- China

- /

- Medical Equipment

- /

- SHSE:688139

Further Upside For Qingdao Haier Biomedical Co.,Ltd (SHSE:688139) Shares Could Introduce Price Risks After 33% Bounce

Qingdao Haier Biomedical Co.,Ltd (SHSE:688139) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

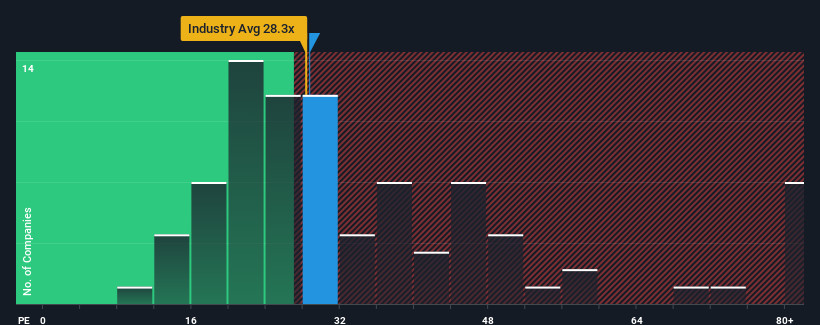

Although its price has surged higher, it's still not a stretch to say that Qingdao Haier BiomedicalLtd's price-to-earnings (or "P/E") ratio of 28.7x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Qingdao Haier BiomedicalLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Qingdao Haier BiomedicalLtd

Is There Some Growth For Qingdao Haier BiomedicalLtd?

Qingdao Haier BiomedicalLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, earnings from three years ago have also fallen 44% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 23% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 21% each year growth forecast for the broader market.

In light of this, it's curious that Qingdao Haier BiomedicalLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Qingdao Haier BiomedicalLtd's P/E

Qingdao Haier BiomedicalLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qingdao Haier BiomedicalLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Qingdao Haier BiomedicalLtd you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Haier BiomedicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688139

Qingdao Haier BiomedicalLtd

Engages in the design, manufacture, marketing, and sale of low temperature storage equipment for biomedical samples in China and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives