- China

- /

- Medical Equipment

- /

- SHSE:688575

Slammed 25% Shenzhen YHLO Biotech Co., Ltd. (SHSE:688575) Screens Well Here But There Might Be A Catch

Shenzhen YHLO Biotech Co., Ltd. (SHSE:688575) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

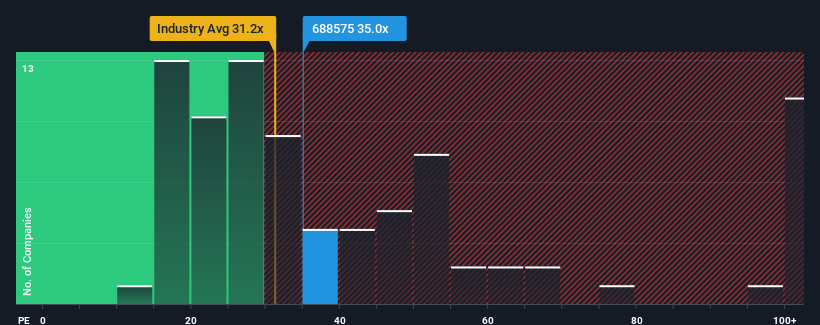

Although its price has dipped substantially, it's still not a stretch to say that Shenzhen YHLO Biotech's price-to-earnings (or "P/E") ratio of 35x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shenzhen YHLO Biotech has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Shenzhen YHLO Biotech

How Is Shenzhen YHLO Biotech's Growth Trending?

The only time you'd be comfortable seeing a P/E like Shenzhen YHLO Biotech's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 57% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 97% over the next year. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Shenzhen YHLO Biotech is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Shenzhen YHLO Biotech's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shenzhen YHLO Biotech currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Shenzhen YHLO Biotech you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Shenzhen YHLO Biotech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688575

Shenzhen YHLO Biotech

Researches, develops, produces, sells, and services in vitro diagnostic instruments and reagents in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives