- China

- /

- Healthtech

- /

- SZSE:300451

B-SOFT Co.,Ltd. (SZSE:300451) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The B-SOFT Co.,Ltd. (SZSE:300451) share price has fared very poorly over the last month, falling by a substantial 25%. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

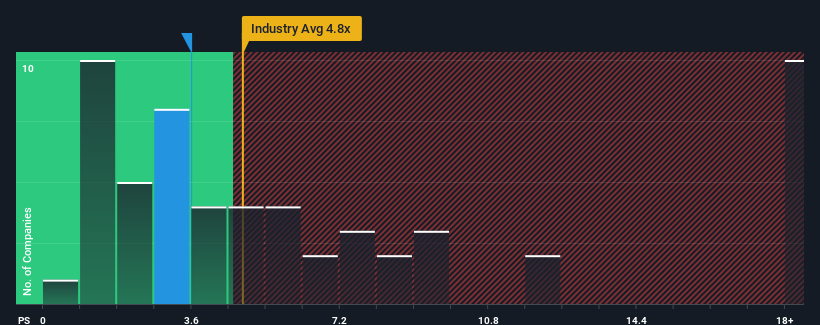

Even after such a large drop in price, it would still be understandable if you think B-SOFTLtd is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 3.6x, considering almost half the companies in China's Healthcare Services industry have P/S ratios above 6.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for B-SOFTLtd

How B-SOFTLtd Has Been Performing

With revenue growth that's superior to most other companies of late, B-SOFTLtd has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on B-SOFTLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For B-SOFTLtd?

The only time you'd be truly comfortable seeing a P/S as low as B-SOFTLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 5.6% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 1.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 16% per annum over the next three years. That's shaping up to be similar to the 18% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that B-SOFTLtd's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does B-SOFTLtd's P/S Mean For Investors?

The southerly movements of B-SOFTLtd's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that B-SOFTLtd currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with B-SOFTLtd.

If you're unsure about the strength of B-SOFTLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if B-SOFTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300451

B-SOFTLtd

Operates in the medical and health informatization industry in China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives