- China

- /

- Medical Equipment

- /

- SZSE:300314

Even With A 27% Surge, Cautious Investors Are Not Rewarding Ningbo David Medical Device Co., Ltd.'s (SZSE:300314) Performance Completely

Ningbo David Medical Device Co., Ltd. (SZSE:300314) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

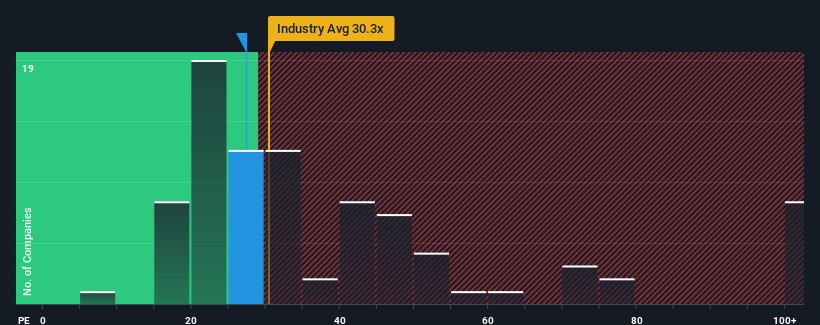

In spite of the firm bounce in price, Ningbo David Medical Device may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.4x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 61x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Ningbo David Medical Device could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Ningbo David Medical Device

Does Growth Match The Low P/E?

Ningbo David Medical Device's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. This means it has also seen a slide in earnings over the longer-term as EPS is down 6.3% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 32% per annum as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 26% each year growth forecast for the broader market.

With this information, we find it odd that Ningbo David Medical Device is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Ningbo David Medical Device's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ningbo David Medical Device currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Ningbo David Medical Device (1 doesn't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Ningbo David Medical Device's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Ningbo David Medical Device, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ningbo David Medical Device might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300314

Ningbo David Medical Device

Engages in the research and development, production, and distribution of medical equipment worldwide.

Flawless balance sheet slight.

Market Insights

Community Narratives