- China

- /

- Medical Equipment

- /

- SHSE:688351

Shanghai MicroPort EP MedTech Co., Ltd.'s (SHSE:688351) Share Price Matching Investor Opinion

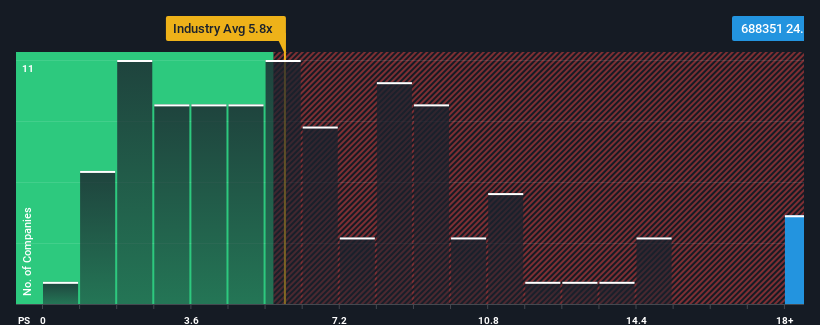

When close to half the companies in the Medical Equipment industry in China have price-to-sales ratios (or "P/S") below 5.8x, you may consider Shanghai MicroPort EP MedTech Co., Ltd. (SHSE:688351) as a stock to avoid entirely with its 24.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Shanghai MicroPort EP MedTech

What Does Shanghai MicroPort EP MedTech's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Shanghai MicroPort EP MedTech has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai MicroPort EP MedTech.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai MicroPort EP MedTech's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. The latest three year period has also seen an excellent 102% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 47% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 18% each year growth forecast for the broader industry.

With this information, we can see why Shanghai MicroPort EP MedTech is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Shanghai MicroPort EP MedTech's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shanghai MicroPort EP MedTech's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Shanghai MicroPort EP MedTech.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688351

Shanghai MicroPort EP MedTech

Engages in the research, development, production, and sale of medical devices in the field of electrophysiological interventional diagnosis and ablation therapy in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives