- China

- /

- Medical Equipment

- /

- SZSE:002932

Wuhan Easy Diagnosis Biomedicine Co.,Ltd. (SZSE:002932) Stock Rockets 26% But Many Are Still Ignoring The Company

Those holding Wuhan Easy Diagnosis Biomedicine Co.,Ltd. (SZSE:002932) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 50% share price drop in the last twelve months.

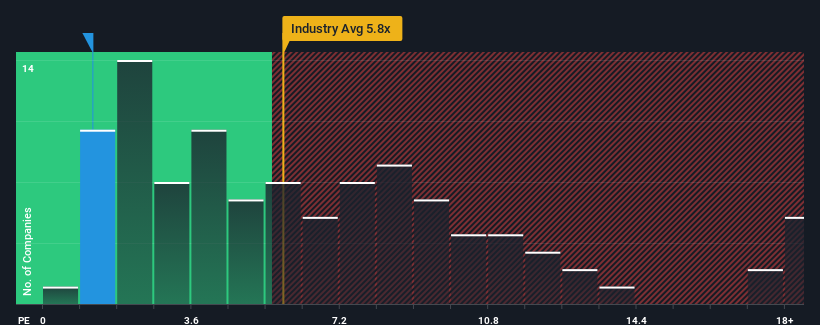

Even after such a large jump in price, Wuhan Easy Diagnosis BiomedicineLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Medical Equipment industry in China have P/S ratios greater than 5.8x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Wuhan Easy Diagnosis BiomedicineLtd

What Does Wuhan Easy Diagnosis BiomedicineLtd's Recent Performance Look Like?

For example, consider that Wuhan Easy Diagnosis BiomedicineLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Wuhan Easy Diagnosis BiomedicineLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Wuhan Easy Diagnosis BiomedicineLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Wuhan Easy Diagnosis BiomedicineLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 56%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 26% shows it's noticeably more attractive.

With this information, we find it odd that Wuhan Easy Diagnosis BiomedicineLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Wuhan Easy Diagnosis BiomedicineLtd's P/S?

Even after such a strong price move, Wuhan Easy Diagnosis BiomedicineLtd's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Wuhan Easy Diagnosis BiomedicineLtd currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Wuhan Easy Diagnosis BiomedicineLtd that you should be aware of.

If these risks are making you reconsider your opinion on Wuhan Easy Diagnosis BiomedicineLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Easy Diagnosis BiomedicineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002932

Wuhan Easy Diagnosis BiomedicineLtd

Wuhan Easy Diagnosis Biomedicine Co.,Ltd.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives