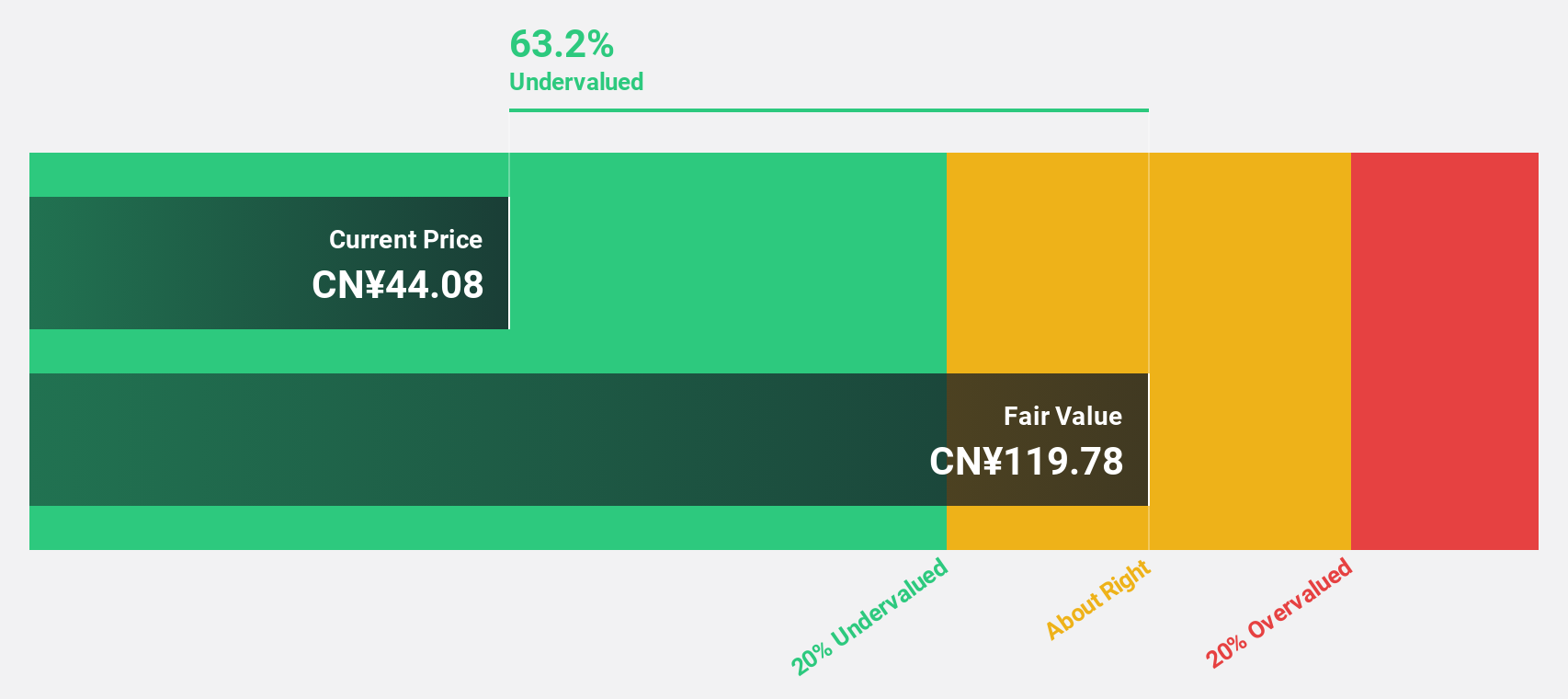

Estimated Discount To Fair Value: 20.5%

EVE Energy, despite a recent dip in quarterly revenue and net income, remains an attractive investment based on cash flow analysis. Trading at CN¥37.97 against a fair value of CN¥47.74 indicates significant undervaluation. The company's earnings are expected to grow by 23.06% annually, outpacing the broader Chinese market's 22.2%. Additionally, its dividend increase and stable payments reflect positively on its financial health, although it has an unstable dividend track record and low forecasted Return on Equity at 14.8%.

- The analysis detailed in our EVE Energy growth report hints at robust future financial performance.

- Take a closer look at EVE Energy's balance sheet health here in our report.

Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957)

Overview: Yunnan Botanee Bio-Technology Group Co. LTD specializes in the production and distribution of skincare and makeup products within China, boasting a market capitalization of approximately CN¥19.83 billion.

Operations: The company primarily generates revenue through the production and sales of skincare and makeup products.

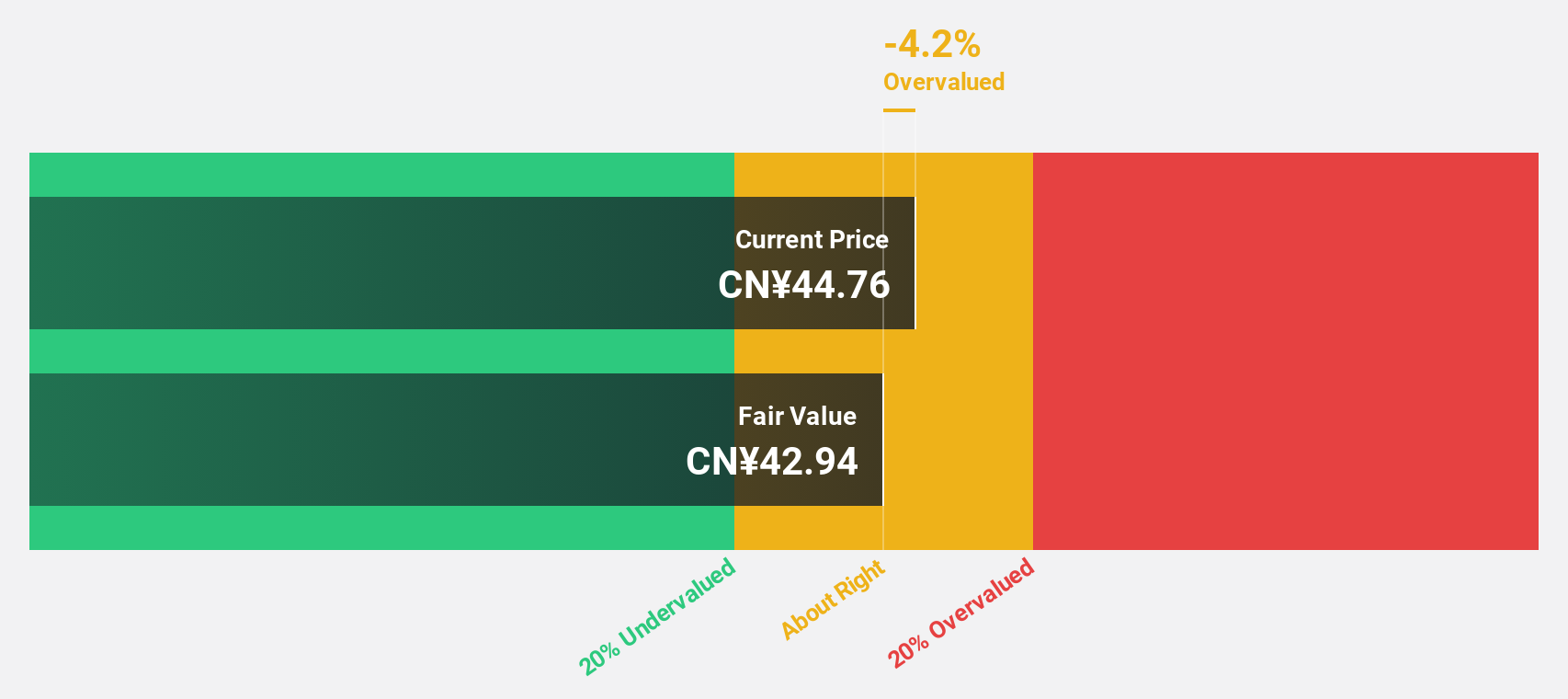

Estimated Discount To Fair Value: 26.1%

Yunnan Botanee Bio-Technology GroupLTD, with a current price of CN¥47.15, is trading at a 26.1% discount to its estimated fair value of CN¥63.8. Despite experiencing a decrease in net profit margin year-over-year from 21% to 13.5%, the company's earnings are expected to grow by 23.11% annually over the next three years, outperforming the Chinese market forecast of 22.2%. Recent share buybacks and consistent dividend payments, despite recent reductions, underscore management's confidence in its financial strategy and future growth prospects.

- Upon reviewing our latest growth report, Yunnan Botanee Bio-Technology GroupLTD's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Yunnan Botanee Bio-Technology GroupLTD stock in this financial health report.

NINGBO HENGSHUAI (SZSE:300969)

Overview: Ningbo Hengshuai Co., Ltd. is a global manufacturer and seller of automotive micro-motors and components, with a market capitalization of CN¥6.22 billion.

Operations: The company generates CN¥981.56 million from its automotive parts and accessories segment.

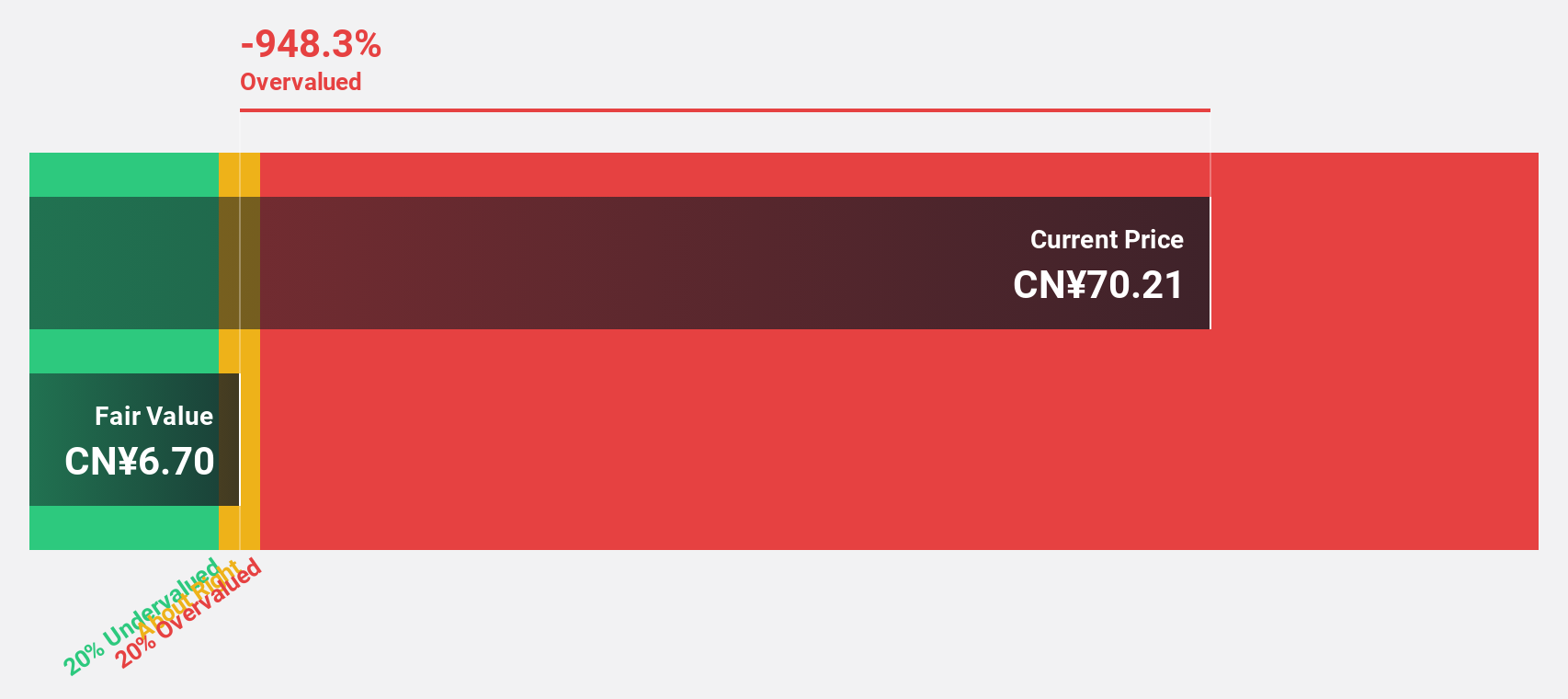

Estimated Discount To Fair Value: 23.5%

NINGBO HENGSHUAI, priced at CN¥77.74, is valued below its estimated fair value of CN¥101.57, indicating a significant undervaluation based on cash flows. Recent financials show robust growth with earnings up 46.2% from last year and revenue growth projected at 20.3% annually, surpassing the Chinese market's 13.7%. However, its earnings growth forecast of 21.5% per year slightly trails the market expectation of 22.2%. The company recently increased dividends to CNY4 per 10 shares and reported strong quarterly results with net income rising to CNY64.79 million from CNY40.85 million year-over-year.

- Insights from our recent growth report point to a promising forecast for NINGBO HENGSHUAI's business outlook.

- Get an in-depth perspective on NINGBO HENGSHUAI's balance sheet by reading our health report here.

Make It Happen

- Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 94 more companies for you to explore.Click here to unveil our expertly curated list of 97 Undervalued Chinese Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EVE Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300014

EVE Energy

Engages in the research, development, production, and sales of lithium batteries in China and internationally.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026