February 2025's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and competitive pressures from emerging technologies, investors are closely watching the Federal Reserve's steady interest rate policy amidst persistent inflation concerns. In this environment, growth companies with strong insider ownership can offer unique insights and potential stability, as insiders often possess a deep understanding of their business's long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Let's uncover some gems from our specialized screener.

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Group (SZSE:300972) is involved in the research, development, cultivation, production, and sale of edible fungi in China with a market cap of CN¥18.50 billion.

Operations: The company's revenue is primarily derived from its activities in the research, development, cultivation, production, and sale of edible fungi within China.

Insider Ownership: 14.7%

Fujian Wanchen Biotechnology Group's revenue is forecast to grow 38.2% annually, outpacing the market, with earnings expected to rise significantly by 81.8% per year. Despite recent shareholder dilution and high share price volatility, the company trades at a substantial discount to its estimated fair value. Recent meetings focused on profit distribution and connected transactions, highlighting strategic financial management despite no recent insider trading activity reported.

- Click here to discover the nuances of Fujian Wanchen Biotechnology Group with our detailed analytical future growth report.

- The analysis detailed in our Fujian Wanchen Biotechnology Group valuation report hints at an deflated share price compared to its estimated value.

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market cap of PLN3.80 billion.

Operations: The company's revenue segment includes Staffing & Outsourcing Services, generating PLN756.07 million.

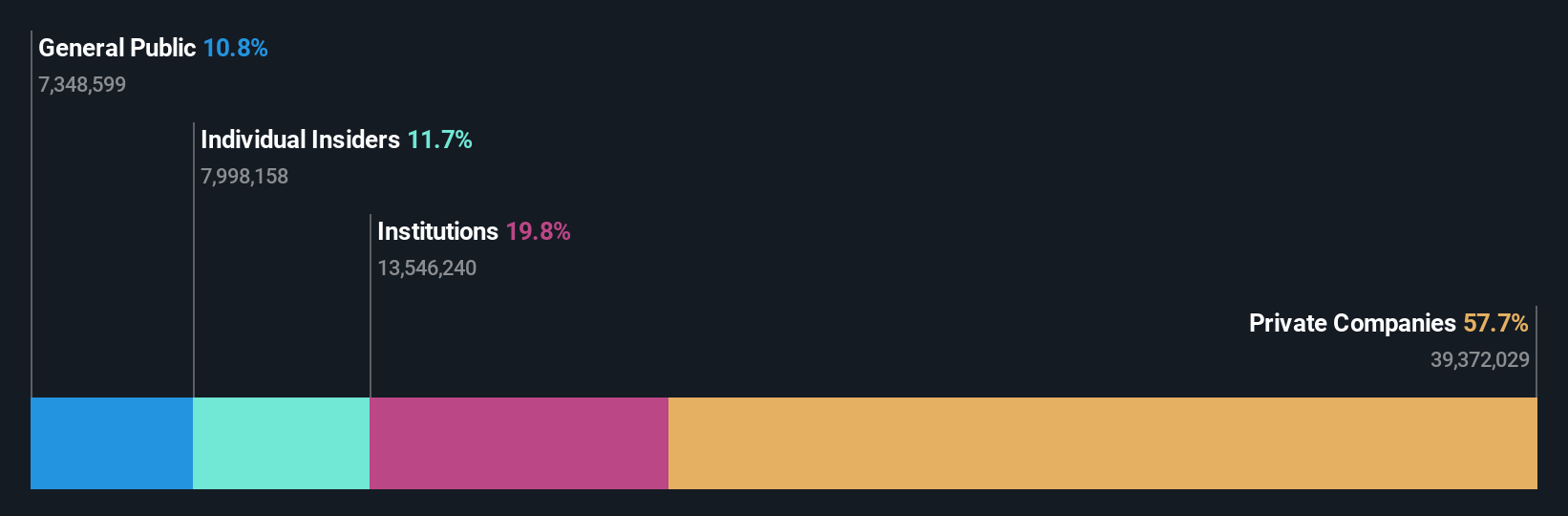

Insider Ownership: 11.7%

Grupa Pracuj's revenue is projected to grow 8.9% annually, surpassing the Polish market's growth rate of 4.7%. The company's earnings are expected to increase significantly by 20.21% per year, outpacing the market's 16.3% growth forecast. Trading at a substantial discount to its estimated fair value, analysts predict a potential stock price rise of 22.8%. Recent earnings show steady improvement with sales and net income increasing year-over-year for Q3 and nine months ended September 2024.

- Take a closer look at Grupa Pracuj's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Grupa Pracuj is priced lower than what may be justified by its financials.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform that facilitates the automated buying and selling of digital advertising space across North America and Europe, with a market cap of €614.84 million.

Operations: The company's revenue is primarily derived from its Supply Side Platforms (SSP) at €367.48 million and Demand Side Platforms (DSP) at €73.36 million.

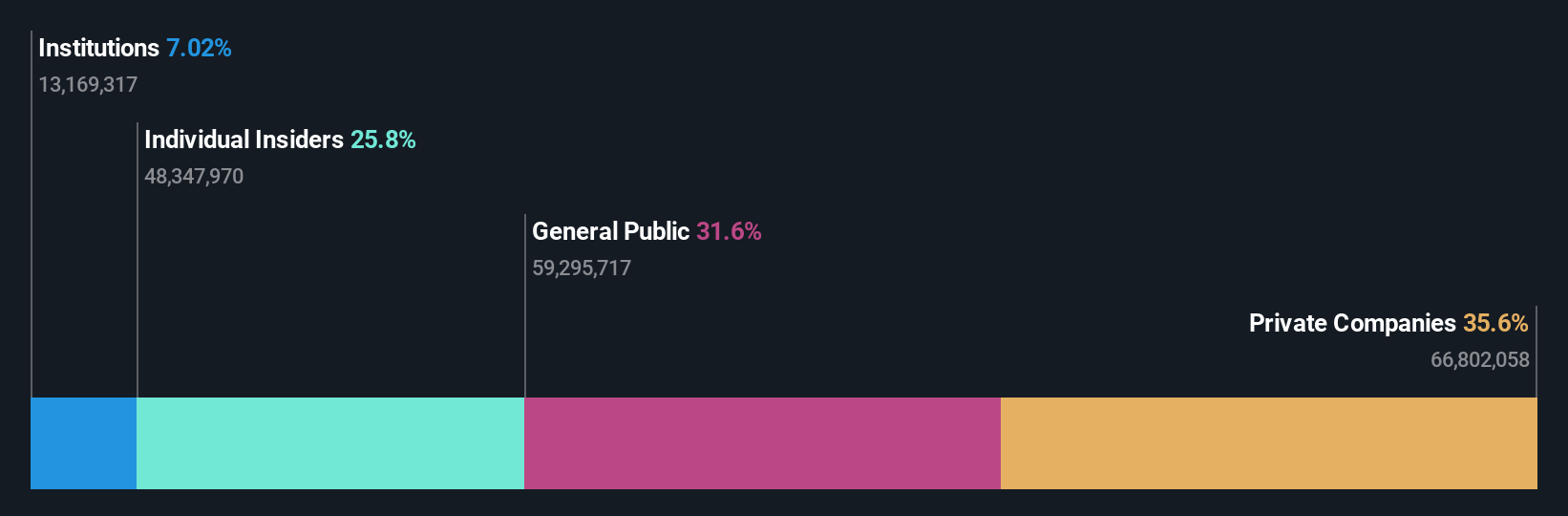

Insider Ownership: 25.9%

Verve Group SE shows promising growth potential, with earnings forecasted to rise significantly at 44.4% annually over the next three years, outpacing the German market's growth rate. Despite recent volatility in its share price and challenges in covering interest payments through earnings, substantial insider buying indicates confidence in the company's future. Recent financial results reveal a notable increase in sales but a decline in net income year-over-year for Q3 2024.

- Get an in-depth perspective on Verve Group's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Verve Group implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 1477 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300972

Fujian Wanchen Biotechnology GroupLtd

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives