Stock Analysis

- China

- /

- Household Products

- /

- SHSE:603515

Opple LightingLTD And Two More Leading Dividend Stocks On The Chinese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Chinese equities have shown resilience, with the Shanghai Composite Index experiencing modest gains. This stability makes it an opportune time to consider the potential benefits of dividend stocks in China, such as Opple Lighting LTD, which can offer investors both income and growth prospects in a dynamic economic environment.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Anhui Anke Biotechnology (Group) (SZSE:300009) | 3.01% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.81% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.68% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.06% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.72% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.73% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.83% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.83% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.79% | ★★★★★★ |

Click here to see the full list of 269 stocks from our Top Chinese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Opple LightingLTD (SHSE:603515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Opple Lighting Co., LTD is a company based in China that specializes in the research and development, production, and sale of lighting products both domestically and internationally, with a market capitalization of approximately CN¥12.11 billion.

Operations: Opple Lighting Co., LTD generates its revenue primarily through the development, production, and sales of lighting products, totaling CN¥7.88 billion.

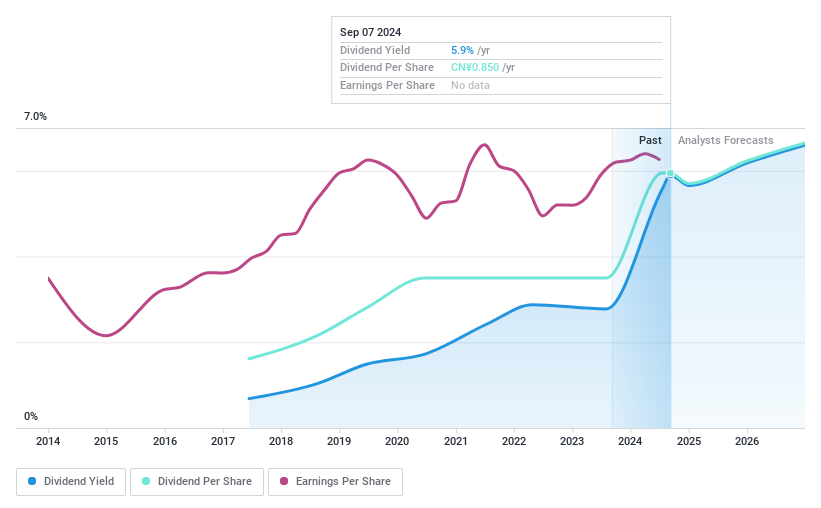

Dividend Yield: 5.2%

Opple Lighting Co., LTD, while relatively new to dividend distribution with only seven years of history, shows promise in its financial health. Its dividends are well-covered by earnings and cash flows, with a payout ratio of 66.4% and a cash payout ratio of 67.2%, respectively. The company's earnings have grown by 16.1% over the past year and are projected to increase by 10.48% annually. Additionally, Opple's current dividend yield stands at 5.17%, placing it in the top quartile within the Chinese market.

- Unlock comprehensive insights into our analysis of Opple LightingLTD stock in this dividend report.

- Our expertly prepared valuation report Opple LightingLTD implies its share price may be lower than expected.

Tibet Weixinkang Medicine (SHSE:603676)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tibet Weixinkang Medicine Co., Ltd. is a Chinese company specializing in the research, development, production, and sale of chemical drugs and their bulk drugs, with a market capitalization of approximately CN¥3.45 billion.

Operations: Tibet Weixinkang Medicine generates its revenue primarily from the pharmaceutical sector, totaling CN¥1.29 billion.

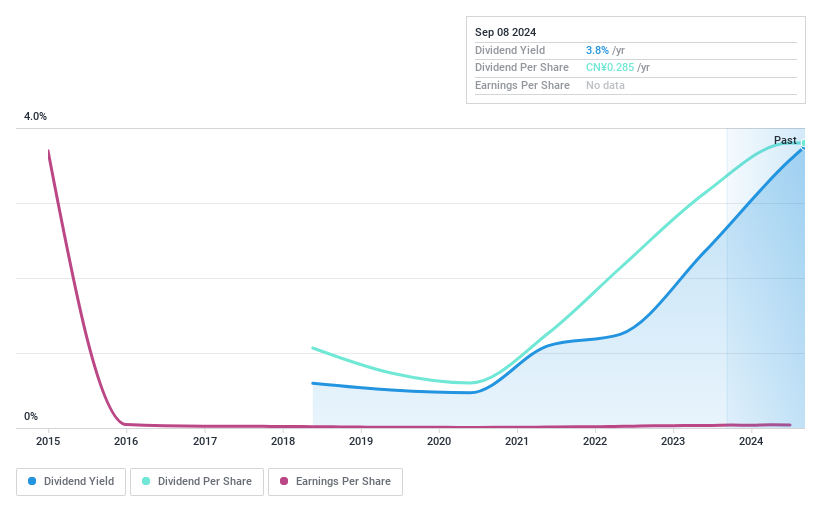

Dividend Yield: 3.6%

Tibet Weixinkang Medicine, despite recent exclusion from the S&P Global BMI Index, maintains a dividend yield of 3.59%, ranking in the top 25% in China. The company's dividends are supported by a payout ratio of 49.1% and cash flows with a cash payout ratio of 51.2%. Although its dividend history is short and volatile, recent earnings growth (25.4% year-over-year) suggests some potential for stability. However, financial results have been affected by significant one-off items, indicating that while dividends are currently manageable, their sustainability could be at risk if such irregularities continue.

- Take a closer look at Tibet Weixinkang Medicine's potential here in our dividend report.

- Our valuation report unveils the possibility Tibet Weixinkang Medicine's shares may be trading at a discount.

Zhejiang Changsheng Sliding Bearings (SZSE:300718)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Changsheng Sliding Bearings Co., Ltd. is a company engaged in the manufacturing of sliding bearings, with a market capitalization of approximately CN¥3.88 billion.

Operations: Zhejiang Changsheng Sliding Bearings Co., Ltd. does not provide detailed segmentation of its revenue in the provided text.

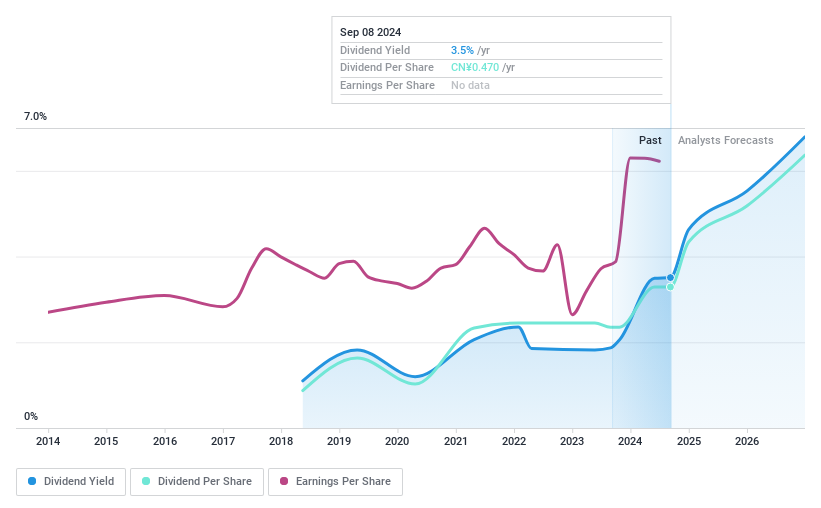

Dividend Yield: 3.6%

Zhejiang Changsheng Sliding Bearings, despite a fluctuating dividend history over its six-year payout period, declared a CNY 2.35 per 10 shares dividend for 2023. The company's dividends are supported by earnings with a payout ratio of 49.8% and cash flows at 70.7%. Recent corporate actions include share buybacks and adjustments in stock incentive plans, highlighting governance activity that could impact future dividends. Additionally, the firm's earnings grew by nearly double last year and are expected to increase further, providing some optimism for ongoing dividend support despite past inconsistencies.

- Navigate through the intricacies of Zhejiang Changsheng Sliding Bearings with our comprehensive dividend report here.

- Our expertly prepared valuation report Zhejiang Changsheng Sliding Bearings implies its share price may be too high.

Seize The Opportunity

- Dive into all 269 of the Top Chinese Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603515

Opple LightingLTD

Engages in the research and development, production, and sale of lighting products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.