- China

- /

- Medical Equipment

- /

- SZSE:300482

Returns On Capital At Guangzhou Wondfo BiotechLtd (SZSE:300482) Paint A Concerning Picture

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after investigating Guangzhou Wondfo BiotechLtd (SZSE:300482), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Guangzhou Wondfo BiotechLtd is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.072 = CN¥449m ÷ (CN¥6.7b - CN¥456m) (Based on the trailing twelve months to March 2024).

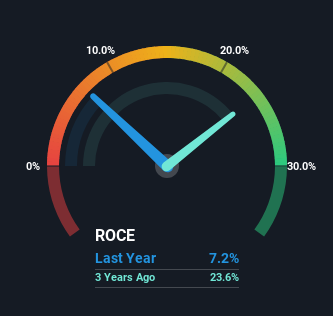

So, Guangzhou Wondfo BiotechLtd has an ROCE of 7.2%. On its own, that's a low figure but it's around the 6.4% average generated by the Medical Equipment industry.

Check out our latest analysis for Guangzhou Wondfo BiotechLtd

Above you can see how the current ROCE for Guangzhou Wondfo BiotechLtd compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Guangzhou Wondfo BiotechLtd .

So How Is Guangzhou Wondfo BiotechLtd's ROCE Trending?

The trend of ROCE doesn't look fantastic because it's fallen from 18% five years ago, while the business's capital employed increased by 174%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. Guangzhou Wondfo BiotechLtd probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

On a side note, Guangzhou Wondfo BiotechLtd has done well to pay down its current liabilities to 6.8% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Key Takeaway

In summary, we're somewhat concerned by Guangzhou Wondfo BiotechLtd's diminishing returns on increasing amounts of capital. Investors haven't taken kindly to these developments, since the stock has declined 14% from where it was five years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you want to continue researching Guangzhou Wondfo BiotechLtd, you might be interested to know about the 2 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking to trade Guangzhou Wondfo BiotechLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300482

Guangzhou Wondfo BiotechLtd

An in vitro diagnostics company, engages in the research and development, production, and sale of point-of-care testing products, and rapid diagnosis and chronic disease management solutions in China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives