- China

- /

- Medical Equipment

- /

- SZSE:300246

Guangdong Biolight Meditech Co., Ltd.'s (SZSE:300246) Shares Bounce 39% But Its Business Still Trails The Industry

Despite an already strong run, Guangdong Biolight Meditech Co., Ltd. (SZSE:300246) shares have been powering on, with a gain of 39% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

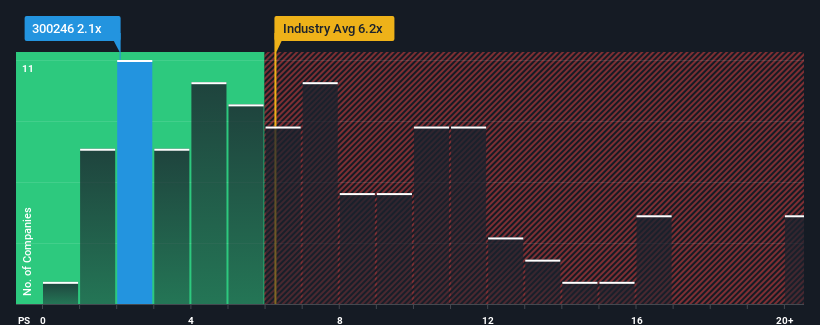

In spite of the firm bounce in price, Guangdong Biolight Meditech may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios greater than 6.2x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Guangdong Biolight Meditech

What Does Guangdong Biolight Meditech's P/S Mean For Shareholders?

For example, consider that Guangdong Biolight Meditech's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Biolight Meditech will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Guangdong Biolight Meditech would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. The last three years don't look nice either as the company has shrunk revenue by 5.4% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Guangdong Biolight Meditech's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Guangdong Biolight Meditech's P/S?

Guangdong Biolight Meditech's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Guangdong Biolight Meditech revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Guangdong Biolight Meditech you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Guangdong Biolight Meditech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300246

Guangdong Biolight Meditech

Engages in the research and development, marketing, sale, and service of medical devices, medical consumables, and healthcare solutions.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives