November 2024's Estimated Value Picks Trading Below Fair Market Evaluations

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices reaching record highs amid expectations of economic growth and regulatory changes, investors are keenly observing the shifts in fiscal policies and their potential impacts on inflation and trade dynamics. In this environment, identifying stocks trading below their fair market value can offer opportunities for those looking to capitalize on discrepancies between current prices and intrinsic worth, especially as markets adjust to new political landscapes and economic forecasts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$178.25 | CA$354.07 | 49.7% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.53 | US$99.93 | 49.4% |

| Synovus Financial (NYSE:SNV) | US$58.27 | US$115.23 | 49.4% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53700.00 | ₩106763.27 | 49.7% |

| GRCS (TSE:9250) | ¥1500.00 | ¥2979.26 | 49.7% |

| Laboratorio Reig Jofre (BME:RJF) | €2.87 | €5.74 | 50% |

| Redcentric (AIM:RCN) | £1.1725 | £2.32 | 49.4% |

| Medios (XTRA:ILM1) | €14.76 | €29.48 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.24 | €16.29 | 49.4% |

| Cellnex Telecom (BME:CLNX) | €32.47 | €64.68 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

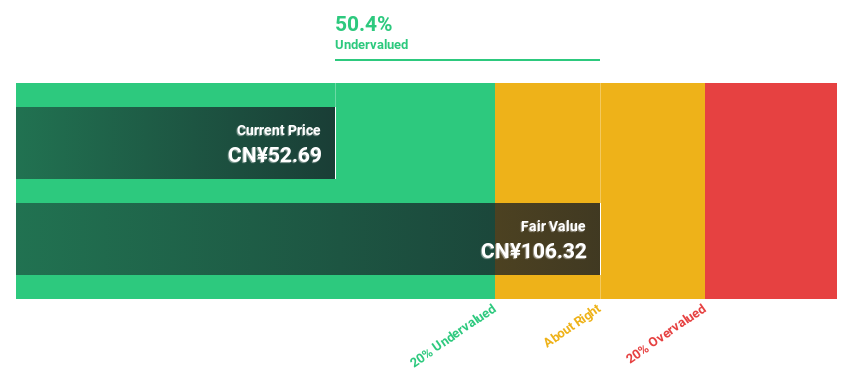

iFLYTEKLTD (SZSE:002230)

Overview: iFLYTEK CO., LTD. provides artificial intelligence (AI) technology services in China and has a market cap of CN¥113.01 billion.

Operations: iFLYTEK CO., LTD. derives its revenue from artificial intelligence technology services in China.

Estimated Discount To Fair Value: 48.7%

iFLYTEK CO., LTD is trading at a significant discount, approximately 48.7% below its estimated fair value of CNY 105.67, with shares priced at CNY 54.21. Despite recent net losses, the company shows potential for growth with forecasted annual earnings growth of 63%, surpassing the Chinese market average of 26.4%. Revenue is expected to grow by 15.1% annually, indicating strong future cash flow prospects despite current financial setbacks.

- Our expertly prepared growth report on iFLYTEKLTD implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of iFLYTEKLTD.

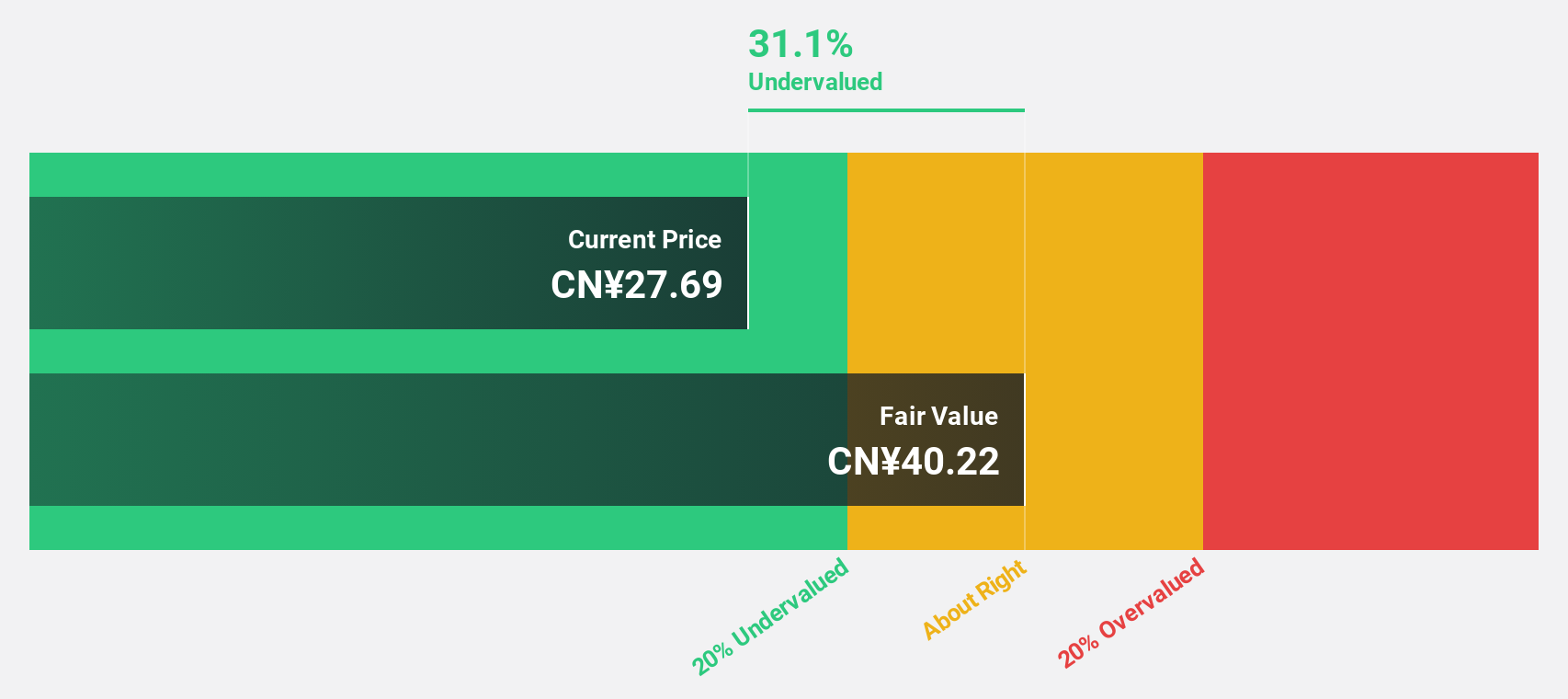

Chongqing Baiya Sanitary Products (SZSE:003006)

Overview: Chongqing Baiya Sanitary Products Co., Ltd. operates in the sanitary products sector and has a market cap of CN¥10.84 billion.

Operations: The company's revenue from personal products is CN¥2.99 billion.

Estimated Discount To Fair Value: 20.9%

Chongqing Baiya Sanitary Products is trading over 20% below its estimated fair value of CN¥32.79, with shares at CN¥25.93, highlighting potential undervaluation based on cash flows. The company's revenue for the first nine months of 2024 rose significantly to CN¥2.32 billion from CN¥1.48 billion a year earlier, while net income increased to CN¥238.52 million from CN¥182.4 million, reflecting robust financial performance despite a dividend not fully covered by free cash flows.

- Our growth report here indicates Chongqing Baiya Sanitary Products may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Chongqing Baiya Sanitary Products stock in this financial health report.

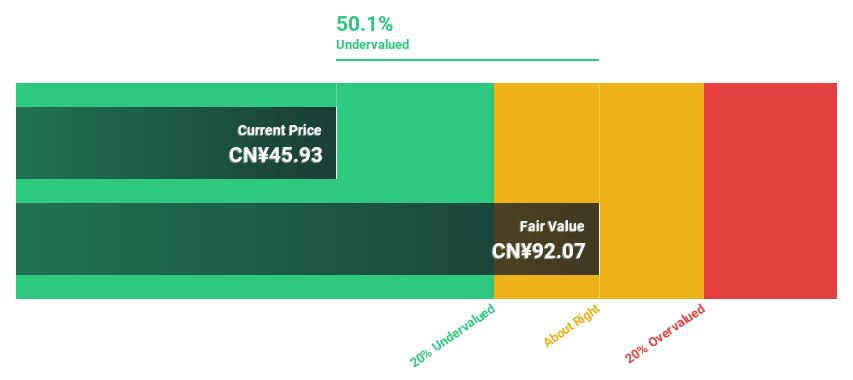

Colorlight Cloud Tech (SZSE:301391)

Overview: Colorlight Cloud Tech Ltd specializes in the R&D, manufacturing, and sales of LED display control systems and related video processing equipment globally, with a market cap of CN¥4.16 billion.

Operations: The company's revenue is primarily derived from the sales of LED display control system equipment, amounting to CN¥878.11 million.

Estimated Discount To Fair Value: 49.1%

Colorlight Cloud Tech is trading at CN¥46.73, significantly below its estimated fair value of CN¥91.89, suggesting undervaluation based on cash flows despite recent challenges. The company's revenue for the first nine months of 2024 fell to CN¥425.82 million from CN¥567.68 million a year ago, with net income dropping to CN¥11.7 million from CN¥109.91 million, reflecting financial pressures and a dividend not well covered by free cash flows.

- The analysis detailed in our Colorlight Cloud Tech growth report hints at robust future financial performance.

- Click here to discover the nuances of Colorlight Cloud Tech with our detailed financial health report.

Summing It All Up

- Click through to start exploring the rest of the 892 Undervalued Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives