- China

- /

- Household Products

- /

- SZSE:000523

Solid Earnings May Not Tell The Whole Story For Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou (SZSE:000523)

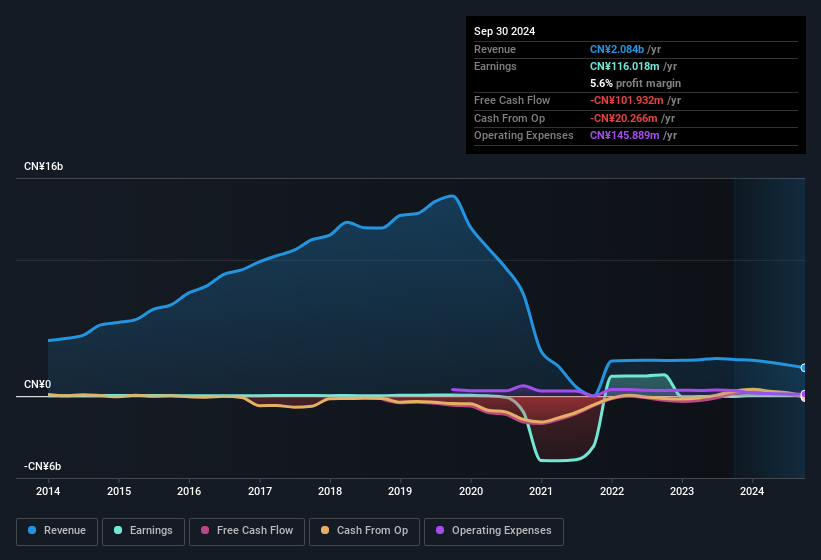

Hongmian Zhihui Science and Technology Innovation Co.,Ltd.Guangzhou's (SZSE:000523) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Check out our latest analysis for Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou

Zooming In On Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2024, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou recorded an accrual ratio of 0.32. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. Even though it reported a profit of CN¥116.0m, a look at free cash flow indicates it actually burnt through CN¥102m in the last year. We saw that FCF was CN¥221m a year ago though, so Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou has at least been able to generate positive FCF in the past. However, we can see that a recent tax benefit, along with unusual items, have impacted its statutory profit, and therefore its accrual ratio. The good news for shareholders is that Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou saw its profit reduced by unusual items worth CN¥38m. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou profited from a tax benefit which contributed CN¥33m to profit. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's Profit Performance

In conclusion, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's accrual ratio suggests that its statutory earnings are not backed by cash flow, in part due to the tax benefit it received; but the fact unusual items actually weighed on profit may create upside if those unusual items do not recur. After taking into account all the aforementioned observations we think that Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's profits probably give a generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. You'd be interested to know, that we found 1 warning sign for Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou and you'll want to know about it.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000523

Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou

Engages in the production and sale of edible sugar, beverages, and other food products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026