- Philippines

- /

- Metals and Mining

- /

- PSE:NIKL

Nickel Asia And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

Global markets have recently experienced significant volatility, with U.S. stocks mostly lower due to AI competition fears and mixed corporate earnings, while European markets saw gains supported by strong earnings and interest rate cuts. For investors willing to look beyond the major indices, penny stocks—typically representing smaller or newer companies—can still offer intriguing opportunities despite their somewhat outdated label. These stocks can provide surprising value when backed by solid financial health, offering potential growth with a degree of stability that might defy expectations.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.66B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$42.85B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR411.2M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

Click here to see the full list of 5,702 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Nickel Asia (PSE:NIKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Asia Corporation is involved in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines with a market capitalization of approximately ₱35.39 billion.

Operations: The company's revenue is primarily derived from its mining operations, with ₱8.84 billion from TMC, ₱5.10 billion from RTN, ₱2.54 billion from HMC, ₱2.29 billion from CMC, and ₱0.81 billion from DMC; supplemented by services generating ₱1.61 billion and power contributions of ₱1.03 billion through EPI and ₱0.21 billion through NAC.

Market Cap: ₱35.39B

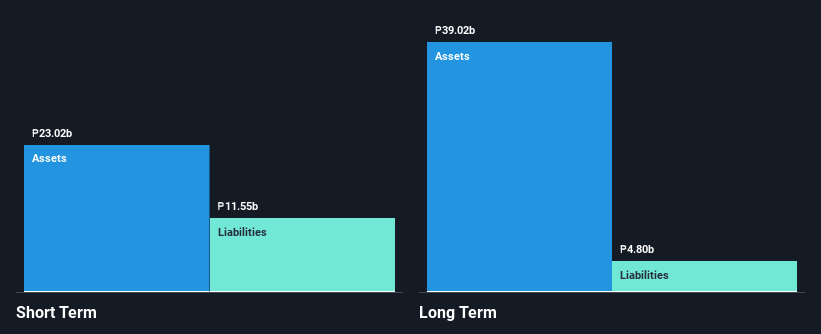

Nickel Asia Corporation, with a market cap of approximately ₱35.39 billion, derives significant revenue from its mining operations across various subsidiaries. Despite experiencing negative earnings growth over the past year and being removed from the Philippines PSE Composite Index, the company maintains a strong balance sheet with more cash than debt and short-term assets exceeding liabilities. Recent discussions to sell its stake in Coral Bay Nickel Corp could impact its financial strategy. The management team is seasoned; however, the board's relative inexperience might influence strategic decisions as they navigate these transitions.

- Click here and access our complete financial health analysis report to understand the dynamics of Nickel Asia.

- Review our growth performance report to gain insights into Nickel Asia's future.

Blue Sail MedicalLtd (SZSE:002382)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Blue Sail Medical Co., Ltd. operates in the health protection, medical device, and nursing sectors both in China and internationally, with a market cap of CN¥4.81 billion.

Operations: Blue Sail Medical Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.81B

Blue Sail Medical Co., Ltd., with a market cap of CN¥4.81 billion, operates in the health and medical sectors but remains unprofitable, facing increased losses over the past five years. Despite its financial challenges, the company maintains a stable weekly volatility and has reduced its debt to equity ratio over time. Short-term assets exceed both short- and long-term liabilities, reflecting a strong liquidity position. However, cash flow is insufficient to cover debt obligations effectively. The management team and board are experienced, potentially aiding strategic decisions as they address these financial hurdles amidst ongoing corporate governance activities.

- Navigate through the intricacies of Blue Sail MedicalLtd with our comprehensive balance sheet health report here.

- Examine Blue Sail MedicalLtd's past performance report to understand how it has performed in prior years.

Zhejiang Renzhi (SZSE:002629)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Renzhi Co., Ltd. specializes in providing professional services for oil and gas drilling and engineering primarily in China, with a market cap of CN¥1.85 billion.

Operations: The company generates its revenue of CN¥184.82 million from operations within China.

Market Cap: CN¥1.85B

Zhejiang Renzhi Co., Ltd. faces challenges typical of penny stocks, with a market cap of CN¥1.85 billion and revenue of CN¥184.82 million primarily from China. The company is unprofitable but has significantly reduced its debt to equity ratio from very high levels to 16.4% over five years, indicating improved financial discipline. Despite this progress, it has less than a year of cash runway if free cash flow continues to decline at historical rates and remains highly volatile with weekly volatility higher than most Chinese stocks, which could impact investor sentiment and stock stability in the near term.

- Click here to discover the nuances of Zhejiang Renzhi with our detailed analytical financial health report.

- Explore historical data to track Zhejiang Renzhi's performance over time in our past results report.

Key Takeaways

- Get an in-depth perspective on all 5,702 Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nickel Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:NIKL

Nickel Asia

Engages in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives