- China

- /

- Professional Services

- /

- SZSE:300492

3 Growth Stocks With High Insider Ownership And 22% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a period of volatility, with U.S. equities experiencing declines amid inflation concerns and political uncertainty, investors are increasingly focused on identifying resilient growth opportunities. In such an environment, stocks characterized by high insider ownership and robust revenue growth can offer potential advantages, as they often reflect strong internal confidence and the ability to thrive despite broader economic challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southchip Semiconductor Technology(Shanghai) Co., Ltd. is a semiconductor design company specializing in power and battery management solutions in China, with a market cap of CN¥14.67 billion.

Operations: The company's revenue from its semiconductor segment is CN¥2.47 billion.

Insider Ownership: 17.1%

Revenue Growth Forecast: 22.4% p.a.

Southchip Semiconductor Technology (Shanghai) has shown strong revenue growth, reporting CNY 1.90 billion for the first nine months of 2024, up from CNY 1.21 billion year-on-year. Earnings are expected to grow significantly at 27.62% annually over the next three years, outpacing the Chinese market average. Despite a lower forecasted return on equity of 13.1%, its price-to-earnings ratio of 44.2x remains attractive compared to industry peers, suggesting potential value for growth-focused investors.

- Dive into the specifics of Southchip Semiconductor Technology(Shanghai) here with our thorough growth forecast report.

- Our expertly prepared valuation report Southchip Semiconductor Technology(Shanghai) implies its share price may be too high.

Huatu Cendes (SZSE:300492)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to a diverse clientele in China, with a market cap of CN¥9.25 billion.

Operations: Huatu Cendes Co., Ltd. generates revenue by providing architectural design, consulting, and engineering services to a variety of clients including state-owned enterprises, multinational corporations, private companies, and government agencies in China.

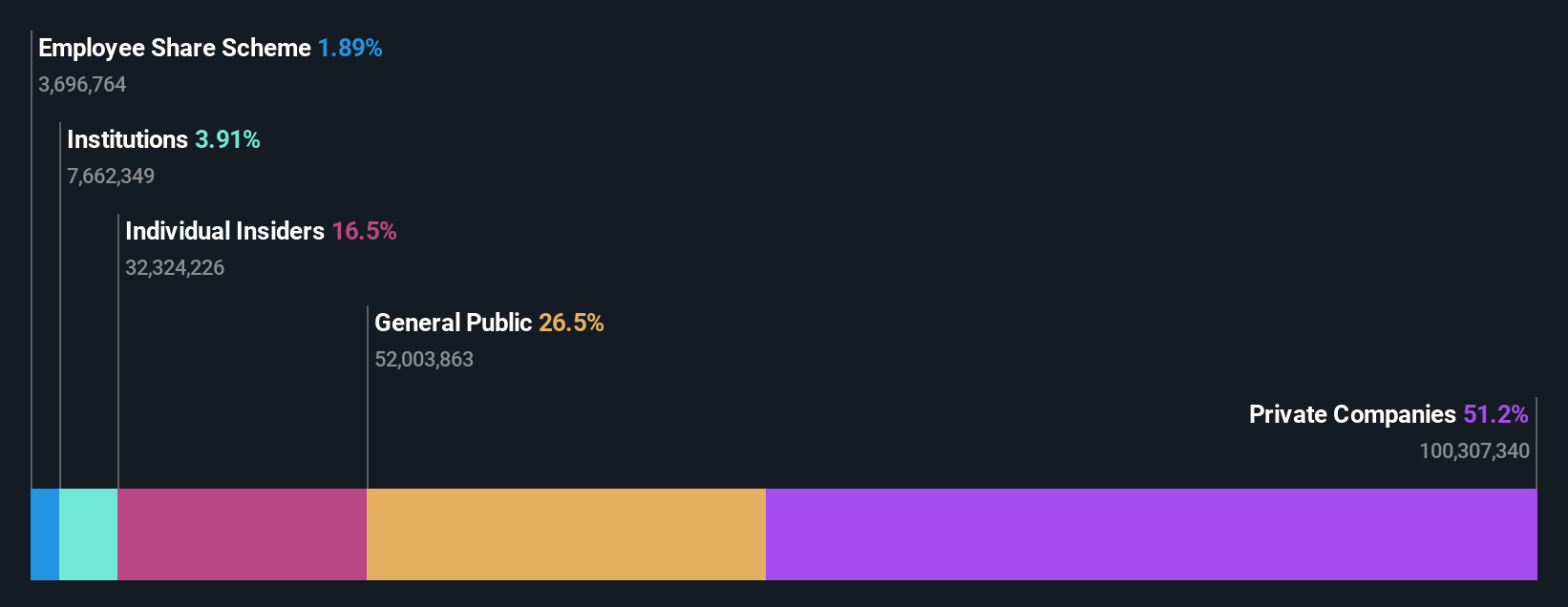

Insider Ownership: 22.4%

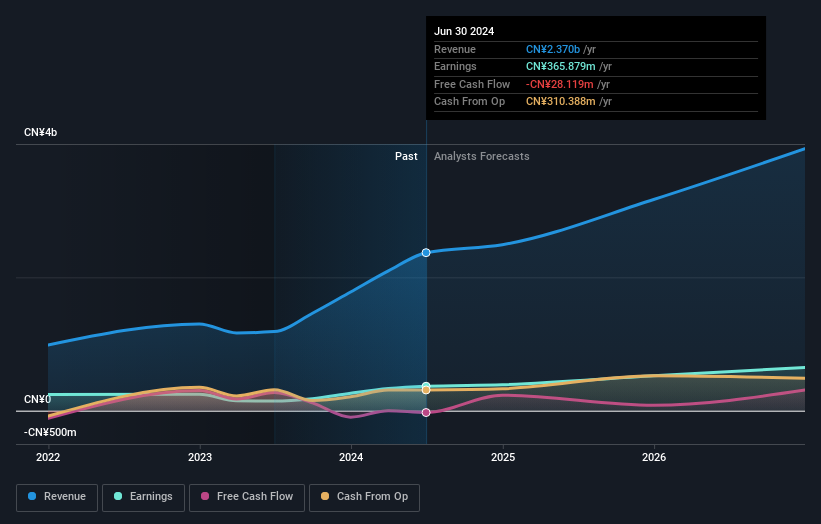

Revenue Growth Forecast: 22.5% p.a.

Huatu Cendes is experiencing substantial growth, with earnings forecasted to increase by 61.7% annually, surpassing the Chinese market average of 25.3%. Revenue for the first nine months of 2024 soared to CNY 2.13 billion from CNY 44.37 million year-on-year, reflecting its robust expansion trajectory. Despite no recent insider trading activity, the company's high return on equity projection of 46% in three years and recent dividend affirmations underscore its strong financial health and shareholder value commitment.

- Unlock comprehensive insights into our analysis of Huatu Cendes stock in this growth report.

- According our valuation report, there's an indication that Huatu Cendes' share price might be on the expensive side.

Intco Medical Technology (SZSE:300677)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intco Medical Technology Co., Ltd. specializes in the research, development, production, and marketing of medical consumables, health care equipment, and physiotherapy care products for use in medical and elderly care institutions as well as household daily use both in China and internationally; the company has a market cap of CN¥15.75 billion.

Operations: Intco Medical Technology's revenue comes from the research, development, production, and marketing of medical consumables, healthcare equipment, and physiotherapy care products for medical and elderly care institutions as well as household use in China and abroad.

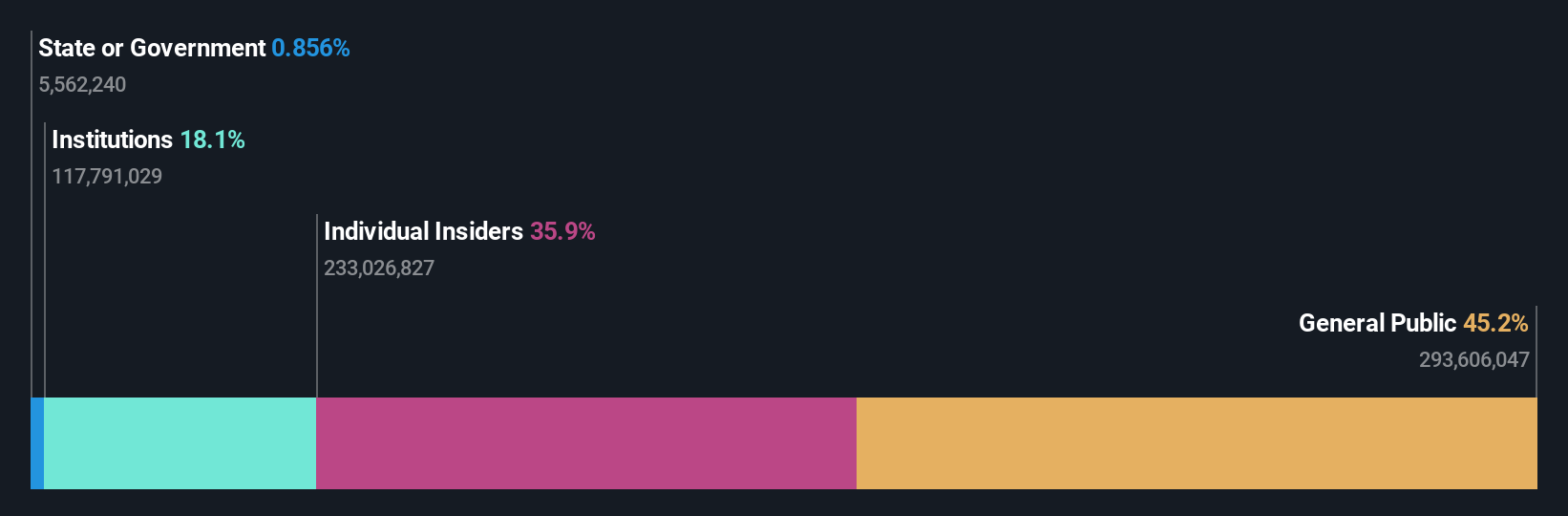

Insider Ownership: 36.3%

Revenue Growth Forecast: 17.1% p.a.

Intco Medical Technology is poised for growth, with earnings projected to rise by 34.1% annually, outpacing the Chinese market average of 25.3%. The company's revenue reached CNY 7.10 billion in the first nine months of 2024, up from CNY 5.04 billion the previous year, reflecting strong performance despite a low forecasted return on equity of 9.2%. Trading at a favorable price-to-earnings ratio relative to peers enhances its attractiveness as an investment option.

- Take a closer look at Intco Medical Technology's potential here in our earnings growth report.

- The analysis detailed in our Intco Medical Technology valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Delve into our full catalog of 1455 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huatu Cendes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300492

Huatu Cendes

Huatu Cendes Co., Ltd., an architectural design company, provides professional, designing, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives