- China

- /

- Healthcare Services

- /

- SZSE:301370

Zhejiang Mustang BatteryLtd Leads These 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by a mix of economic indicators and geopolitical developments. While U.S. stocks experienced fluctuations due to AI competition fears and tariff risks, the European Central Bank's rate cut provided some optimism across the Atlantic. Amid these turbulent times, investors often seek out small-cap stocks with robust fundamentals as potential opportunities for growth. Zhejiang Mustang Battery Ltd stands out as one such company, leading a trio of undiscovered gems that may offer resilience in an unpredictable market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Mustang BatteryLtd (SHSE:605378)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Mustang Battery Co., Ltd focuses on the research, development, production, and sale of dry batteries in China, with a market capitalization of CN¥4.08 billion.

Operations: Zhejiang Mustang Battery Co., Ltd derives its revenue primarily from the production and sale of dry batteries. The company's financial performance is highlighted by a net profit margin trend, which provides insight into its profitability relative to total revenue.

Zhejiang Mustang Battery Ltd, a nimble player in the market, showcases impressive financial metrics. With a price-to-earnings ratio of 28x, it stands below the CN market average of 35.8x, highlighting its potential value proposition. The company is debt-free and has maintained this status for over five years, which suggests prudent financial management. Earnings have surged by 43% in the past year, outpacing industry peers who faced a -6.7% earnings growth rate. Despite these strengths, its share price has been highly volatile recently, which could pose risks for investors seeking stability.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Mustang BatteryLtd.

Gain insights into Zhejiang Mustang BatteryLtd's past trends and performance with our Past report.

Shenzhen Longtech Smart Control (SZSE:300916)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Longtech Smart Control Co., Ltd. operates in the smart control technology sector and has a market cap of CN¥4.59 billion.

Operations: Longtech Smart Control generates revenue primarily from the smart control technology sector. The company has a market cap of CN¥4.59 billion, reflecting its position in the industry.

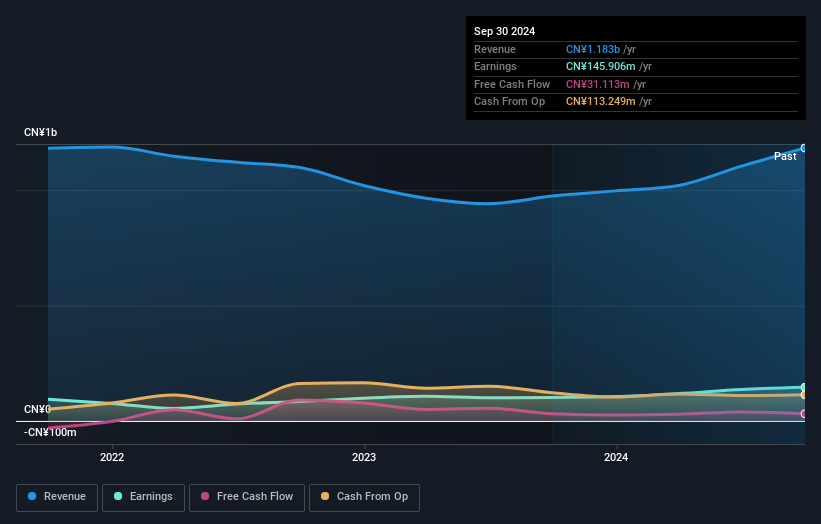

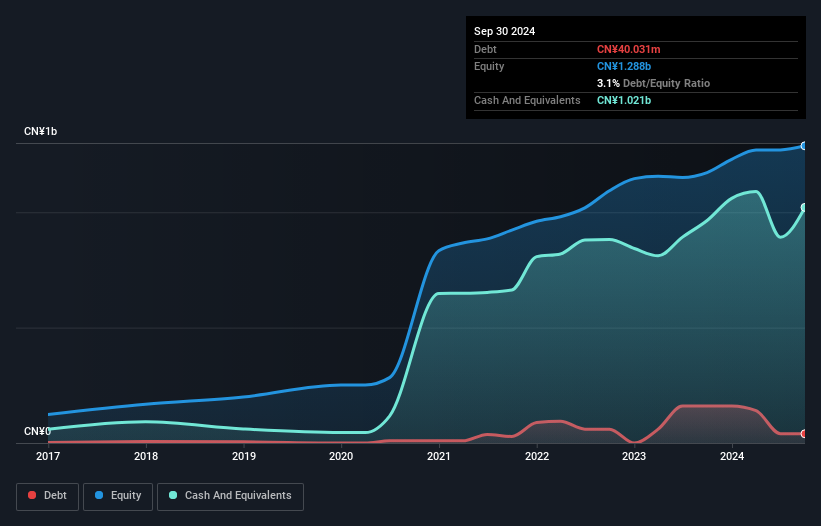

Longtech Smart Control, a relatively small player in the electronics sector, showcases promising financial health. Its earnings growth of 43.9% over the past year significantly outpaces the industry average of 3%, suggesting robust performance. The company's price-to-earnings ratio of 30.3x is favorable compared to the broader CN market at 35.8x, indicating potential value for investors. Despite an increase in its debt-to-equity ratio from 0.5% to 3.1% over five years, Longtech remains financially stable with more cash than total debt and positive free cash flow, reflecting strong operational efficiency and prudent management strategies.

GKHT Medical Technology (SZSE:301370)

Simply Wall St Value Rating: ★★★★★★

Overview: GKHT Medical Technology Co., Ltd. focuses on the distribution and sale of medical devices in China, with a market cap of CN¥5.11 billion.

Operations: GKHT Medical Technology generates its revenue primarily from distributing and selling medical devices in China. The company's market cap stands at CN¥5.11 billion, reflecting its scale in the industry.

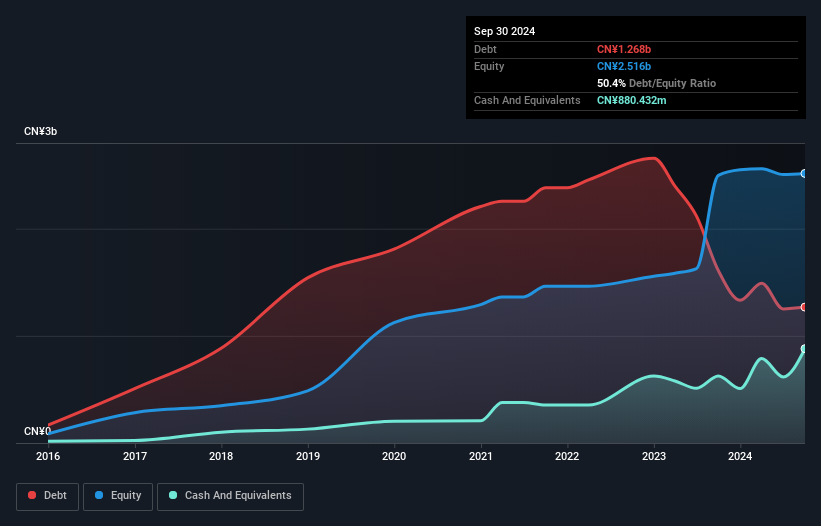

GKHT Medical Technology, a smaller player in the healthcare sector, showcases high-quality earnings with its stock trading at nearly 90% below estimated fair value. Over the past year, earnings surged by 33.8%, outpacing the broader industry decline of 5.7%. The company's debt management appears robust, with a reduction in its debt-to-equity ratio from 180.9% to 50.4% over five years and a satisfactory net debt-to-equity ratio of 15.4%. Despite past annual declines of around 1.1%, recent performance suggests potential for future growth amid strategic financial improvements and market positioning adjustments.

Summing It All Up

- Unlock our comprehensive list of 4724 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301370

Flawless balance sheet with proven track record.

Market Insights

Community Narratives