In the current global market landscape, uncertainty surrounding trade tariffs and a cooling labor market in the U.S. have led to a mixed performance across major indices, with small-cap stocks also feeling the impact. Amid these conditions, investors are increasingly looking for opportunities in lesser-known companies that demonstrate resilience and potential for growth despite broader economic challenges. Identifying such stocks often involves examining factors like innovative business models, strong management teams, and unique market positions that can thrive even when larger economic forces are at play.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NPR-Riken | 12.24% | 14.08% | 50.12% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| Uoriki | NA | 3.85% | 9.40% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.11% | 0.82% | 7.95% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Nanjing Kangni Mechanical & ElectricalLtd (SHSE:603111)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing Kangni Mechanical & Electrical Co., Ltd is involved in the research, development, manufacture, sale, and maintenance of railway vehicle door systems and has a market cap of CN¥6.03 billion.

Operations: Kangni Mechanical & Electrical generates revenue primarily from the sale and maintenance of railway vehicle door systems. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and cost management.

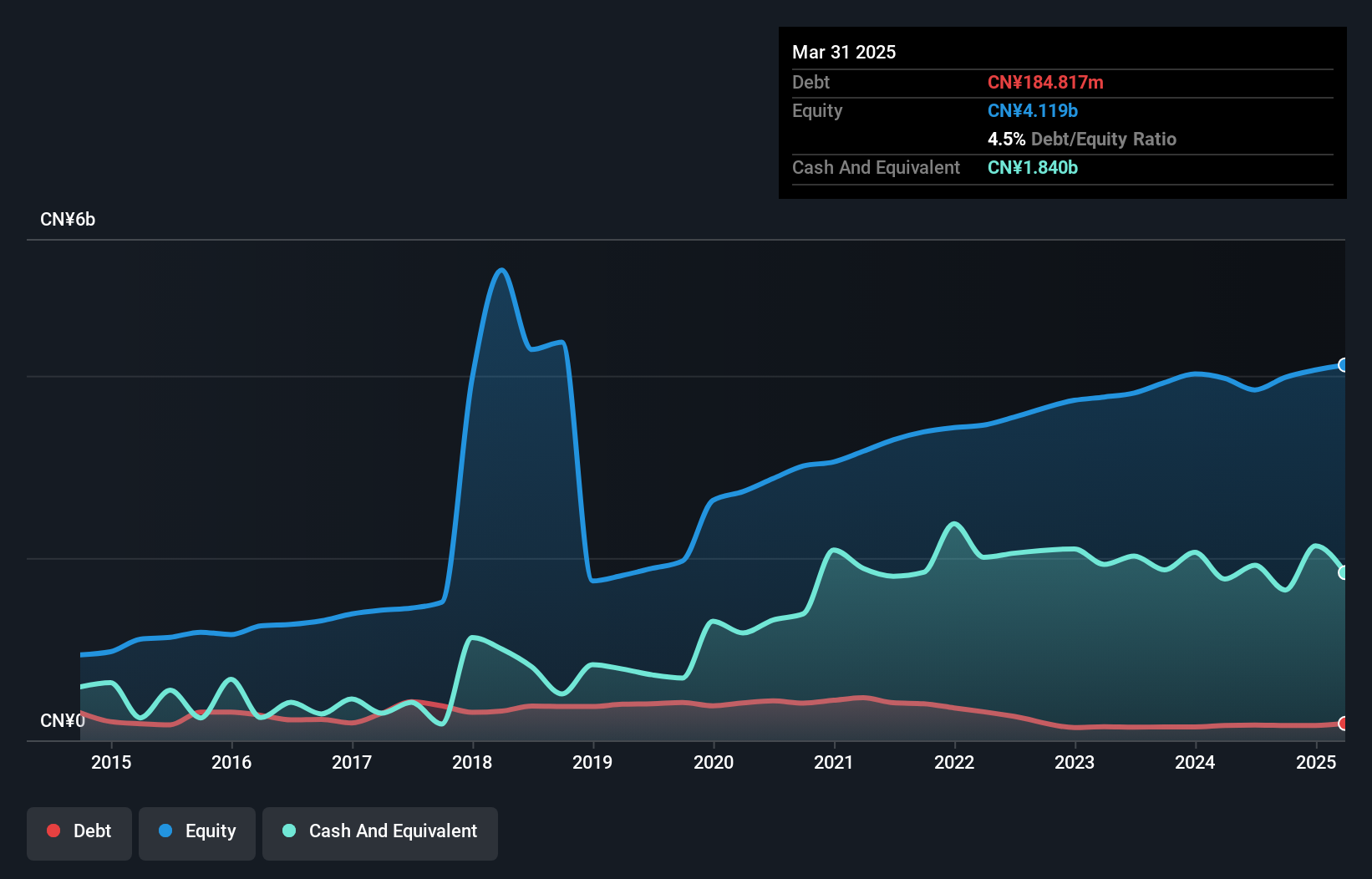

Nanjing Kangni Mechanical & Electrical, a smaller player in the machinery sector, stands out with a robust financial profile. The company boasts earnings growth of 41.7% over the past year, notably surpassing the industry's -0.06%. Its debt-to-equity ratio has impressively shrunk from 21.1% to 4.1% over five years, highlighting effective debt management. With a price-to-earnings ratio at 15.3x compared to the broader CN market's 36.7x, it presents as an attractive value proposition. Recent shareholder meetings and completed share buybacks further indicate active corporate governance and strategic positioning in its market segment.

- Take a closer look at Nanjing Kangni Mechanical & ElectricalLtd's potential here in our health report.

Learn about Nanjing Kangni Mechanical & ElectricalLtd's historical performance.

Jianerkang Medical (SHSE:603205)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Province JianErKang Medical Dressing Co., Ltd. specializes in the production and distribution of medical dressings, with a market cap of CN¥4.51 billion.

Operations: Jianerkang Medical generates revenue primarily from the production and distribution of medical dressings. The company has a market capitalization of CN¥4.51 billion.

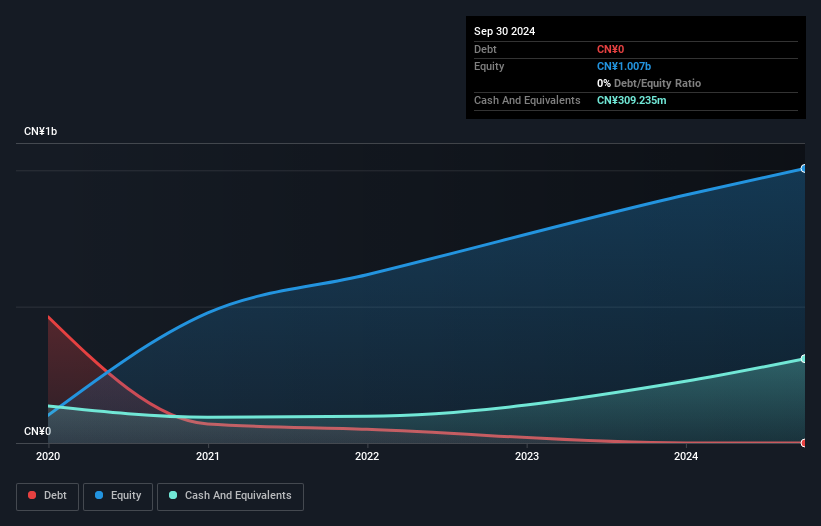

Jianerkang Medical, a nimble player in the medical equipment sector, is debt-free and boasts high-quality earnings. Despite a 7.7% annual dip over five years, recent growth of 1.2% outpaces the industry average of -8.8%. Its price-to-earnings ratio stands at 35.1x, slightly under the CN market's 36.7x, indicating potential value for investors seeking opportunities in this space. With levered free cash flow reaching CNY102 million as of February 2025 and no debt concerns affecting interest coverage, Jianerkang seems well-positioned to navigate future challenges and capitalize on its financial strengths effectively.

- Delve into the full analysis health report here for a deeper understanding of Jianerkang Medical.

Assess Jianerkang Medical's past performance with our detailed historical performance reports.

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Value Rating: ★★★★★☆

Overview: MCLON JEWELLERY Co., Ltd. is engaged in jewelry retail both in China and internationally, with a market cap of CN¥2.99 billion.

Operations: MCLON JEWELLERY Co., Ltd. generates revenue through its jewelry retail operations in China and international markets. The company's net profit margin has shown variability across recent periods, reflecting changes in operational efficiency and market conditions.

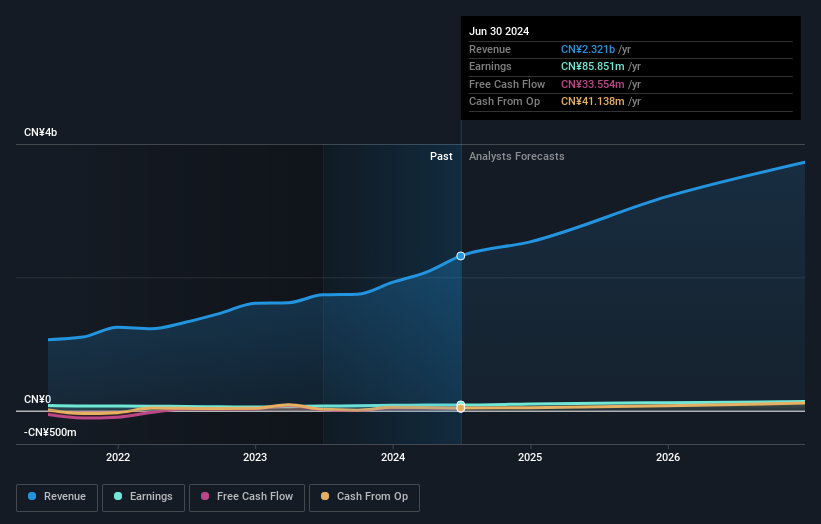

MCLON Jewellery, a small player in the luxury sector, has seen its earnings grow by 21.7% over the past year, outpacing the industry's 1.9%. Impressively trading at 69% below its estimated fair value, it presents a compelling valuation case. The company is free cash flow positive and boasts more cash than total debt, highlighting financial stability despite a volatile share price recently. Over five years, their debt to equity ratio increased from 1.1 to 6.6 times which could be an area of concern for investors keeping an eye on leverage trends within this dynamic market environment.

- Click here to discover the nuances of MCLON JEWELLERYLtd with our detailed analytical health report.

Explore historical data to track MCLON JEWELLERYLtd's performance over time in our Past section.

Seize The Opportunity

- Get an in-depth perspective on all 4698 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Kangni Mechanical & ElectricalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603111

Nanjing Kangni Mechanical & ElectricalLtd

Engages in the research and development, manufacture, sale, and maintenance of railway vehicle door systems.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives