- China

- /

- Metals and Mining

- /

- SHSE:600219

Top 3 Dividend Stocks In Global To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, investors are observing notable movements in indices such as the Nasdaq Composite and Russell 2000. In this dynamic environment, dividend stocks offer a compelling opportunity for those seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.97% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| NCD (TSE:4783) | 4.45% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.45% | ★★★★★★ |

Click here to see the full list of 1318 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Shandong Nanshan AluminiumLtd (SHSE:600219)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shandong Nanshan Aluminium Co., Ltd. engages in aluminum processing activities globally and has a market cap of CN¥56.63 billion.

Operations: Shandong Nanshan Aluminium Co., Ltd. generates revenue through its global aluminum processing operations.

Dividend Yield: 3.2%

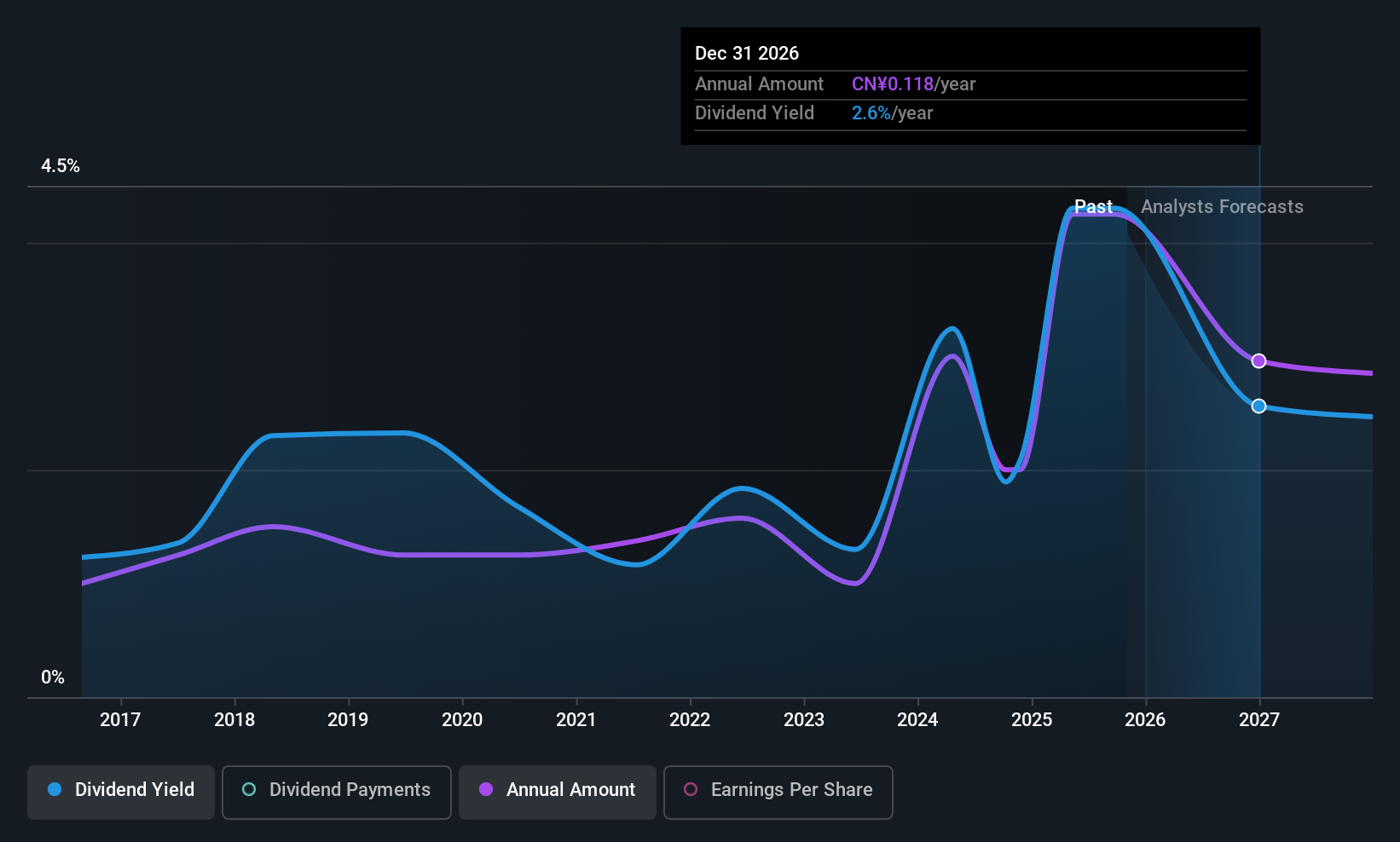

Shandong Nanshan Aluminium Ltd. offers a mixed picture for dividend investors. While its dividend yield of 3.19% ranks in the top 25% of CN market payers, the company's dividends have been volatile over the past decade, lacking consistency in growth. However, dividends are well-covered by earnings and cash flows with payout ratios of 29.6% and 40.8%, respectively, suggesting sustainability despite historical unreliability. Recent earnings show a net income increase to CNY 3.77 billion for nine months ending September 2025, indicating potential financial stability moving forward.

- Click to explore a detailed breakdown of our findings in Shandong Nanshan AluminiumLtd's dividend report.

- Our valuation report here indicates Shandong Nanshan AluminiumLtd may be undervalued.

Luyan PharmaLtd (SZSE:002788)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Luyan Pharma Co., Ltd. is involved in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥3.95 billion.

Operations: Luyan Pharma Co., Ltd. generates its revenue through the research, development, production, and sale of pharmaceutical products within China.

Dividend Yield: 3.2%

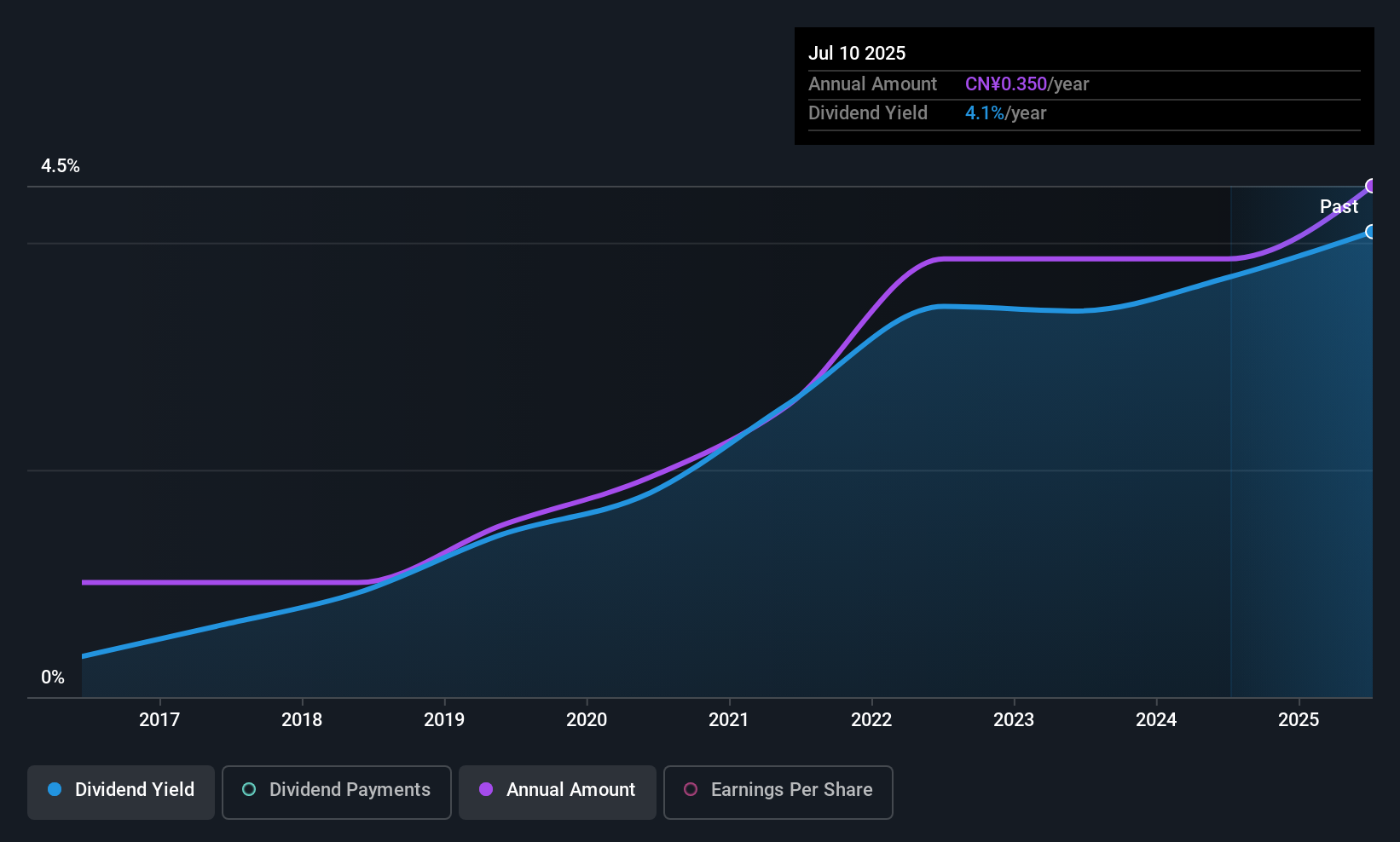

Luyan Pharma Ltd. provides a reliable dividend profile, with a stable and growing dividend history over the past decade. The company's dividends are well-covered by earnings and cash flows, reflected in payout ratios of 43.8% and 40.3%, respectively, ensuring sustainability. Despite recent earnings showing a decline in net income to CNY 219.67 million for the nine months ending September 2025, its dividend yield at 3.22% remains attractive within the top quartile of CN market payers.

- Delve into the full analysis dividend report here for a deeper understanding of Luyan PharmaLtd.

- Insights from our recent valuation report point to the potential overvaluation of Luyan PharmaLtd shares in the market.

Ampoc Far-East (TWSE:2493)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampoc Far-East Co., Ltd. researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong with a market cap of NT$12.12 billion.

Operations: Ampoc Far-East Co., Ltd.'s revenue is derived from various segments, including NT$2.18 billion from Zhongli - Machine Equipment, NT$1.14 billion from Taipei - Consumable Materials, NT$0.43 billion from Others - Machine Equipment, NT$0.32 billion from Others - Consumable Materials, and NT$0.12 billion from Zhongli - Maintenance.

Dividend Yield: 3.4%

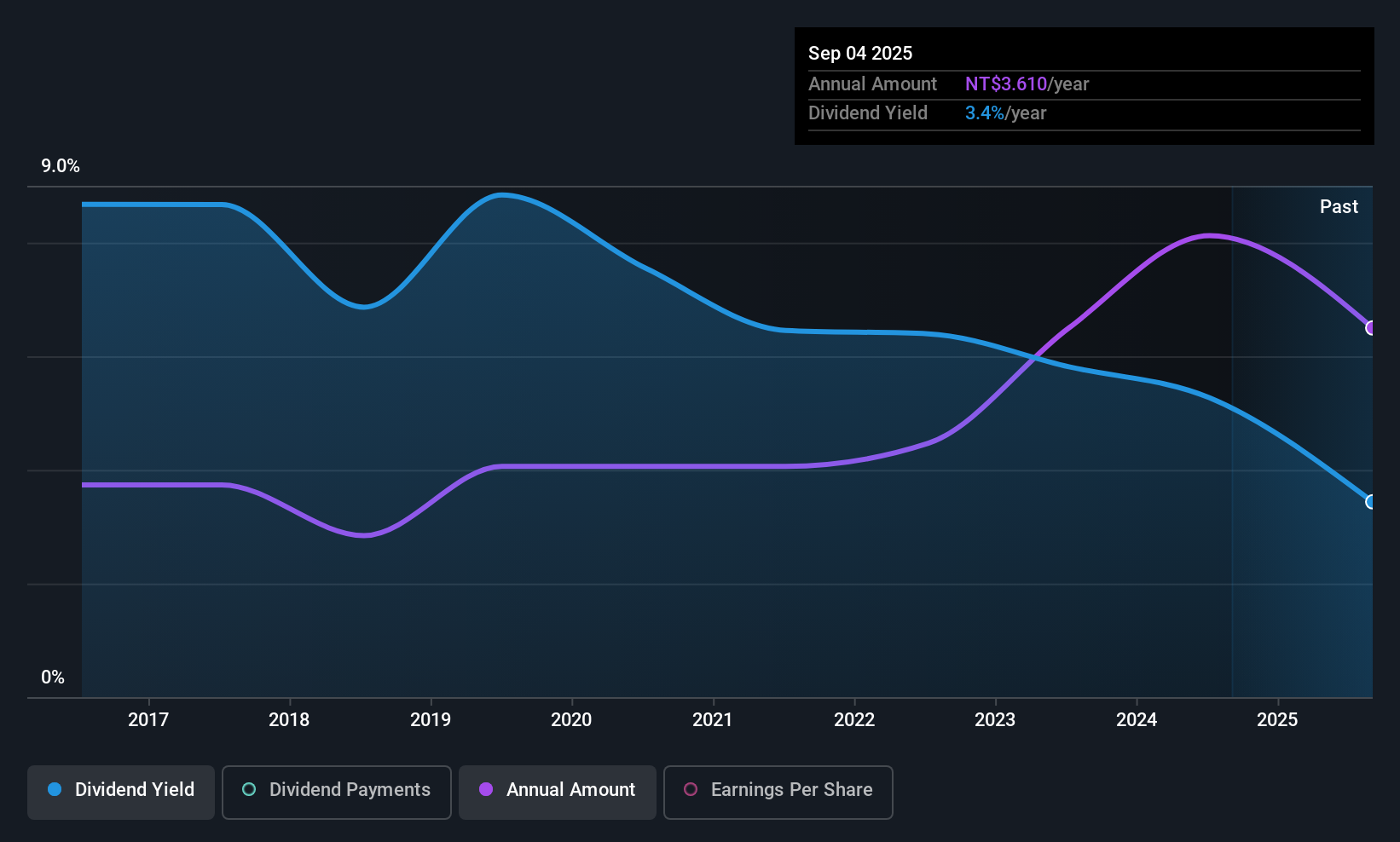

Ampoc Far-East's dividends are covered by earnings and cash flows, with payout ratios of 81.4% and 68.9%, respectively, indicating sustainability despite a volatile history over the past decade. Recent earnings showed a decline in net income to TWD 401.12 million for the nine months ending September 2025, impacting dividend reliability. The dividend yield at 3.44% is below Taiwan's top quartile payers, though its price-to-earnings ratio of 23.7x suggests reasonable valuation within the semiconductor industry.

- Dive into the specifics of Ampoc Far-East here with our thorough dividend report.

- Upon reviewing our latest valuation report, Ampoc Far-East's share price might be too optimistic.

Where To Now?

- Get an in-depth perspective on all 1318 Top Global Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600219

Shandong Nanshan AluminiumLtd

Shandong Nanshan Aluminium Co.,Ltd. is involved in the aluminum processing activity worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026