As global markets navigate a landscape marked by interest rate expectations and economic shifts, Asian stock markets have shown resilience with notable gains in China and Japan, driven by domestic liquidity and positive economic revisions. In this context, dividend stocks can offer investors potential stability and income, making them an appealing option for those seeking to balance growth with consistent returns in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.71% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.65% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.73% | ★★★★★★ |

| NCD (TSE:4783) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.27% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.49% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1020 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

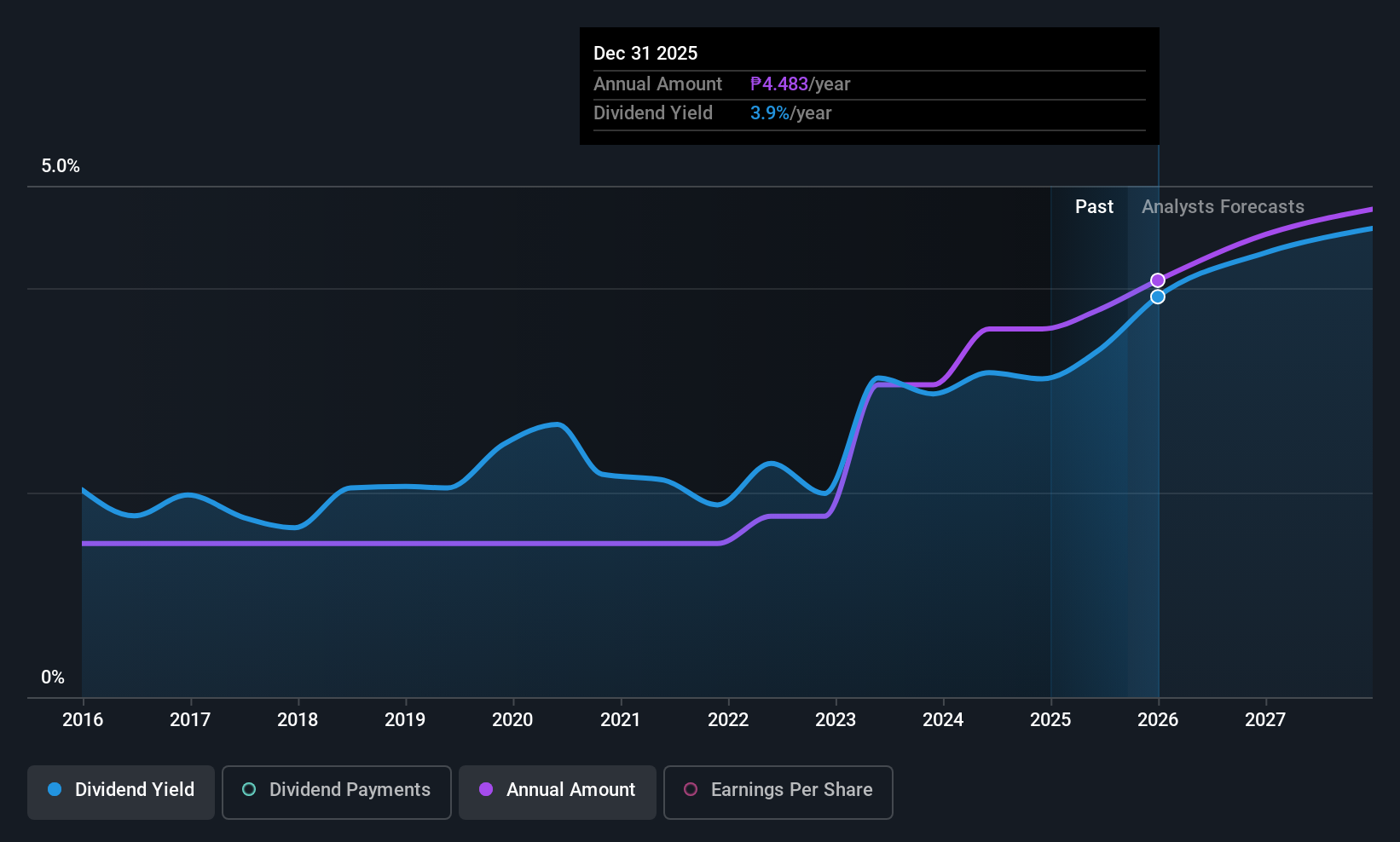

Bank of the Philippine Islands (PSE:BPI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of the Philippine Islands, along with its subsidiaries, offers a range of financial products and services to retail and corporate clients in the Philippines, with a market cap of approximately ₱602.35 billion.

Operations: Bank of the Philippine Islands generates revenue through its financial products and services provided to retail and corporate clients in the Philippines.

Dividend Yield: 3.6%

Bank of the Philippine Islands maintains a stable dividend with a payout ratio of 33.2%, suggesting dividends are well covered by earnings and forecast to remain sustainable at 35.6% in three years. While its dividend yield of 3.65% is below the top tier in the Philippines, BPI's dividends have been reliable and growing over the past decade. However, recent legal challenges could impact financials if liabilities materialize from ongoing litigation involving significant claims against BPI.

- Get an in-depth perspective on Bank of the Philippine Islands' performance by reading our dividend report here.

- The analysis detailed in our Bank of the Philippine Islands valuation report hints at an inflated share price compared to its estimated value.

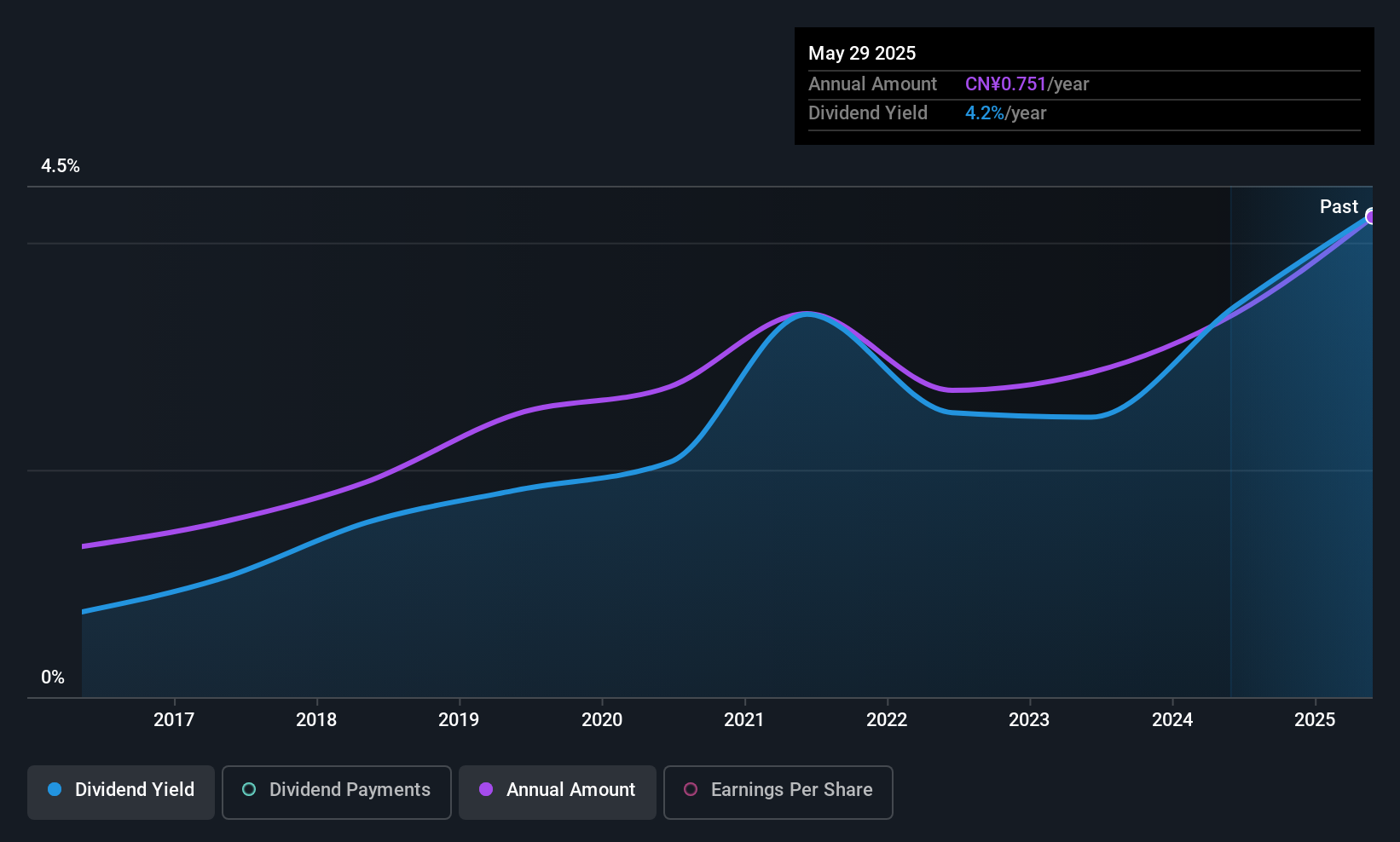

Guangxi LiuYao Group (SHSE:603368)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Guangxi LiuYao Group Co., Ltd operates in the wholesale and retail of pharmaceutical products in China, with a market capitalization of CN¥7.95 billion.

Operations: Guangxi LiuYao Group Co., Ltd generates revenue from its primary segments, with CN¥3.27 billion from retail, CN¥16.31 billion from wholesale, and CN¥1.16 billion from industrial operations.

Dividend Yield: 3.7%

Guangxi LiuYao Group offers a compelling dividend profile with a 3.75% yield, placing it in the top 25% of Chinese dividend payers. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 36.5%, ensuring sustainability from earnings and cash flows. Despite recent earnings declines, its valuation remains attractive due to trading below estimated fair value, while a CNY 200 million share buyback underscores management's confidence in future prospects.

- Navigate through the intricacies of Guangxi LiuYao Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Guangxi LiuYao Group is trading behind its estimated value.

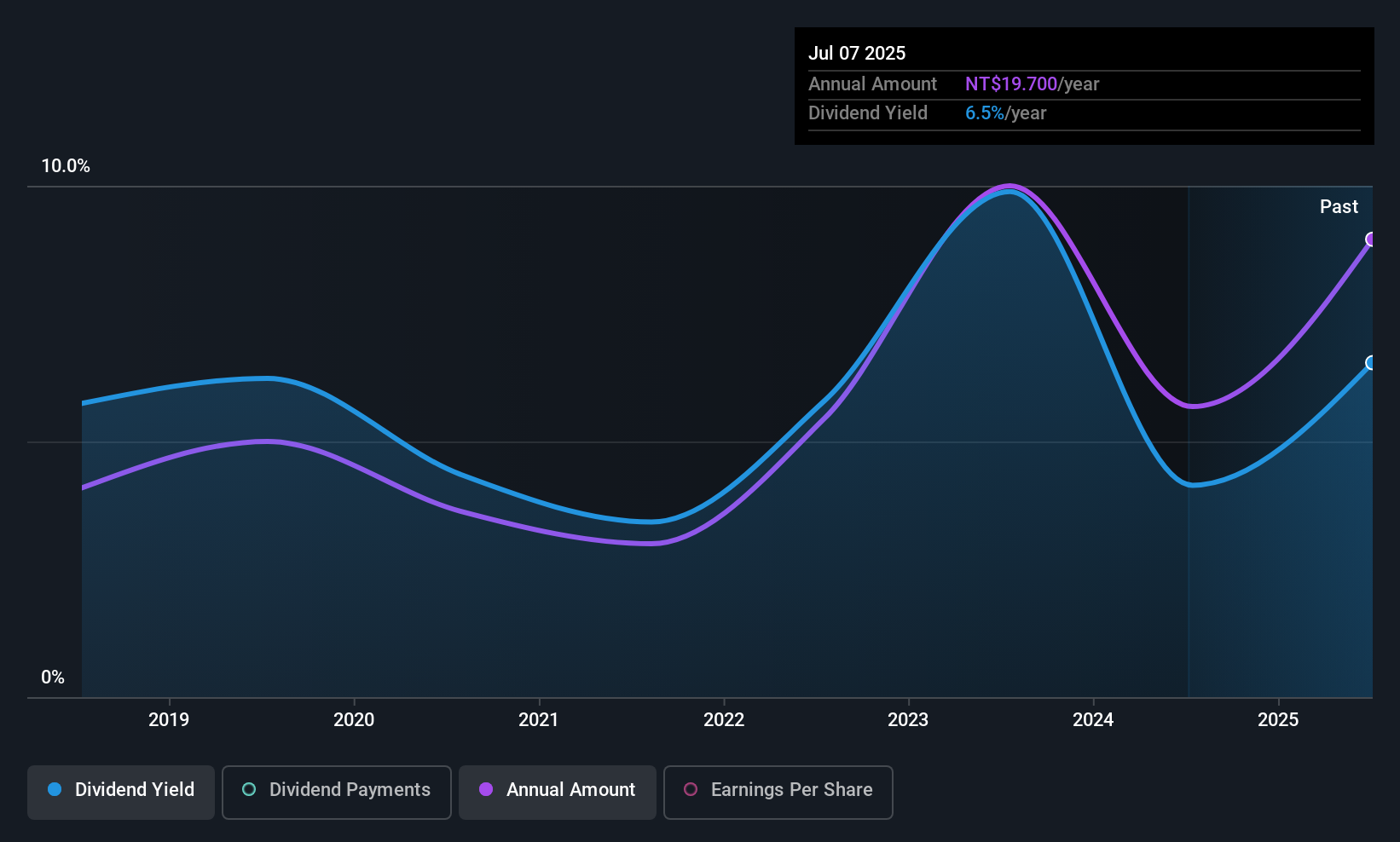

FuSheng Precision (TWSE:6670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market capitalization of NT$37.56 billion.

Operations: FuSheng Precision Co., Ltd. generates revenue primarily from its operations in the golf and sports equipment industries, serving markets in Japan, the United States, and globally.

Dividend Yield: 7.3%

FuSheng Precision's dividend yield of 7.31% ranks it among the top 25% in Taiwan, supported by a payout ratio of 65.6%, indicating coverage from earnings and cash flows. Despite recent revenue growth to TWD 15 billion for the first half of 2025, net income has declined, impacting earnings per share. The company's dividend history is unstable with volatility over seven years, although recent increases suggest management's commitment to shareholder returns amidst favorable valuation compared to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of FuSheng Precision.

- The valuation report we've compiled suggests that FuSheng Precision's current price could be quite moderate.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1017 Top Asian Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6670

FuSheng Precision

Engages in the golf and sports equipment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives