- China

- /

- Metals and Mining

- /

- SHSE:601388

Global Penny Stocks Under US$4B Market Cap: 3 Promising Picks

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with U.S. stock indexes climbing higher amid dovish Federal Reserve comments and weaker-than-expected economic reports suggesting a potential rate cut in December. While large-cap stocks often dominate headlines, small-cap stocks have outperformed their larger counterparts, highlighting the potential opportunities within this segment. Penny stocks—often smaller or newer companies—continue to captivate investors when they exhibit strong financials and growth prospects. Despite being considered a niche area of investment today, these stocks can still offer significant opportunities for those looking to uncover hidden value in promising companies.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.695 | MYR369.46M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$438.02M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €234.7M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.685 | $398.21M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.205 | MYR315.87M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,557 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Vista Group International (NZSE:VGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vista Group International Limited offers software and data analytics solutions for the film industry, with a market capitalization of NZ$620.97 million.

Operations: The company's revenue is generated from two primary segments: the Cinema Business, which contributes NZ$124.9 million, and the Film Business, accounting for NZ$32.5 million.

Market Cap: NZ$620.97M

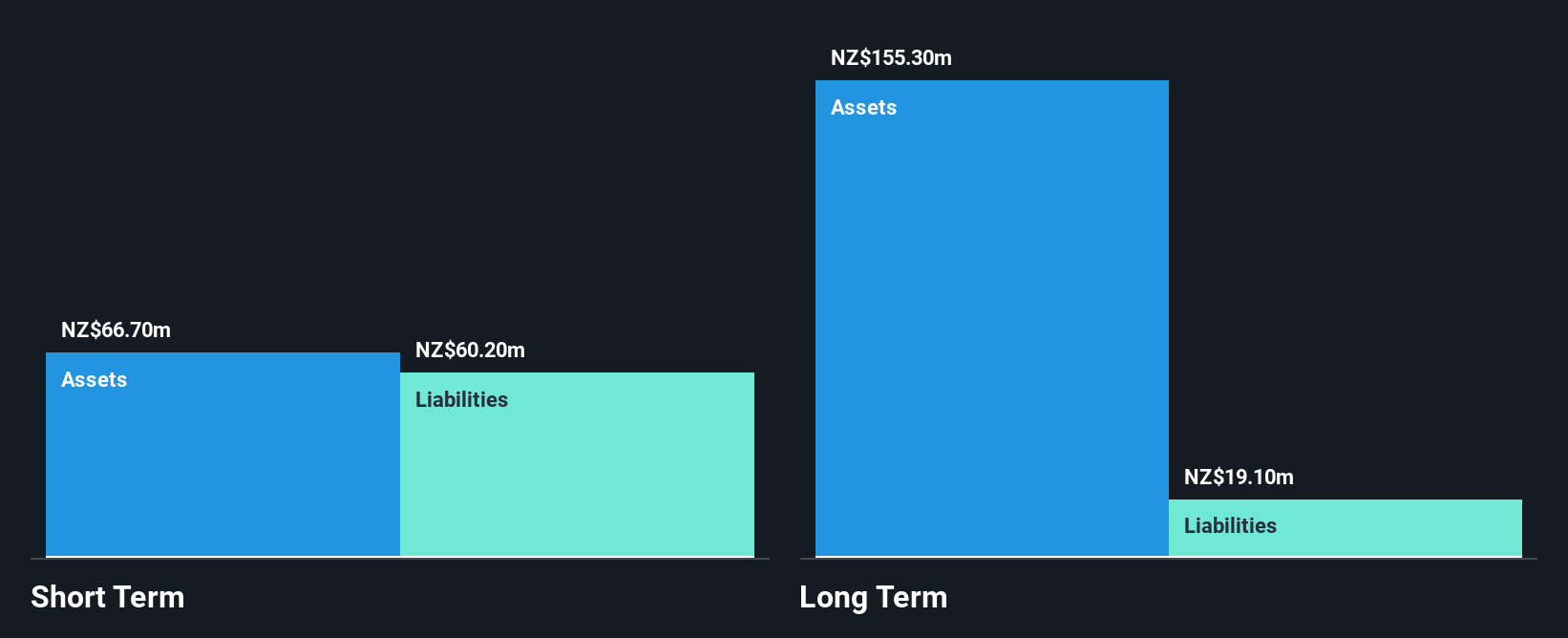

Vista Group International Limited, with a market cap of NZ$620.97 million, operates in the software and data analytics sector for the film industry. Despite being unprofitable, it has demonstrated a reduction in losses at 42.2% annually over five years and maintains a stable weekly volatility of 5%. Analysts predict a notable price increase of 45.5%. The company has more cash than debt and sufficient cash runway exceeding three years, even as free cash flow decreases by 8.4% annually. Management is experienced with an average tenure of 2.7 years, while the board averages 8.8 years in tenure.

- Get an in-depth perspective on Vista Group International's performance by reading our balance sheet health report here.

- Understand Vista Group International's earnings outlook by examining our growth report.

Jointown Pharmaceutical Group (SHSE:600998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jointown Pharmaceutical Group Co., Ltd operates in the pharmaceutical distribution and supply chain sector both in China and internationally, with a market cap of CN¥24.43 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Jointown Pharmaceutical Group Co., Ltd.

Market Cap: CN¥24.43B

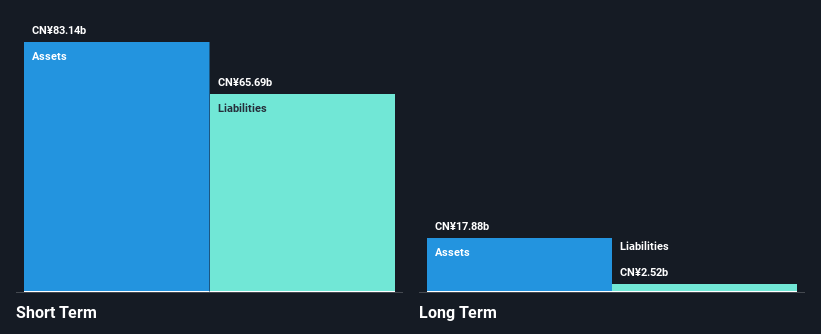

Jointown Pharmaceutical Group, with a market cap of CN¥24.43 billion, shows strong financial health as its short-term assets exceed both short and long-term liabilities. The company has reduced its debt-to-equity ratio significantly over five years, now holding more cash than total debt. Earnings have grown by 36.2% in the past year, surpassing industry averages despite a decline over five years. Its Price-To-Earnings ratio of 8.9x suggests good value compared to the broader Chinese market average of 43.6x. However, an inexperienced management team and unstable dividend track record may warrant caution for investors seeking stability in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Jointown Pharmaceutical Group.

- Evaluate Jointown Pharmaceutical Group's prospects by accessing our earnings growth report.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥6.34 billion.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥6.34B

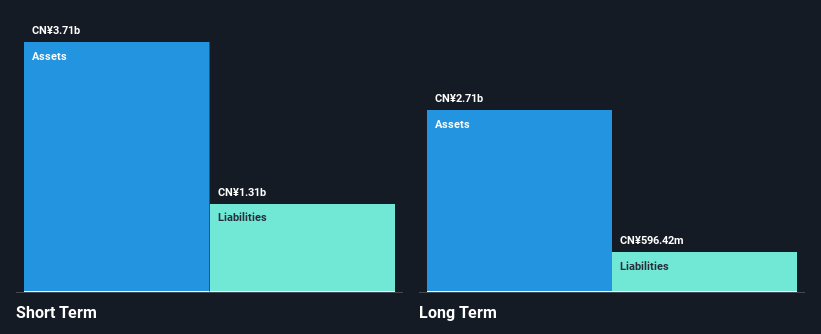

Yechiu Metal Recycling (China) Ltd., with a market cap of CN¥6.34 billion, has demonstrated stable financial management, as evidenced by its satisfactory net debt to equity ratio of 9.5% and short-term assets exceeding both short and long-term liabilities. Despite a reduction in debt levels over the past five years, the company's net profit margins have declined from 1.3% to 0.5%, indicating challenges in maintaining profitability amidst declining earnings growth over the past year and five years. Furthermore, while interest payments are well covered by EBIT, operating cash flow does not sufficiently cover its debt obligations.

- Take a closer look at Yechiu Metal Recycling (China)'s potential here in our financial health report.

- Explore historical data to track Yechiu Metal Recycling (China)'s performance over time in our past results report.

Next Steps

- Click here to access our complete index of 3,557 Global Penny Stocks.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601388

Yechiu Metal Recycling (China)

Engages in aluminum alloy recycling business in Asia and the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026