Even With A 25% Surge, Cautious Investors Are Not Rewarding Kunming Chuan Jin Nuo Chemical Co., Ltd.'s (SZSE:300505) Performance Completely

Despite an already strong run, Kunming Chuan Jin Nuo Chemical Co., Ltd. (SZSE:300505) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 26%.

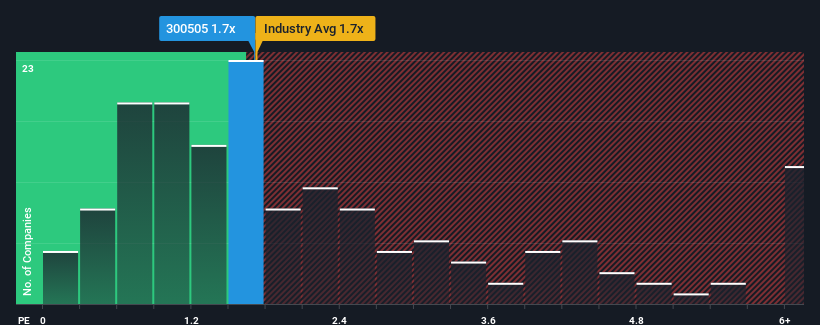

Even after such a large jump in price, it's still not a stretch to say that Kunming Chuan Jin Nuo Chemical's price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Food industry in China, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Kunming Chuan Jin Nuo Chemical

How Kunming Chuan Jin Nuo Chemical Has Been Performing

Kunming Chuan Jin Nuo Chemical has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kunming Chuan Jin Nuo Chemical will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Kunming Chuan Jin Nuo Chemical's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 131% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 16%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Kunming Chuan Jin Nuo Chemical is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Kunming Chuan Jin Nuo Chemical's P/S

Its shares have lifted substantially and now Kunming Chuan Jin Nuo Chemical's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kunming Chuan Jin Nuo Chemical currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Kunming Chuan Jin Nuo Chemical (1 is a bit concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kunming Chuan Jin Nuo Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300505

Kunming Chuan Jin Nuo Chemical

Develops, produces and sells phosphate chemicals in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives