- China

- /

- Healthcare Services

- /

- SHSE:600713

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a positive shift, with cooling inflation in the U.S. and strong bank earnings driving major indices higher. In Europe, slower-than-expected inflation has fueled optimism for potential rate cuts, while China's economy shows signs of recovery despite ongoing deflationary pressures. Amid these dynamic market conditions, dividend stocks stand out as potentially attractive investments due to their ability to provide steady income streams and potential for capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance services to private and business customers across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and other international markets with a market cap of SEK1.55 billion.

Operations: Solid Försäkringsaktiebolag's revenue segments include Product at SEK311.85 million, Assistance at SEK371.42 million, and Personal Safety at SEK441.04 million.

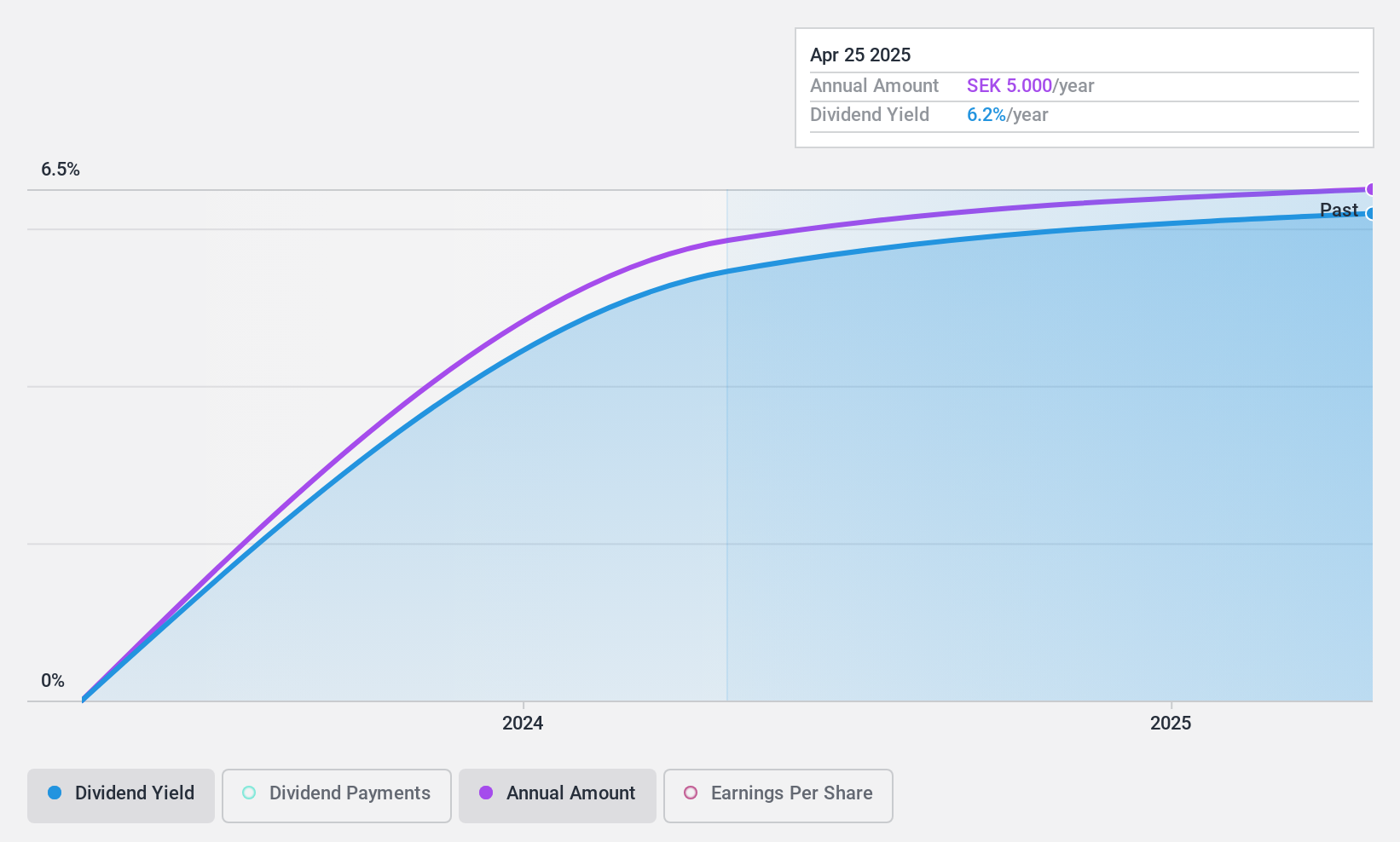

Dividend Yield: 5.3%

Solid Försäkringsaktiebolag has demonstrated notable growth in earnings, with a 27.2% annual increase over the past five years. Recent results show improved net income and earnings per share for both the third quarter and nine months of 2024. Although dividends have only been paid for two years, they are well-covered by both earnings (46.4% payout ratio) and cash flows (60.3% cash payout ratio). The dividend yield is competitive within the Swedish market's top quartile at 5.29%.

- Click to explore a detailed breakdown of our findings in Solid Försäkringsaktiebolag's dividend report.

- Our comprehensive valuation report raises the possibility that Solid Försäkringsaktiebolag is priced lower than what may be justified by its financials.

NanJing Pharmaceutical (SHSE:600713)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NanJing Pharmaceutical Company Limited operates in the pharmaceutical wholesale and retail sectors in China with a market cap of CN¥6.34 billion.

Operations: NanJing Pharmaceutical Company Limited generates its revenue primarily from the pharmaceuticals segment, which accounted for CN¥53.98 billion.

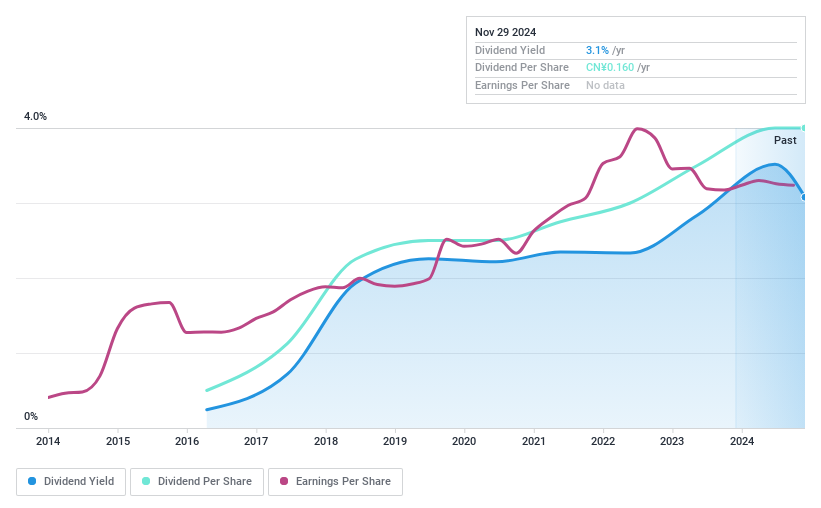

Dividend Yield: 3.3%

NanJing Pharmaceutical's dividend yield of 3.31% ranks in the top 25% of the Chinese market, supported by a low payout ratio of 36%, indicating strong earnings coverage. Despite only nine years of dividend history, payments have been stable and growing with minimal volatility. However, debt coverage by operating cash flow is weak. Recent earnings showed modest growth with CNY 441.88 million net income for the first nine months of 2024, reflecting steady financial performance amidst revenue stability at CNY 40.94 billion.

- Navigate through the intricacies of NanJing Pharmaceutical with our comprehensive dividend report here.

- Our valuation report here indicates NanJing Pharmaceutical may be undervalued.

Chengdu Kanghua Biological Products (SZSE:300841)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Kanghua Biological Products Co., Ltd. operates in the biotechnology sector, focusing on the development and production of biological products, with a market cap of CN¥6.69 billion.

Operations: The revenue segments for Chengdu Kanghua Biological Products Co., Ltd. are not provided in the given text.

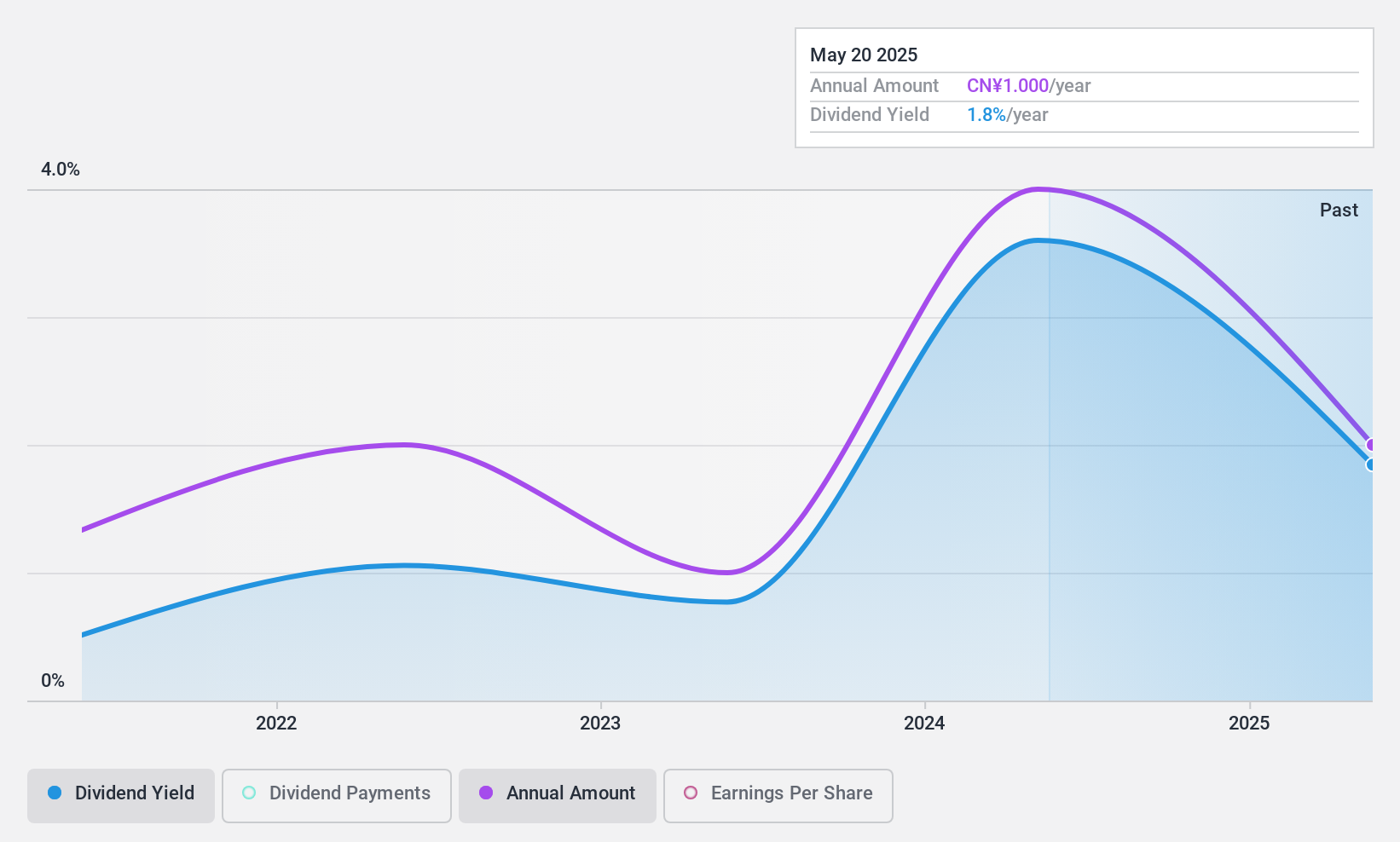

Dividend Yield: 3.9%

Chengdu Kanghua Biological Products offers a dividend yield of 3.88%, placing it among the top 25% in China, though its four-year history shows volatility and unreliability. Despite this, dividends are well-covered by earnings (48.6% payout ratio) and cash flows (62.8%). Recent earnings for the first nine months of 2024 showed growth with net income rising to CNY 405.9 million on sales of CNY 1,060.38 million, indicating potential financial stability amidst ongoing market activities like recent M&A transactions.

- Dive into the specifics of Chengdu Kanghua Biological Products here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chengdu Kanghua Biological Products shares in the market.

Make It Happen

- Access the full spectrum of 1997 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJing Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600713

NanJing Pharmaceutical

Engages in the pharmaceutical wholesale and retail businesses in China.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives