As global markets experience mixed performances, with major U.S. indexes reaching record highs amid a rally in growth stocks, investors are increasingly looking for stability in the form of reliable dividend stocks. In such a dynamic environment, selecting dividend stocks that offer consistent yields can provide both income and potential growth, aligning well with the current market conditions where sector performance is widely dispersed.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

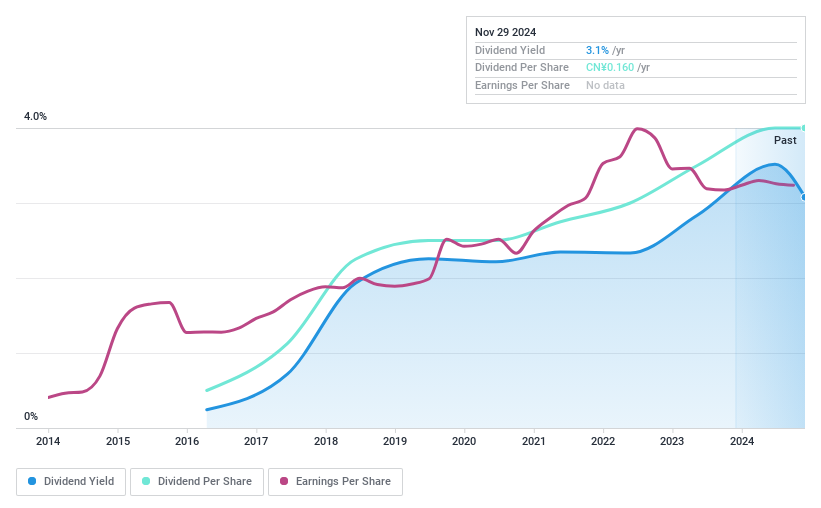

NanJing Pharmaceutical (SHSE:600713)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NanJing Pharmaceutical Company Limited operates in the pharmaceutical wholesale and retail sectors in China, with a market capitalization of CN¥6.98 billion.

Operations: NanJing Pharmaceutical Company Limited generates revenue of CN¥53.98 billion from its pharmaceuticals segment.

Dividend Yield: 2.9%

NanJing Pharmaceutical's dividend payments are well covered by earnings and cash flows, with a payout ratio of 36% and a cash payout ratio of 18.2%. Although the company has only paid dividends for nine years, they have been stable and reliable. The dividend yield is competitive within the Chinese market at 2.92%. Recent earnings show slight growth in profit, but debt coverage by operating cash flow remains a concern.

- Unlock comprehensive insights into our analysis of NanJing Pharmaceutical stock in this dividend report.

- The analysis detailed in our NanJing Pharmaceutical valuation report hints at an deflated share price compared to its estimated value.

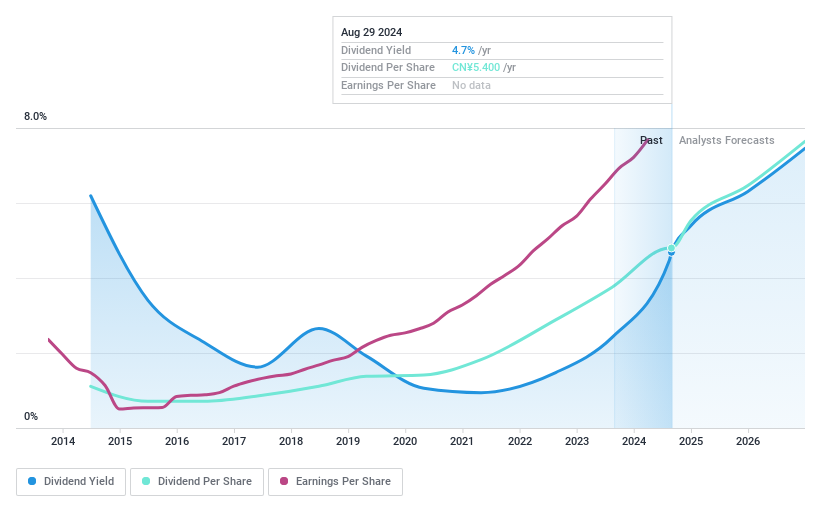

Luzhou LaojiaoLtd (SZSE:000568)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzhou Laojiao Co., Ltd is a company that produces liquor products in China, with a market cap of CN¥207.99 billion.

Operations: Luzhou Laojiao Co., Ltd's revenue primarily comes from its liquor products segment in China.

Dividend Yield: 3.7%

Luzhou Laojiao's dividend yield is among the top 25% in China, supported by a payout ratio of 55.6% and cash payout ratio of 62%. Despite trading at a significant discount to its estimated fair value, the company's dividend history is marked by volatility over the past decade. Recent earnings growth and increased revenue to CNY 24.30 billion highlight financial strength, yet past unreliability in dividends may concern cautious investors seeking stability.

- Take a closer look at Luzhou LaojiaoLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Luzhou LaojiaoLtd shares in the market.

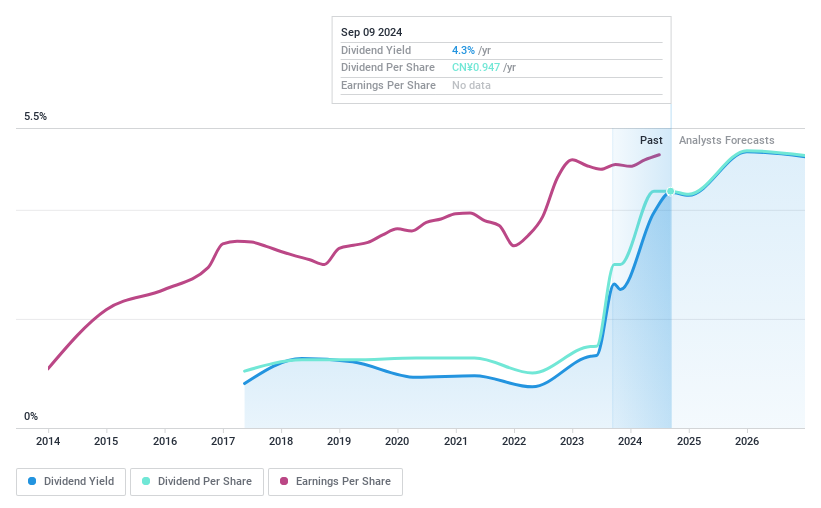

ShenZhen YUTO Packaging Technology (SZSE:002831)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShenZhen YUTO Packaging Technology Co., Ltd. (SZSE:002831) operates in the packaging industry, focusing on providing comprehensive packaging solutions, with a market cap of CN¥22.61 billion.

Operations: ShenZhen YUTO Packaging Technology Co., Ltd. generates revenue primarily from its Paper Packaging segment, amounting to CN¥16.27 billion.

Dividend Yield: 3.7%

ShenZhen YUTO Packaging Technology's dividend yield ranks in the top 25% of China's market, with a payout ratio of 55.2% and cash payout ratio of 58.6%, indicating coverage by earnings and cash flows. Despite this, its dividend history is unstable with less than a decade of payments marked by volatility. Recent share buybacks totaling CNY 101.89 million suggest confidence in value, while earnings growth further supports financial robustness despite past dividend unreliability concerns.

- Dive into the specifics of ShenZhen YUTO Packaging Technology here with our thorough dividend report.

- Our valuation report here indicates ShenZhen YUTO Packaging Technology may be undervalued.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1927 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002831

ShenZhen YUTO Packaging Technology

ShenZhen YUTO Packaging Technology Co., Ltd.

Flawless balance sheet, good value and pays a dividend.