In May 2025, global markets are experiencing a wave of optimism following the U.S. and China’s agreement to pause tariffs for 90 days, leading to significant gains in major indices like the Nasdaq Composite and S&P 500. Amidst this positive sentiment, investors might find opportunities in undervalued stocks that could benefit from easing trade tensions and cooling inflation, as these factors can enhance their potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.40 | SEK96.31 | 49.7% |

| Pansoft (SZSE:300996) | CN¥14.27 | CN¥28.31 | 49.6% |

| S&D (KOSDAQ:A260970) | ₩88900.00 | ₩176610.74 | 49.7% |

| H.U. Group Holdings (TSE:4544) | ¥3006.00 | ¥5997.76 | 49.9% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.46 | CN¥26.84 | 49.8% |

| Lectra (ENXTPA:LSS) | €23.60 | €47.03 | 49.8% |

| adidas (XTRA:ADS) | €218.30 | €434.91 | 49.8% |

| Kanto Denka Kogyo (TSE:4047) | ¥829.00 | ¥1645.11 | 49.6% |

| Cavotec (OM:CCC) | SEK16.25 | SEK32.35 | 49.8% |

| SpiderPlus (TSE:4192) | ¥461.00 | ¥918.50 | 49.8% |

Let's review some notable picks from our screened stocks.

Akbank T.A.S (IBSE:AKBNK)

Overview: Akbank T.A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and internationally, with a market cap of TRY278.98 billion.

Operations: The company's revenue is primarily derived from Consumer Banking and Private Banking, which contribute TRY110.77 billion, and Commercial Banking, Corporate Banking, and SME Banking, which account for TRY105.94 billion.

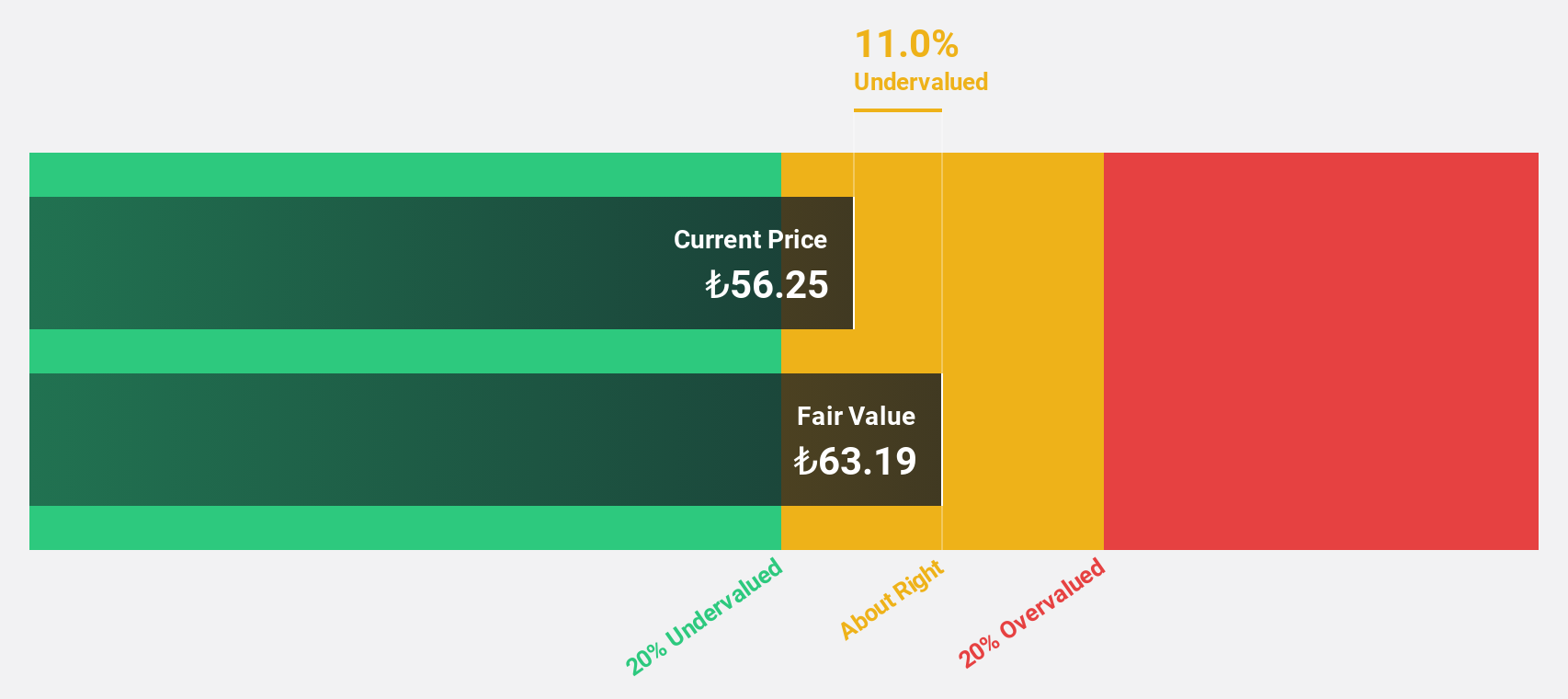

Estimated Discount To Fair Value: 16.5%

Akbank T.A.S. appears undervalued with its current trading price of TRY 53.65 below the estimated fair value of TRY 64.23, suggesting potential for appreciation based on cash flows. Despite a reduced net interest income in Q1 2025 compared to last year, net income increased slightly to TRY 13,734.13 million. However, challenges include a high level of non-performing loans at 3.2% and a declining profit margin from the previous year’s figures.

- The analysis detailed in our Akbank T.A.S growth report hints at robust future financial performance.

- Dive into the specifics of Akbank T.A.S here with our thorough financial health report.

SNT Energy (KOSE:A100840)

Overview: SNT Energy Co., Ltd. operates in the machinery industry with a market cap of ₩779.58 billion.

Operations: SNT Energy Co., Ltd. generates its revenue from various segments within the machinery industry.

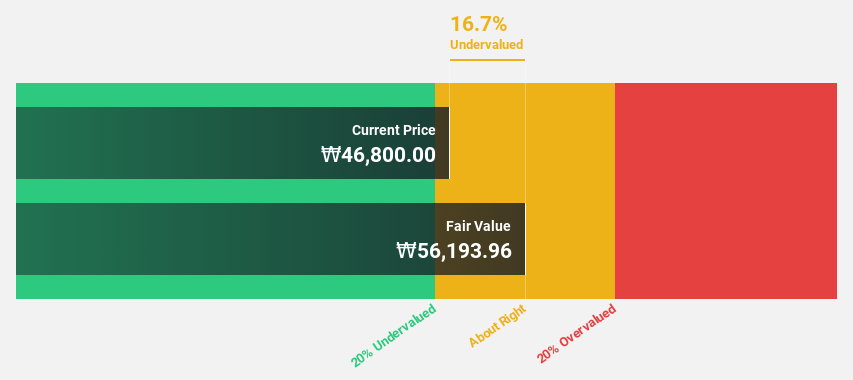

Estimated Discount To Fair Value: 16.2%

SNT Energy Co., Ltd. is trading at ₩47,050, below its estimated fair value of ₩56,172.79 by 16.2%, reflecting potential undervaluation based on cash flows. The company reported Q1 2025 sales of KRW 115.26 billion, a significant increase from last year, while net income remained stable at KRW 8.37 billion. Despite high share price volatility recently and low forecasted return on equity (17%), earnings are expected to grow significantly over the next three years.

- Our growth report here indicates SNT Energy may be poised for an improving outlook.

- Take a closer look at SNT Energy's balance sheet health here in our report.

HangzhouS MedTech (SHSE:688581)

Overview: Hangzhou AGS MedTech Co., Ltd. focuses on the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥4.98 billion.

Operations: HangzhouS MedTech's revenue primarily derives from its activities related to endoscopic surgery equipment and accessories within China.

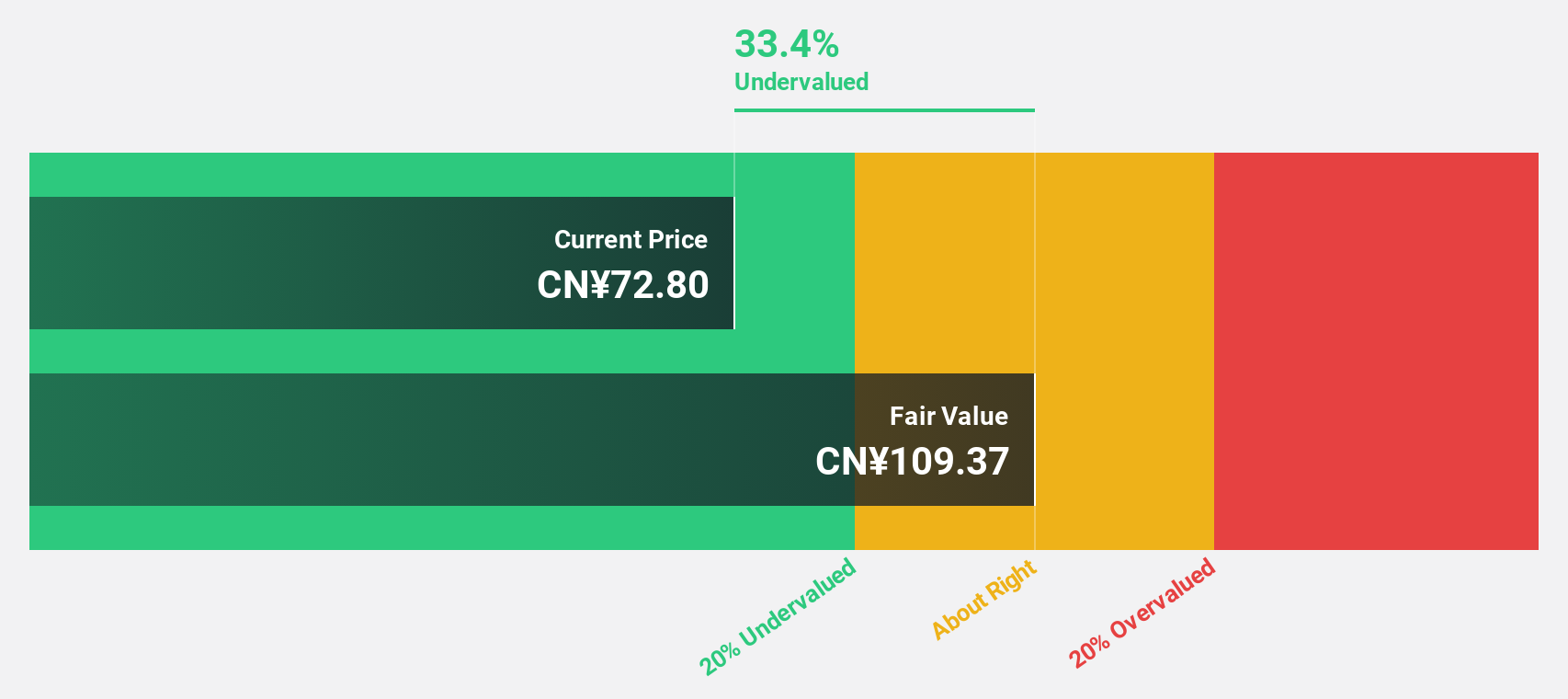

Estimated Discount To Fair Value: 39.3%

HangzhouS MedTech's current trading price of CN¥65.1 is significantly below its estimated fair value of CN¥107.29, indicating potential undervaluation based on cash flows. Despite earnings growth forecasted at 21.8% annually, slightly lagging the market, revenue is expected to grow robustly at 28.1%, outpacing the broader market growth rate. Recent Q1 results show increased sales and net income compared to last year, reinforcing solid financial performance amidst a favorable valuation backdrop.

- Our expertly prepared growth report on HangzhouS MedTech implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in HangzhouS MedTech's balance sheet health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Global Stocks Based On Cash Flows screener has unearthed 497 more companies for you to explore.Click here to unveil our expertly curated list of 500 Undervalued Global Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKBNK

Akbank T.A.S

Provides various banking products and services in Turkey and internationally.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives