- China

- /

- Medical Equipment

- /

- SHSE:688277

Tinavi Medical Technologies Co.,Ltd.'s (SHSE:688277) 45% Share Price Surge Not Quite Adding Up

The Tinavi Medical Technologies Co.,Ltd. (SHSE:688277) share price has done very well over the last month, posting an excellent gain of 45%. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

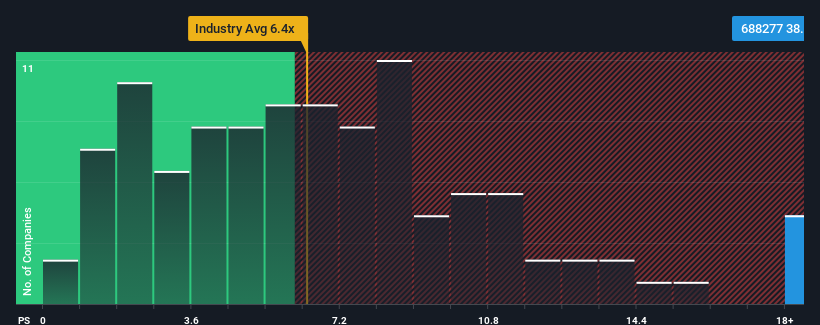

After such a large jump in price, Tinavi Medical TechnologiesLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 38.8x, when you consider almost half of the companies in the Medical Equipment industry in China have P/S ratios under 6.4x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Tinavi Medical TechnologiesLtd

What Does Tinavi Medical TechnologiesLtd's P/S Mean For Shareholders?

For instance, Tinavi Medical TechnologiesLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tinavi Medical TechnologiesLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Tinavi Medical TechnologiesLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tinavi Medical TechnologiesLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

With this information, we find it concerning that Tinavi Medical TechnologiesLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Tinavi Medical TechnologiesLtd's P/S?

Tinavi Medical TechnologiesLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Tinavi Medical TechnologiesLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It is also worth noting that we have found 3 warning signs for Tinavi Medical TechnologiesLtd (2 are a bit concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tinavi Medical TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688277

Tinavi Medical TechnologiesLtd

Engages in the research and development, production, sale, market, service, and clinical application of orthopedic surgery robots and related technologies.

Excellent balance sheet minimal.

Similar Companies

Market Insights

Community Narratives