- Hong Kong

- /

- Infrastructure

- /

- SEHK:3382

Discovering Undiscovered Gems with Potential In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating mixed signals, with the S&P 500 and Nasdaq Composite closing out a strong year despite recent economic concerns like the steep drop in the Chicago PMI and a downward revision of GDP forecasts. Amidst these broader market dynamics, small-cap stocks have shown resilience, as evidenced by gains in indices like the Russell 2000, highlighting potential opportunities for investors seeking undiscovered gems. In this environment, identifying promising stocks involves looking for companies with robust fundamentals that can withstand economic fluctuations and capitalize on niche market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Tianjin Port Development Holdings (SEHK:3382)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Port Development Holdings Limited is an investment holding company that operates the port of Tianjin in the People’s Republic of China, with a market capitalization of HK$3.94 billion.

Operations: The primary revenue streams for Tianjin Port Development Holdings are cargo handling, generating HK$7.62 billion, and sales amounting to HK$3.78 billion, complemented by port ancillary services contributing HK$3.14 billion.

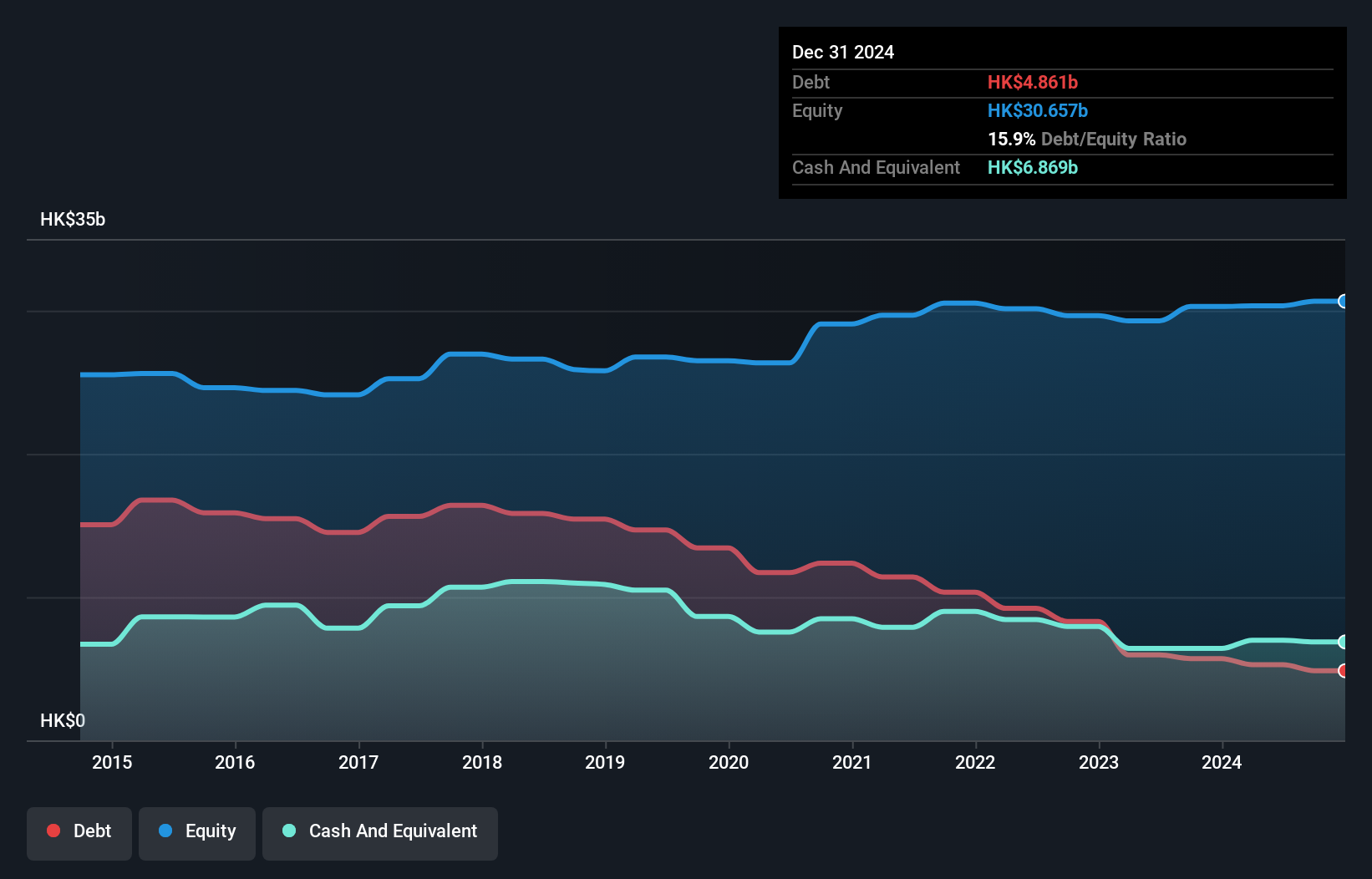

Tianjin Port Development Holdings, a modestly sized player in the infrastructure sector, is trading at 70.7% below its estimated fair value. This company has demonstrated impressive earnings growth of 26% over the past year, outpacing the industry average of 6.7%. The debt-to-equity ratio has significantly improved from 54.9% to 17.4% in five years, indicating better financial health and more cash than total debt suggests a solid footing. Interest payments are well covered by EBIT at a multiple of 13.8x, reflecting robust operational efficiency and stability despite its size within the market landscape.

Jianerkang Medical (SHSE:603205)

Simply Wall St Value Rating: ★★★★★★

Overview: Jianerkang Medical, officially known as Jiangsu Province JianErKang Medical Dressing Co., Ltd., specializes in the production of medical dressings and has a market cap of CN¥4.55 billion.

Operations: Jianerkang Medical generates revenue primarily from the production and sale of medical dressings. The company's net profit margin exhibits notable fluctuations, reflecting variations in cost management and operational efficiency.

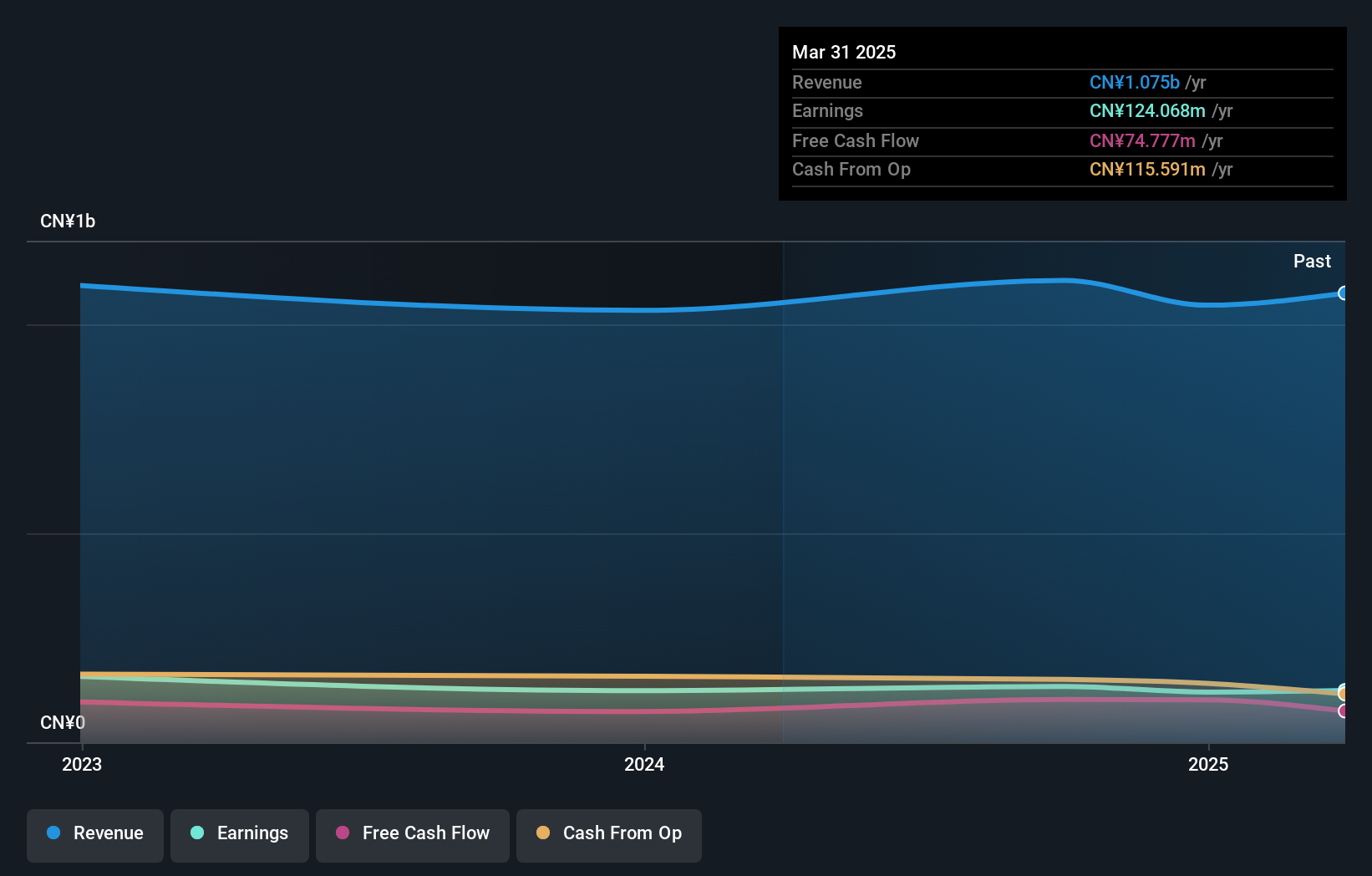

Jianerkang Medical, a notable player in the medical equipment industry, recently completed an IPO, raising CNY 439.5 million. This move comes as the company reported sales of CNY 782.94 million for the nine months ending September 2024, up from CNY 711.33 million in the previous year, with net income rising to CNY 93.46 million from CNY 83.4 million a year earlier. Despite earnings declining by an average of 7% annually over five years, recent growth of 1% outpaced the industry's -8%. With no debt and high-quality earnings, Jianerkang seems well-positioned for future opportunities.

- Click to explore a detailed breakdown of our findings in Jianerkang Medical's health report.

Understand Jianerkang Medical's track record by examining our Past report.

Hengong Precision Equipment (SZSE:301261)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hengong Precision Equipment Co., Ltd. specializes in the research, development, production, processing, and sales of new fluid technology materials both in China and internationally with a market cap of CN¥3.70 billion.

Operations: Hengong Precision Equipment generates revenue primarily through the sales of new fluid technology materials. The company's cost structure includes expenses related to research, development, production, and processing activities.

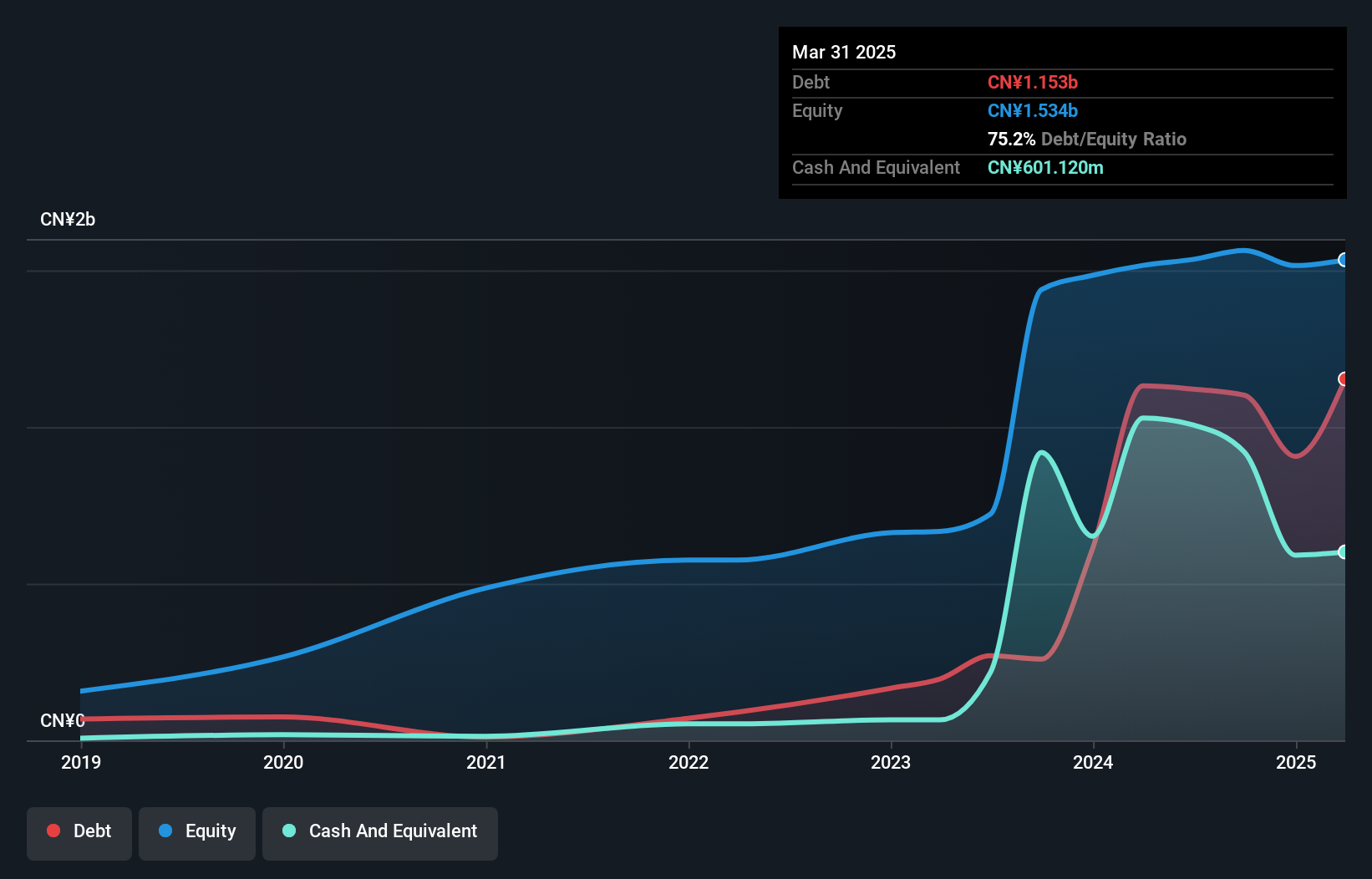

Hengong Precision Equipment, a promising player in its field, reported sales of CNY 747.06 million for the first nine months of 2024, up from CNY 630.42 million last year. Net income reached CNY 96.14 million compared to CNY 81.39 million previously, showcasing robust growth despite a slight dip in basic earnings per share from continuing operations to CNY 1.09 from CNY 1.15 last year. The company’s debt-to-equity ratio has climbed to 70% over five years but remains manageable with a satisfactory net debt-to-equity ratio of just over 11%. With earnings growth outpacing the industry and high-quality non-cash earnings, Hengong seems poised for continued expansion despite recent dividend reductions and increased capital expenditures impacting free cash flow negatively at US$520M by late September '24.

Where To Now?

- Click here to access our complete index of 4654 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Port Development Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3382

Tianjin Port Development Holdings

An investment holding company, operates the port of Tianjin in the People’s Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives