Stock Analysis

- China

- /

- Healthcare Services

- /

- SZSE:000028

Earnings are growing at China National Accord Medicines (SZSE:000028) but shareholders still don't like its prospects

Most people feel a little frustrated if a stock they own goes down in price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. So while the China National Accord Medicines Corporation Ltd. (SZSE:000028) share price is down 15% in the last year, the total return to shareholders (which includes dividends) was -13%. That's better than the market which declined 19% over the last year. Longer term investors have fared much better, since the share price is up 12% in three years. The falls have accelerated recently, with the share price down 14% in the last three months. But this could be related to the weak market, which is down 10% in the same period.

With the stock having lost 4.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for China National Accord Medicines

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the China National Accord Medicines share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But other metrics might shed some light on why the share price is down.

Revenue was pretty flat on last year, which isn't too bad. But the share price might be lower because the market expected a meaningful improvement, and got none.

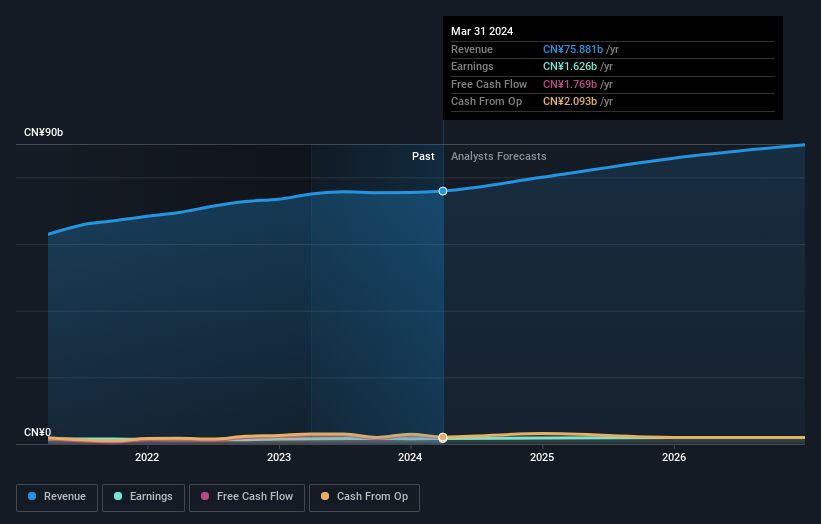

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at China National Accord Medicines' financial health with this free report on its balance sheet.

A Different Perspective

Although it hurts that China National Accord Medicines returned a loss of 13% in the last twelve months, the broader market was actually worse, returning a loss of 19%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 0.9% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand China National Accord Medicines better, we need to consider many other factors. For example, we've discovered 1 warning sign for China National Accord Medicines that you should be aware of before investing here.

We will like China National Accord Medicines better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000028

China National Accord Medicines

China National Accord Medicines Corporation Ltd.

Excellent balance sheet with proven track record and pays a dividend.