- China

- /

- Medical Equipment

- /

- SHSE:688358

Chison Medical Technologies Co., Ltd. (SHSE:688358) Soars 44% But It's A Story Of Risk Vs Reward

Chison Medical Technologies Co., Ltd. (SHSE:688358) shareholders would be excited to see that the share price has had a great month, posting a 44% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

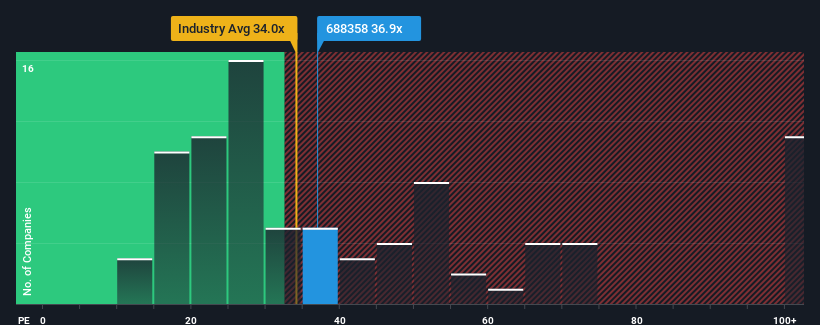

In spite of the firm bounce in price, it's still not a stretch to say that Chison Medical Technologies' price-to-earnings (or "P/E") ratio of 36.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 37x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Chison Medical Technologies has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Chison Medical Technologies

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Chison Medical Technologies would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. As a result, earnings from three years ago have also fallen 7.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 110% over the next year. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Chison Medical Technologies is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Chison Medical Technologies' P/E?

Its shares have lifted substantially and now Chison Medical Technologies' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chison Medical Technologies currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Chison Medical Technologies has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Chison Medical Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688358

Chison Medical Technologies

Develops, manufactures, and sells diagnostic ultrasound systems in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion