- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

Global Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by government shutdowns and shifting economic indicators, growth stocks have shown resilience, with the technology-heavy Nasdaq Composite Index and the Russell 2000 Index leading gains. In this environment, companies with high insider ownership can be particularly compelling as insiders' investments often signal confidence in their business's long-term potential.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of approximately ₩25.22 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, amounting to approximately ₩158.06 billion.

Insider Ownership: 25.8%

Earnings Growth Forecast: 65.1% p.a.

Alteogen, with its high insider ownership, is positioned for substantial growth. Its revenue and earnings are forecast to grow significantly faster than the Korean market. The company's recent European Commission approval for EYLUXVI®, an Eylea biosimilar, expands its biosimilar portfolio and enhances potential revenue streams. Despite no recent insider trading activity, Alteogen's strong pipeline and high return on equity projections underscore its growth potential in the competitive biopharmaceutical sector.

- Get an in-depth perspective on ALTEOGEN's performance by reading our analyst estimates report here.

- Our valuation report here indicates ALTEOGEN may be overvalued.

Yidu Tech (SEHK:2158)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yidu Tech Inc. is an investment holding company that offers healthcare solutions utilizing big data and AI technologies in China, Brunei, Singapore, and other international markets, with a market cap of HK$7.55 billion.

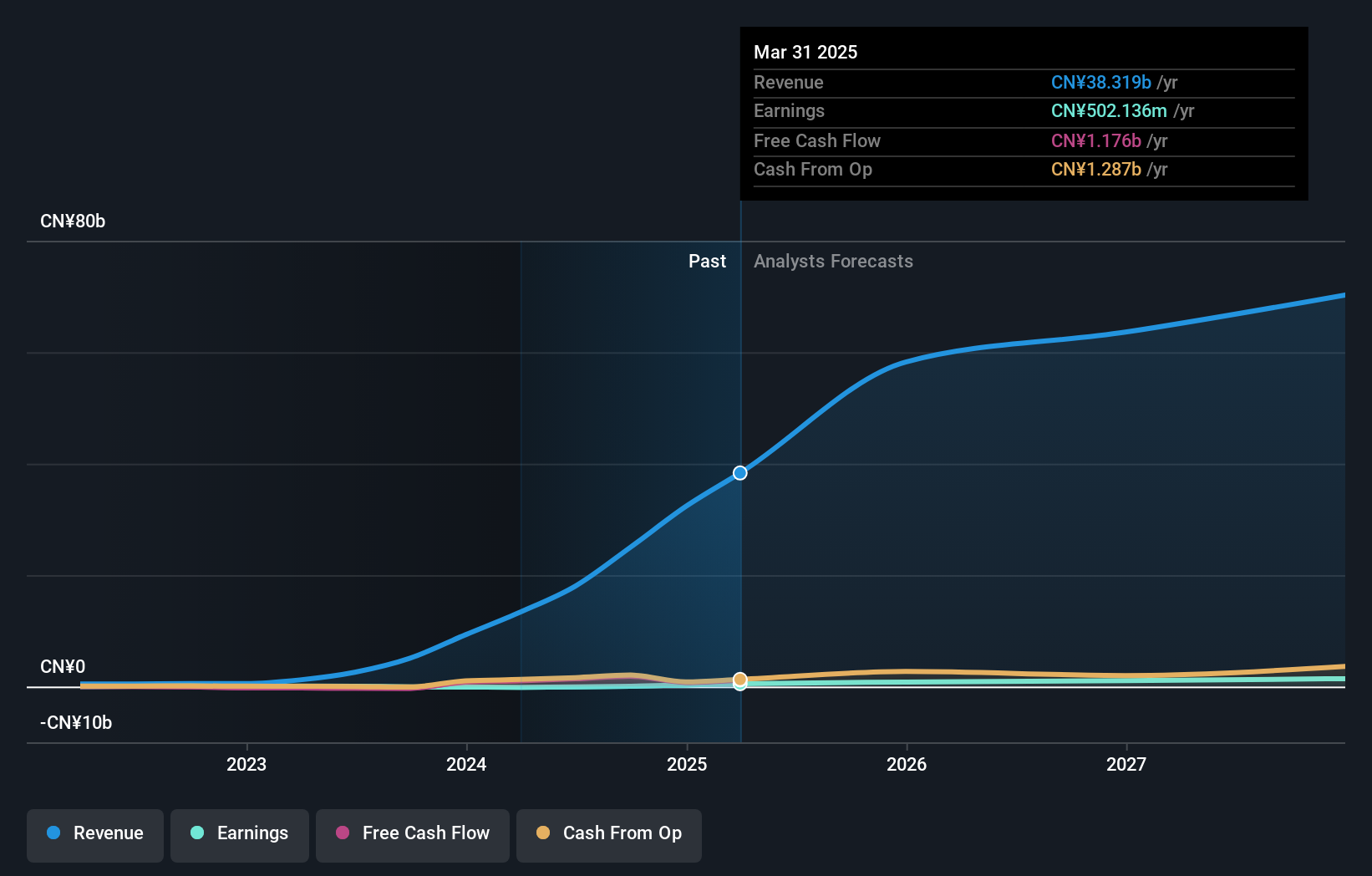

Operations: The company's revenue is derived from three main segments: Life Sciences Solutions (CN¥247.11 million), Big Data Platform and Solutions (CN¥345.89 million), and Health Management Platform and Solutions (CN¥121.98 million).

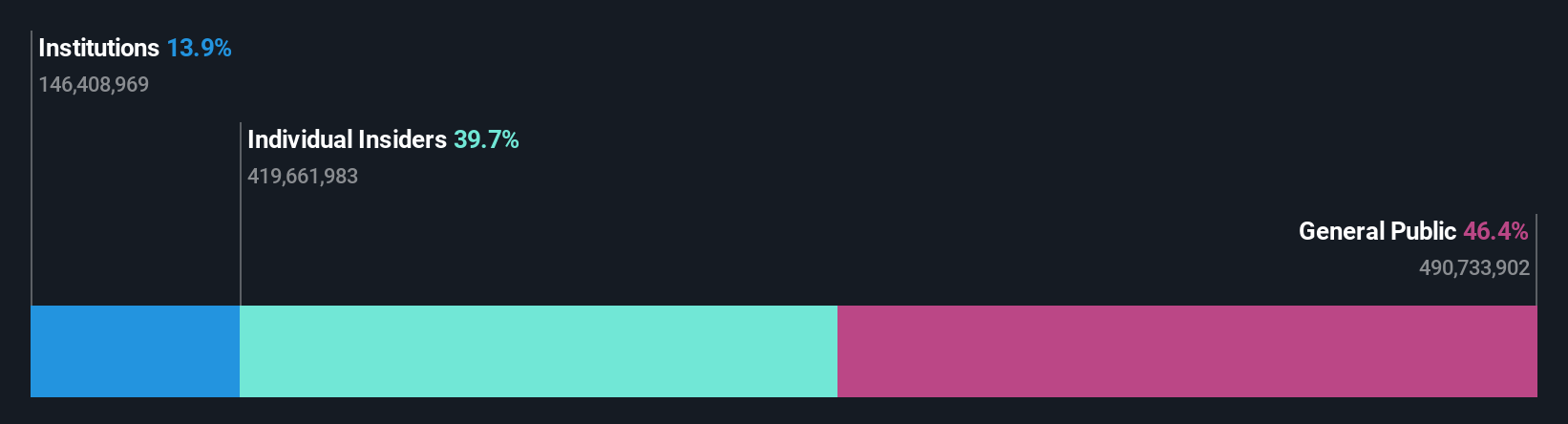

Insider Ownership: 39.5%

Earnings Growth Forecast: 99.8% p.a.

Yidu Tech's high insider ownership aligns with its growth trajectory, as earnings are forecast to grow nearly 100% annually. While expected to become profitable in the next three years, revenue growth of 15.1% per year slightly trails behind the desired 20%. Despite low future return on equity projections and no recent insider trading activity, Yidu Tech completed a share buyback worth HK$10.84 million, indicating confidence in its long-term strategy amidst market competition.

- Unlock comprehensive insights into our analysis of Yidu Tech stock in this growth report.

- In light of our recent valuation report, it seems possible that Yidu Tech is trading beyond its estimated value.

Fujian Wanchen Biotechnology GroupLtd (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fujian Wanchen Biotechnology Co., Ltd, with a market cap of CN¥34.05 billion, focuses on the research, development, cultivation, production, and sale of edible fungi in China.

Operations: The company's revenue is primarily derived from its activities in research, development, cultivation, production, and sale of edible fungi within China.

Insider Ownership: 25.8%

Earnings Growth Forecast: 32.1% p.a.

Fujian Wanchen Biotechnology Group's recent profitability marks a significant milestone, with earnings expected to grow 32.1% annually, outpacing the CN market. Despite high share price volatility and an unstable dividend track record, its revenue growth of 18.6% per year surpasses market averages. Recent amendments to company bylaws and a proposed H-share offering in Hong Kong suggest strategic governance improvements and expansion plans, while insider transactions indicate active shareholder engagement without substantial buying or selling activity recently.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Wanchen Biotechnology GroupLtd.

- Our valuation report unveils the possibility Fujian Wanchen Biotechnology GroupLtd's shares may be trading at a premium.

Make It Happen

- Unlock our comprehensive list of 806 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 33 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives