- China

- /

- Medical Equipment

- /

- SZSE:300482

A Piece Of The Puzzle Missing From Guangzhou Wondfo Biotech Co.,Ltd's (SZSE:300482) Share Price

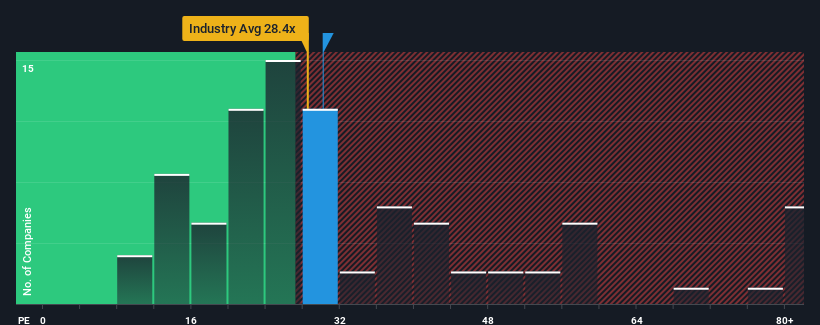

With a median price-to-earnings (or "P/E") ratio of close to 31x in China, you could be forgiven for feeling indifferent about Guangzhou Wondfo Biotech Co.,Ltd's (SZSE:300482) P/E ratio of 30.2x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Guangzhou Wondfo BiotechLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Guangzhou Wondfo BiotechLtd

Does Growth Match The P/E?

Guangzhou Wondfo BiotechLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. This means it has also seen a slide in earnings over the longer-term as EPS is down 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 62% as estimated by the four analysts watching the company. With the market only predicted to deliver 39%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Guangzhou Wondfo BiotechLtd is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Guangzhou Wondfo BiotechLtd's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guangzhou Wondfo BiotechLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Guangzhou Wondfo BiotechLtd you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Guangzhou Wondfo BiotechLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300482

Guangzhou Wondfo BiotechLtd

An in vitro diagnostics company, engages in the research and development, production, and sale of point-of-care testing products, and rapid diagnosis and chronic disease management solutions in China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives