- China

- /

- Medical Equipment

- /

- SHSE:688677

Not Many Are Piling Into Qingdao NovelBeam Technology Co.,Ltd. (SHSE:688677) Just Yet

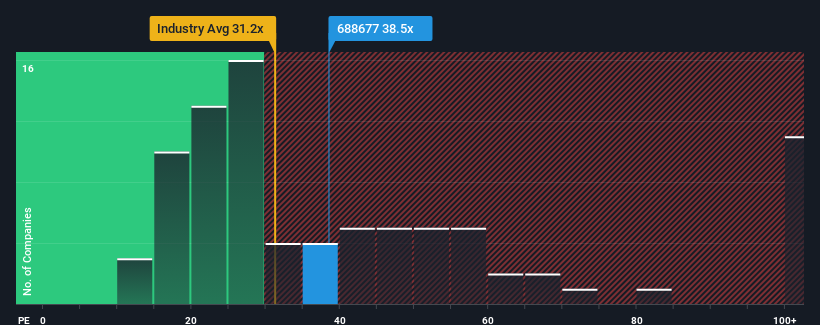

It's not a stretch to say that Qingdao NovelBeam Technology Co.,Ltd.'s (SHSE:688677) price-to-earnings (or "P/E") ratio of 38.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 36x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Qingdao NovelBeam TechnologyLtd has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Qingdao NovelBeam TechnologyLtd

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Qingdao NovelBeam TechnologyLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 90% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's curious that Qingdao NovelBeam TechnologyLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Qingdao NovelBeam TechnologyLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Qingdao NovelBeam TechnologyLtd with six simple checks.

You might be able to find a better investment than Qingdao NovelBeam TechnologyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Qingdao NovelBeam TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qingdao NovelBeam TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688677

Qingdao NovelBeam TechnologyLtd

Engages in the research, development, production, and sales of medical endoscopic instruments and optical products worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives